Times are tough, and the economy is still recovering. About 8.5 million people who lost their jobs in 2020 remain jobless. Four million of those job seekers are in an active job search that’s lasted longer than six months. Many are stretching their resources thin as they look for fulfilling work that pays a living wage.

The tough job market also hurts those who may be stuck in jobs that they don’t want. People may want to change careers, but feel as if they don’t have the time or money to devote to what could be a dramatic shift in their life.

Thinkful has seen how people are struggling, and in response, the school has worked with Ascent Funding to introduce a new deferred tuition plan with living expenses. This plan can help you cover rent and put food on the table as you work towards a new career.

How Does the Deferred Tuition with Living Expenses Plan Work?

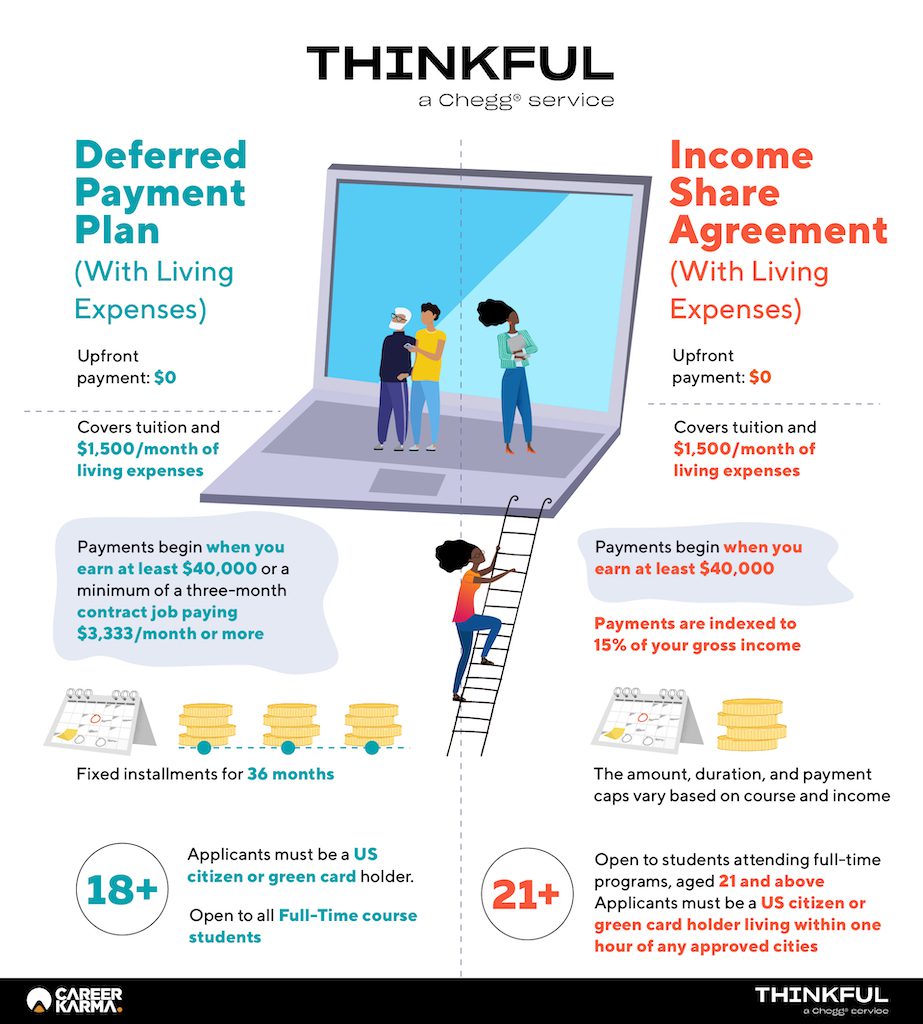

Under the current deferred tuition plan at Thinkful, you pay nothing upfront. This plan allows students to focus solely on learning their program’s curriculum without worrying about the cost. The added living expenses option also gives students an extra layer of support during their journey.

Students can now choose to add a monthly loan of $1,500 to cover their living expenses as they’re enrolled in the program. You can use the extra money to help pay for your rent/mortgage, groceries, child care, transportation, and more. There are restrictions on how students can spend the money, but the extra funding for necessities still offers relief for struggling students.

By easing some of the financial burdens of a new education experience, Thinkful hopes to make quality careers more accessible.

You’ll only start to pay back your tuition and living expenses loan once you’ve found a qualifying job. A qualifying job is a permanent position that pays $40,000 per year or more, or a contract job offer that lasts for at least three months that pays $3,333 per month or more. Once you find that job, you’ll pay monthly installments for 36 months until you’ve paid back your loan and tuition.

Am I Eligible?

The plan is available to Thinkful students who are enrolling in the full-time Data Analytics or UX/UI Design programs. In order to qualify, you must also be at least 18 years old and a US citizen or green card holder that can pass a background check.

If you meet all of these requirements, then you’re ready to apply for deferred tuition with a living expenses plan.

How Does the Application Process Work?

After you’ve applied for the Full-Time Data Analytics or Full-Time UX/UI Design program, a Thinkful Admissions Representative will contact you. Let that representative know you’re interested in enrolling with the Deferred Tuition and Living Expenses Plan.

You’ll fill out a form for the Deferred Tuition option along with another form for the Living Expenses. At this point, Thinkful will let you know if your application is accepted, and if it isn’t, your Admissions Representative can guide you to the best resource to learn more about the decision. You can contact your Admissions Representative at any time during the process with questions or concerns.

How Is This Loan Different From an Income Share Agreement (ISA)?

Though ISAs and this Deferred Tuition plan both offer an easier career change by letting you pay for tuition after the fact, there is an important difference.

ISA loans are indexed to a percentage of your income, whereas your Deferred Tuition loan payments are a flat amount every month. This means that before you graduate, you’ll know exactly how much you’ll be paying per month with the deferred tuition plan. You’ll have to wait until you land a qualifying job to see what you’ll be paying under an ISA.

Under an ISA, if you make $40,000 per year, and you’ve committed to paying 15 percent of your pre-tax monthly income, that’s $500 per month. If you make $75,000, you’re paying $937.50 per month. Your payments will depend on your job, which isn’t a bad thing, but you won’t know how much you’ll be paying until you’re hired.

Some students prefer the upfront knowledge of how much they’ll pay before they land a job under the deferred tuition plans. The right option for you depends on your personal preference.

Is This New Tuition Plan Right for Me?

This plan is designed for students who are worried about their ability to both work a job and attend school at the same time.

Let’s imagine a potential career changer called Jane, who is a single mother of a toddler. She worked towards a bachelor’s degree about 10 years ago but was unable to finish school due to unexpected circumstances. After leaving school, she’s been working as a cook at local restaurants. But now that Jane’s child is getting older, she wants to spend more time with them and make enough money to give them everything they need.

She’s interested in attending a UX/UI design bootcamp because she’s always had an eye for design. But Jane’s worried that she can’t afford to pay for her education upfront, as she hasn’t really been able to save much money while taking care of herself and a child on a lower salary.

Jane would be able to take either of the qualifying programs from her own home, without worrying about covering the bills. She’d have a set schedule and no commute, which would give her more time to spend with her child.

This plan gives people like Jane the chance to follow their dreams and build a better life without extra financial stress. If you think that sounds appealing to you, and you’re interested in Data Analytics or UX/UI design, then this plan is right for you.

Conclusion

Thinkful is establishing the Deferred Tuition and Living Expenses tuition option to give more people a fair chance at achieving their dreams. With the program’s increased accessibility, people around the country will be able to climb out of a tough job search and into a fulfilling career.

The loan comes with an obligation to repay, but a reasonable payment structure ensures you know what you’ll be paying ahead of time. And with increased earning potential after graduation, you’ll be happy to give back to an institution that believed in you enough to give you an extra boost.

If this plan sounds like it could be right for you, speak to a Thinkful Admissions Representative to start the application process today. Make sure to also check out this in-depth Thinkful review to learn more about this great school.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.