The year 2021 saw the beginning of the Great Resignation when over 20 million Americans quit their jobs during the second and third quarters of the year. Tired of ‘sticking it out’ and realizing the fragility of most industries, workers have started to look for jobs that promise higher pay and a better job outlook. Among their top choices are jobs in the tech industry.

With more companies adapting to a remote-first world, the demand for tech professionals has grown exponentially. And as workers scramble to reboot their careers in this field in as little time as possible, tech bootcamps have emerged as the popular choice.

Tech bootcamps offer industry-relevant skills training that lasts three to six months, on average. Many programs also come with built-in career services designed to increase the students’ chances of securing employment.

That said, the average bootcamp program fee runs between $13,249 and $14,263, according to Career Karma’s 2020 bootcamp report. They can also cost over $20,000 depending on the program curriculum, duration, and other factors. And although bootcamps are cheaper than colleges, not everyone can pay them up front or qualify for traditional student loans.

This is where Climb Credit comes into play.

Climb Credit understands the obstacles that individuals who seek to advance their education face, the primary of which is determining how to pay for the program. To solve this, Climb provides affordable financing options to students to ease their financial stress.

Seven years since Climb Credit’s founding, it has successfully helped over 40,000 students advance their education and has become one of the trusted lending partners in the bootcamp space.

Climb Credit opens more opportunities for students to upskill in tech with their latest 0% interest financing and interest-free recurring payments.

Learn more about Climb’s financing solution here.Why Choose Climb Credit to Fund Your Education?

The overall dropout rate among undergraduate students in the US reached 40 percent, with 30 percent of students leaving in their first year. To make matters worse, only 41 percent of college students graduate. One of the main culprits? The financial stress brought on by the rising tuition costs.

In 2021, student debt in the US increased to $1.73 trillion, pushing more students and parents to consider alternative education pathways. The latest report reveals that the national average debt per student is $28,950.

Climb Credit believes that everyone deserves a chance at a career-advancing education. And they are on a mission to create opportunities for people who are attending career-advancing programs, starting with catering to a diverse community of student borrowers.

Those who did not complete college make up 64 percent of Climb Credit’s borrowers, while the remaining is a mix of students with bachelor’s degrees, associate degrees, and advanced degrees. Most of Climb Credit’s borrowers report a median pre-program income of $35,000, and many have FICO scores lower than 610. They are often the ones who need access to career training the most in order to improve their career and salary prospects.

What makes Climb Credit unique is its focus on responsible financing. They strive to partner with bootcamps and other training schools that offer high-impact yet affordable programs.

This way, students can be more confident that they are enrolling with bootcamps that have high completion rates, placement rates, and post-graduate salaries, all at a reasonable tuition fee. In effect, students have a higher chance of starting a lucrative career in their chosen field and, in turn, a higher chance of affording their loan payments.

Based on Climb Credit’s recent outcomes, 81 percent of their graduates landed full-time careers in their chosen field. If you’re searching for bootcamps, be sure to look for Climb’s Verification Badge. Among its long-time and trusted bootcamp partners are General Assembly, Ironhack, and Galvanize.

How to Choose the Right Climb Credit Payment Plan

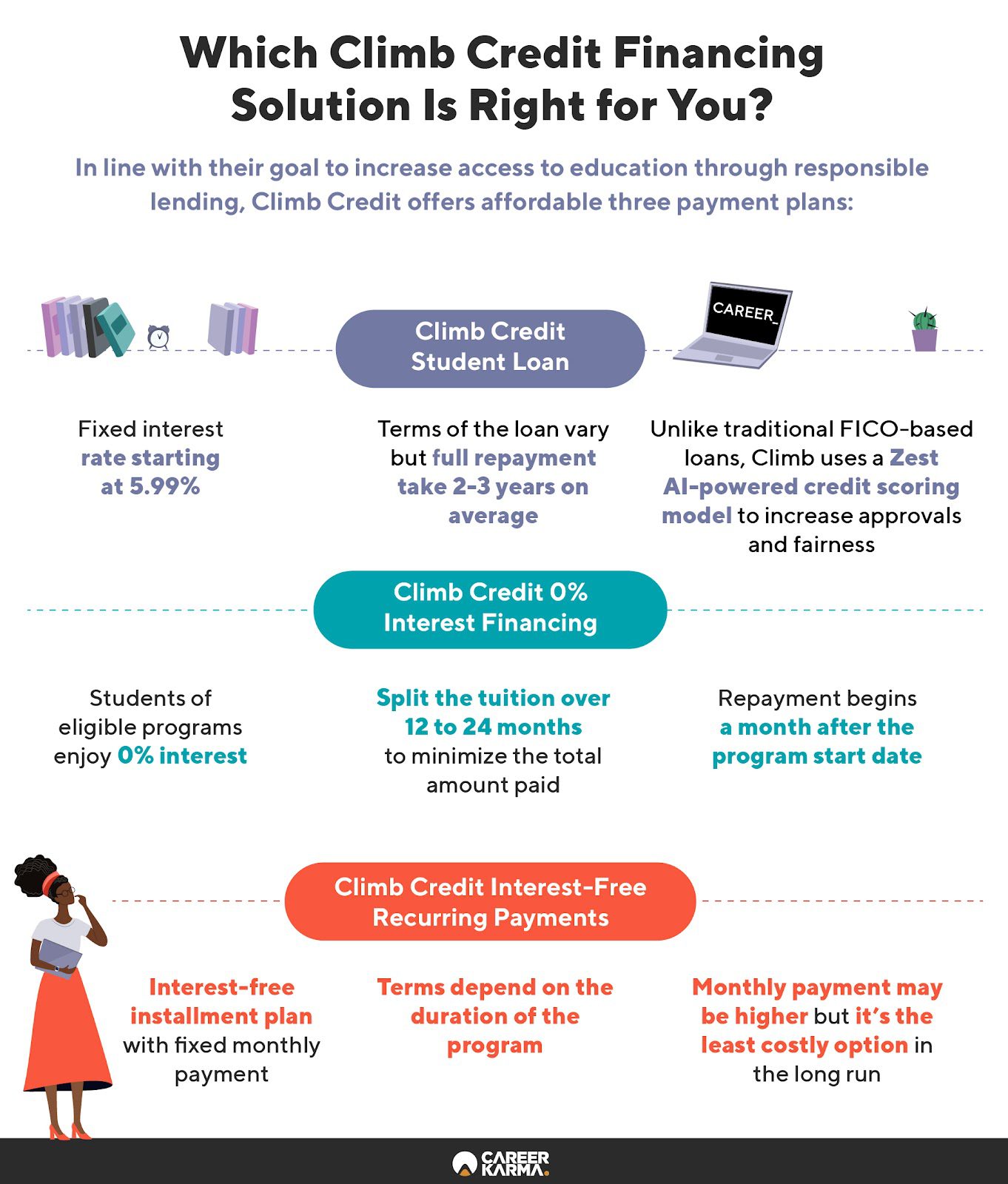

Climb Credit has gained a deep understanding of the evolving needs of students seeking to advance their education. This is why Climb offers three affordable payment plans: the Climb Loan, 0% Interest Financing, and Interest-Free Recurring Payments.

Climb Credit Student Loan

Climb Credit bridges students to opportunities by offering student loans for bootcamps. Students who apply for a Climb Loan are charged a fixed interest rate starting at 5.99 percent. Individual interest rates will vary based on a borrower’s credit history.

The repayment period of the loan varies from one program to another. Some allow you to defer your tuition until after you graduate, after the agreed job-hunting period ends, or until you find employment. Students who apply for Climb Loans for coding bootcamps usually take an average of three years to fully repay their loan. That’s shorter than the time it takes to pay back traditional loans, averaging at 10 or even 20 years.

But the main advantage of applying for a Climb Loan is the loan process and approval rate. By comparison, the majority of loans rely heavily on FICO scores before approving borrowers, creating credit gaps. Case in point, a study by the Consumer Financial Data Bureau (CFDB) shows that Black and Hispanic consumers are more likely to score below 620 compared with whites.

In a bid to boost Climb Credit’s credit model and increase accessibility and inclusivity, Climb has partnered with Zest AI, a financial software company that provides credit underwriting software. Through Zest AI’s system, the impact of credit bureau data known to correlate with race, gender, and ethnicity is minimized compared to other lenders to increase overall fairness.

Such improvement in Climb Credit’s lending model opens up more opportunities for all Americans and helps to narrow the skills gap in the US workforce. In the words of Climb Credit CEO Angela Ceresnie: “We’re committed to answering the calls of many for increased transparency, fairness, and inclusion in the student lending space.”

Climb Credit’s approval rate for loans is about 50 percent, which is significantly higher than the 21 percent approval rate across all private student loans.

Climb Credit 0% Interest Financing

Students also have a choice to pay their loans in a shorter period without any penalty. To top it off, they may be entitled to zero percent monthly interest, depending on the program they enroll in.

For 0% Interest Financing, the repayment kicks in a month after the program starts. The application process for this option is similar to the previous financing option, but some bootcamp partners prioritize giving affordable access to as many students as they can. In this case, Climb Credit provides a 100 percent approval rate allowing students for effortless loan applications.

The 0% Interest Financing option is perfect for working students who prefer to split the cost of their bootcamp fees between 12 to 24 months, to minimize their overall loan balance. Going this route also alleviates the stress on your pocket, as the 0% interest financing doesn’t take away a chunk of your salary.

Climb Credit Interest-Free Recurring Payments

Students can always pay upfront, but some prefer to spread their tuition fee payments over a certain period instead of paying all at once. Other students find themselves unable to apply for loans due to low credit scores.

To address these obstacles, Climb Credit offers an interest-free installment plan where students can pay a fixed monthly fee over the length of the course. Your payment schedule will depend on the duration of your chosen program. For example, enrolling in a six-month program gives you half a year to complete your tuition payment.

Although the monthly payment is higher with this option than other Climb Credit financing options, it is less costly in the long run. For those interested, you can finance your studies this way when you enroll with Ironhack, Array, or other Climb Credit bootcamp partners.

Removing Financial Barriers to Education with Climb Credit

For the longest time, student loans have been considered a necessary evil for those who want to pursue a degree to build a career. However, some loans have become a heavy obligation as some graduates face the harsh reality that their degrees do not guarantee employment.

Staying true to their mission of bringing career-advancing education closer to all Americans, Climb Credit’s financing options and partnerships with high-ROI bootcamps are creating a system where students can have access to the training they need without being buried in tons of debt that outweighs their salary potential.

Out of all the Climb graduates, the median salary increase reported was 64 percent, to boot. Take the Climb Credit quiz and see which financing option best suits you.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.