Coding bootcamps have become an incredibly popular option in recent years for people who want to transform their careers and their lives by developing skills in the tech industry. Just as the programs are non-conventional, so are the loan options available for bootcamp programs. In many ways, the options to pay for coding bootcamps are different from the mountainous, scary loans that are generally associated with a traditional 4-year degree program.

Ascent Funding is a leader in outcomes-based lending and is dedicated to student success. Ascent has an innovative risk-share model that aligns its incentives as a lender with the outcomes of students and schools–namely to ensure students earn high-paying careers after they graduate.

Federal aid and traditional private student loan options are not commonly available for bootcamp students. So, for people who want to transform their careers, they either have to survive on a tight budget or find $15,000 to cover the tuition.

That’s where Ascent comes in and helps fill the gap. Ascent recognizes the value of great bootcamps and the outcomes they can provide. Ascent offers affordable financing options to cover the cost of tuition and other living expenses at bootcamps that have proven positive outcomes, expanding access to this transformative option to launch a rewarding career in the tech industry.

Ascent also offers scholarships, increasing access to high-quality education for students from all economic backgrounds–in 2021, Ascent will award over $80,000 in scholarships.

Take It From A Student

Mike is an example of someone who was able to drastically shift his life for the better by attending a coding bootcamp with the help of Ascent.

From Arcade Bar Owner to Video Game Designer

After finishing his career as a touring musician in his twenties, Mike started running arcade bars in the greater Boston area. As a small business owner, he enjoyed being involved in the game-space world and industry, but other parts of the job were beginning to be too taxing.

The bar industry wasn’t where he saw himself long-term–it was a lot of late nights and not the kind of lifestyle he wanted. He was feeling burnt out in the industry; despite all the hustle, he wasn’t making much money and wanted to figure out something else that could be sustainable as a long-term career.

One day, a friend told him about Launch Academy, a bootcamp based in Boston where his friend had recently graduated. His friend had secured a great job in software engineering shortly after leaving and was enjoying the outcome of his decision. He encouraged Mike to explore a career in software engineering by attending a coding bootcamp. Mike took an “Introduction to Coding” class offered by Launch Academy and loved it. After taking the program’s pre-course to test out his interest again, he decided to go all-in and commit to the bootcamp.

Mike wanted a job where he could apply his intelligence and was ready to buckle down and make a change in his career. But he couldn’t afford to go to school and work to support the tuition at the same time. He didn’t have the money to pay for the full tuition upfront either. As a qualified candidate for the bootcamp, with the passion and drive to commit to it, he found himself in a difficult position.

“I was presented with the option of doing a free bootcamp that was paid for by a grant from the government,” Mike says, “But because the program wasn’t invested in helping their graduates get placed in a job afterward, it felt like if I did that I might just be giving up a couple of months of my life and not get a job afterward.”

Having already spent time pursuing his other passions, Mike knew that what he wanted out of a bootcamp wasn’t just to follow the bliss of his interest in software engineering—it was to get a great job that would lead to a fulfilling and lifelong career.

“In some cases, you get what you pay for,” Mike said. “I knew Launch Academy was invested in getting me a job and making me into a success story.”

Then he was told that Launch Academy is a partner school of Ascent Funding and that a bootcamp loan may be an option for him.

“I didn’t even know it was possible to get a loan for a bootcamp and I was super happy when Launch Academy told me they were willing to fund my tuition through Ascent Funding. Because I was self-employed for so long, I was concerned about my ability to get a loan.”

Ascent recognizes the value of a bootcamp education and is committed to students who are investing in their individual long-term success. Ascent is confident students will develop new skills throughout their program that will lead them to a high-paying job after graduation.

How did Ascent contribute to Mike’s bootcamp experience?

“I quite literally couldn’t have done the bootcamp without it,” he said. Mike decided that given all the variables, a consumer loan worked better for his situation than an Income Share Agreement (ISA) loan or other payment plans.

It has been close to two years since his graduation and Mike has been employed for over a year and a half as a lead software engineer at a game design company. He has now found an exciting, stable, and long-term career where he can combine his love for video games and entrepreneurial spirit with his technical skills. Not only that but he’s also fully repaid his loan.

Advice from A Student

As someone who has changed his life because of Ascent, Mike has great advice on the topic. Has repaying the loan felt like a burden? He says that the three-month grace period upon graduation Ascent provides gave him the time to search for the right job for him. “The payments were low,” he says, “considering the money I was making at my first job.” Mike was able to pay his loan off less than two years after graduating and ahead of schedule.

One piece of advice he’d give to people considering a loan is that if you’re serious about changing your career and becoming a software engineer, you should consider going to a bootcamp that takes fewer students, places a lot of value on education, and charges you a bit more because you get more out of it. Bootcamps that are dedicated to helping you find employment are also key. Taking out a consumer loan can help people pay for the bootcamps that are a bit more expensive but have more intensive career placement programs.

If you need help comparing different bootcamps, check out Ascent’s Bootcamp Finder.

Deciding whether to go with an ISA or consumer loan? Mike’s advice is that ISA loans are great if you’re not sure that you want to be a software engineer yet, but you’d like to learn about the field and perhaps get a job adjacent to tech. ISAs can help students assess if the program is right for them and dip their toes in. You can read more about ISAs in the section that follows.

But if you’re serious about becoming a software engineer, Mike suggests taking out a loan and going to a small, intensive bootcamp.

Three Methods of Funding a Bootcamp Education

There are three most common ways of funding a bootcamp education. Finding the right one depends on your personal situation and your goals.

Pay Upfront

One option to pay for bootcamps is to pay the total cost of the bootcamp upfront. The average cost of an in-person bootcamp as of 2019 was $13,293 and the average cost of an online bootcamp as of 2019 was$14,623.

For this option, students will not have to pay interest on tuition and don’t have to worry about making payments while trying to find a job. The downside however is that many people do not have the funds to pay the full amount of tuition upfront, making it less viable for many. This is why ISAs and consumer loans exist in this space.

Income Share Agreements (ISAs)

An Income Share Agreement (ISA) loan is a financing agreement between a funding body (which could be a school or a third-party working with a school) and a student. ISAs generally cover the tuition of a bootcamp while the student is in school and they will start paying the tuition amount back in installments based on a percentage of their income once they get a job.

Many schools offer ISAs for students and the nature of an ISA means that the student and the school are often aligned in their pursuit of getting the student a job after graduation because for some schools it’s only after this that a school gets paid. However, each school deals with ISAs differently. They have different numbers of required payments and different percentages of income that students have to pay once securing a job. The minimum salaries that students have to obtain before they start paying their ISA also differ by bootcamp.

The benefit of an ISA is that students don’t start paying it until they’ve got a job earning a specific agreed-upon salary. But one thing to keep in mind is that the total costs students end up paying overtime may be higher than other payment options, especially if a student experiences a great outcome and lands a high-paying job.

Bootcamp Loans

The next option is consumer loans for bootcamp students. These loans are offered by third-party organizations, like Ascent, that work with bootcamps that are high-quality and producing graduates who will go on to have successful careers. One thing that sets Ascent apart from other financing partners is that they work directly with the best bootcamps to subsidize the cost of financing their students. This means the school is invested in their students experiencing great outcomes and reduces the amount of interest a student pays.

Students can check if the bootcamp they’re interested in offers loan options. Ascent works with over 80 of the highest-rated bootcamps in the United States. Students can choose to work directly with Ascent, see what bootcamps it works with, and make a bootcamp selection that way. Ascent offers a grace period of three months after graduation to enable students to find a job before they start paying back their loans.

Ascent also offers multiple repayment options. You can begin making full payments immediately while in school (which reduces the amount of interest you’ll pay), you can pay only interest while in school or during the grace period, or you can fully defer payments until three months after graduating. These flexible repayment options allow students to choose the repayment plan that works best for them. It should be noted that repayment options vary by school.

Which Payment Option Is Best For You?

This would depend on your personal situation and capacity. If you don’t have extra cash readily available, then upfront payment is not the best option. If you would like to defer your payments using an ISA, you can look for a bootcamp offering an ISA plan that suits you best.

For those who can’t afford bootcamp tuition upfront but are concerned about the variability of an ISA loan, a consumer loan may be the best choice. Ascent also offers a Deferred Tuition Loan with select schools, which is similar to an ISA in that the loan repayment is dependent upon the outcome of the student’s success after the bootcamp. We’ll discuss Ascent’s Deferred Tuition Loan a little later in this article.

Why Ascent Is Unique

Let’s go over several factors that make Ascent Funding different from other loan providers:

Partnered with Reputable Coding Bootcamps

Ascent partners specifically with schools that have proven positive results for students. Ascent has an extensive vetting process to ensure that partner bootcamps set students up in a great position to be able to comfortably pay back their loans with their new exciting, expanding career.

Ascent does this by rigorously vetting bootcamp partners about their application process, acceptance rates, curriculum, qualifications of the staff, and student outcomes such as employment rates and average salaries of graduates. If you’re wondering what bootcamp you should go to, check out Ascent’s partner schools to get started.

Ascent always monitors the performance of partner bootcamps to ensure that students will be set up for success and therefore would be able to pay back their loans with minimized financial stress.

Ascent also recently expanded their bootcamp loan eligibility to Deferred Action Childhood Arrival (DACA) students without a cosigner, which is unique in the space.

Some of the bootcamps Ascent works with include Flatiron School, Fullstack Academy, General Assembly, Springboard, Thinkful, and many others.

Offers Unique Repayment Options

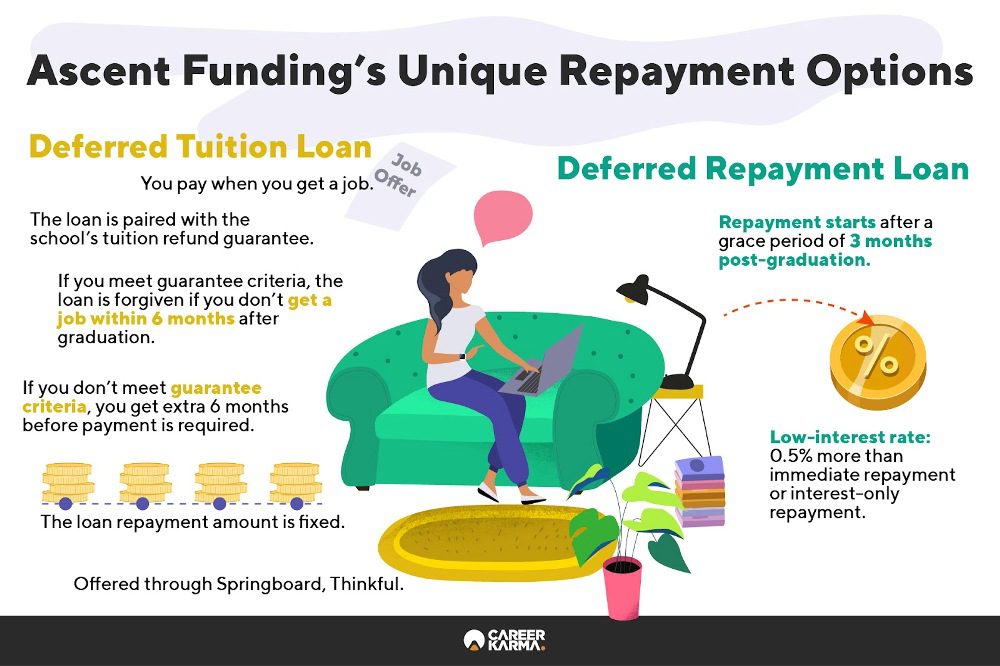

Beyond the typical way that loans function, Ascent Funding has two options that are unique and might be advantageous for students in certain positions.

The first is a Deferred Tuition Loan, available at select schools, which functions in a similar way to an ISA. With this option, students don’t begin repayment until they get a job. They are paired with the school’s tuition refund guarantee, so if they meet the requirements of the job guarantee and they don’t get a job six months post-graduation, their loan will be forgiven and they owe nothing.

If they don’t meet the requirements of the job guarantee or if a school doesn’t offer a job guarantee, they have the option of an additional six months of forbearance before having to make payments. The benefit of this Deferred Tuition Loan, as opposed to an ISA loan, is that the amount owed by the student is clear and upfront, rather than dependent on the amount of income they make in their new job. The total cost is typically lower than the payment cap of an ISA. Ascent Funding currently offers the Deferred Tuition Loan at Springboard and Thinkful.

Another unique option is the Deferred Repayment Option, in which students don’t have to start repaying their loan for three months after graduating, allowing them a grace period to look for a job. The interest rate for this option is only 0.5 percent more than the immediate repayment or interest-only repayment options. Ascent Funding offers the Deferred Repayment Option at the majority of their partner schools.

Ascent has made it clear that it is not interested in racking up high loan balances for students. The company believes in empowering brighter futures and student success and wants students to be able to pay back their loans quickly. To help accomplish this goal, there are no prepayment fees with Ascent loans. Ascent also offers funds for students to cover their living expenses while in the bootcamp at many schools, in the case that they have to put their job on hold while learning.

While there are other financing options like upfront payment and ISA loans, consumer loans may be the best option for those who are dedicated to the outcome of their bootcamp and are confident they are going to be able to achieve their goals but don’t have the money to pay upfront.

At the end of the day, Ascent aims to provide accessibility to bootcamps for all students, so that they can positively change their career paths and transform their lives. If you’re interested in finding out if Ascent is the right option for you, learn more here.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.