Note: This article is intended as a guide to Public Service Loan Forgiveness (PSLF) and should not be construed as financial or legal advice. Consult a professional, a loan servicer, or the federal government with any specific questions about the program.

Proposals around student loan forgiveness have become increasingly popular among Democratic presidential hopefuls. Senator Bernie Sanders recently announced a $1.6 trillion proposal that would forgive all outstanding student loans and expressed his belief that you are not truly free when you have debt that limits your career options. Senator Elizabeth Warren made a similar proposal earlier this year when she announced a $640 billion loan forgiveness plan, which would provide up to $50,000 in forgiveness for those earning under $100,000 and partial forgiveness for those earning up to $250,000. Sen. Warren, like Sen. Sanders, believes student debt is limiting career options for students, citing the example of teachers. Indeed, student loan debt can make it more difficult for people to pursue careers like teaching and other public service jobs, which often come with lower salaries.

Borrowers across the country owe around $1.6 trillion in student loans, with an average of around $34,000 per person. The federal government now projects to lose $31.5 billion on the federal student loan program over the next decade, and these losses are expected to grow as more people default on their loans. Thus, it makes sense that student loan forgiveness proposals are gaining traction. Student loans have been shown to decrease rates of homeownership and entrepreneurship and may also affect one’s interest in starting a family as early as one would like. However, there is already a plan available for people who work in public service jobs to request loan forgiveness: the Public Service Loan Forgiveness program, or PSLF. In this article, we will cover the main facets of the PSLF program and the application requirements, as well as address some of the problems with the program which have resulted in many people being denied forgiveness.

What is the Public Service Loan Forgiveness (PSLF) Program?

The PSLF program is a student loan forgiveness program designed to assist graduates who enter into public service jobs like teaching, military careers, and nursing. In the mid-2000s, Congress took note of the influence of student debt on the ability to pursue a career in public service. Many people with higher student debt burdens decided that public service was not a viable option because the salaries offered were lower than they needed to cover their student loan debt and their living costs. Thus, Congress decided to create a program that would encourage public service by giving forgiveness to graduates who wanted to enter into a public service job. In 2007, President George W. Bush signed into law the Public Service Loan Forgiveness program, which would provide such relief. This law was part of a larger bill called the College Cost Reduction and Access Act, which would provide student borrowers with some relief by working in public service.

However, at the start of the program, Congress did not want every public servant to be eligible. The program, therefore, incorporated a few eligibility criteria which would limit access to the program to a certain group of borrowers. Students who were interested in applying for loan forgiveness had to be enrolled in a Direct Loan. This type of loan was created in the 1990s as an alternative to an older loan program, the Federal Family Education Loan, where the government would guarantee loans made by private banks. If a student defaulted or couldn’t pay back their loan, the government would pay the bank most of the money back. This was the start of a new generation in student lending where the government would be directly responsible for issuing student loans, rather than outside servicers. The PSLF program was made active in October 2007, and people could start applying for forgiveness in October 2017, after making 120 payments toward their loan.

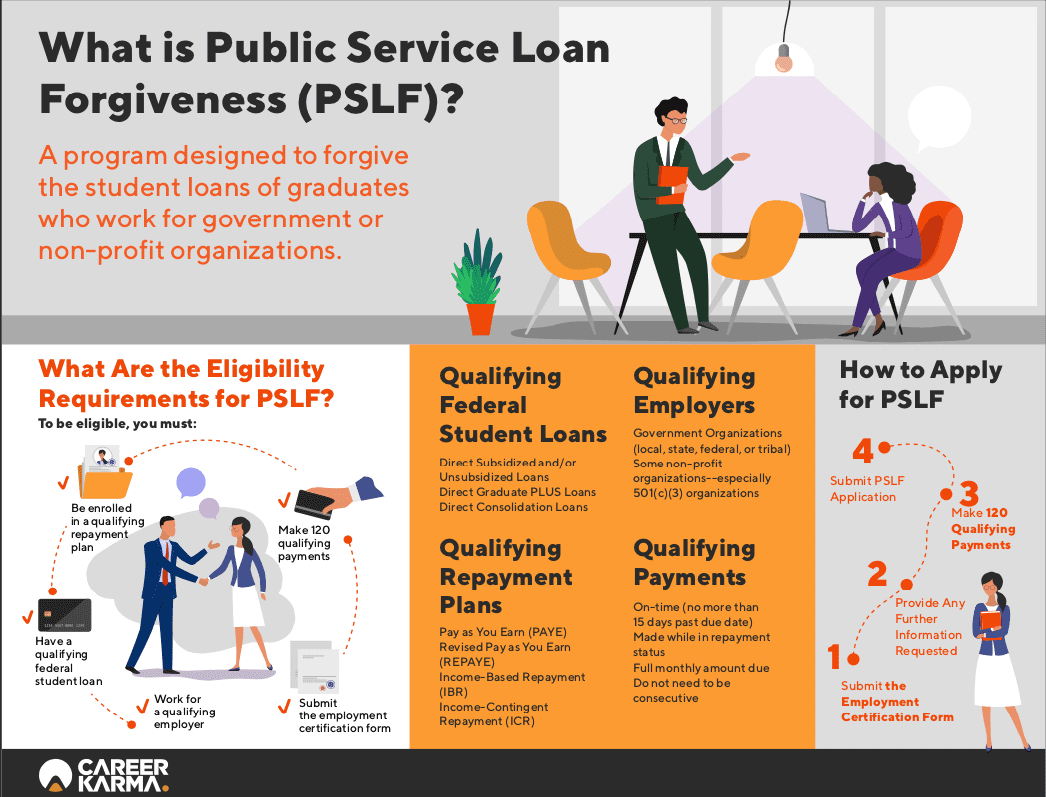

Who qualifies for Public Service Loan Forgiveness?

There are a few requirements that borrowers need to meet in order to be eligible for the Public Service Loan Forgiveness program. The first is that borrowers must work in a qualified job, which means they must be employed by a 501(c)(3) non-profit, a federal, state, or local government body, or certain types of nonprofits in public services. A few examples of a qualified job would include:

- Any federal, state, or local government department

- Military service

- Early childhood education (K-12)

- Public health services

- Public safety or law enforcement

- A non-profit organization focused on research or public advocacy

Borrowers can be employed in any position in these organizations in order to be eligible, including technical jobs. For example, an administrator working at a high school would be eligible for PSLF; a web developer working on the city government’s website would be eligible; a doctor in a public health service would further be eligible. In addition, applicants must be in full-time employment while making student loan payments in order to qualify for PSLF. Full-time employment for the program is defined by using each employer’s definition of full-time employment or at least 30 hours per week — whichever one is higher. If you work part-time in a public service job, you may not be eligible to apply for the program.

Aside from employment qualifications, there are a series of requirements for borrowers which affect the type of loan they have taken out. Firstly, students must have a Direct Loan, which, as aforementioned, is a type of loan issued directly by the federal government. Private loans, loans in default, and other types of federal loans are therefore not eligible for the program. The types of Direct Loan which the program requires are either: Direct subsidized or unsubsidized; Direct consolidated loans; Direct PLUS; and Direct Stafford subsidized or unsubsidized. Borrowers who have loans that do not fall into this category can apply for the Direct Loan Consolidation program at StudentLoans.gov, which will take all of your federal loans and merge them into one Direct Loan.

Borrowers also have to make 120 qualifying payments toward their loans. One of the main reasons why borrowers have been denied loan forgiveness through PSLF is that their payments are not qualified under the program. There are a few different requirements that have to be met in order for a payment to be active, which are:

- The payment was made on-time

- The payment was made in full

- The payment was made while you were employed in a full-time job with a qualified employer

- The payment was made after October 1, 2007, which was the official start date for the program

- The payment was made toward a Direct Loan

- The payment was made through a qualified repayment plan

If your loan is in deferment — a period where you have temporary permission to skip payments — the number of qualifying payments will not change. Further, if your loan is in forbearance, which is the same as deferment except interest will accrue on the loan, the number of qualified payments will also not change until you start making payments again.

Borrowers can switch between qualified jobs and their payments will count toward the PSLF program. However, payments made by borrowers who move to a non-qualifying employer will not count toward the 120 required qualifying payments.

What Are the Qualifying Repayment Plans for PSLF?

When students leave college with a loan, they are put into the standard repayment plan. In this plan, the principal and interest balance on the loan will be divided into equal monthly payments which will have to be made for a period of ten years. Congress has also created other plans such as the “graduated” plan, where payments will start small and get larger over time, and the “extended plan”, where the payment period will last longer than 10 years. However, payments made toward a loan enrolled in any of these plans will not be eligible for the Public Service Loan Forgiveness program. Instead, borrowers must be enrolled in a form of income-based repayment plan.

Income-contingent repayment, or ICR, was created by Congress as a more affordable way to make payments toward student loans. Through ICR, students would make monthly payments equal to 20 percent of their discretionary income — their income minus basic living expenses. This meant that if students became unemployed, they would not have to make payments toward their student loans. Thus, students would not have to make payments when they were in no position to do so. However, interest still continued to accumulate through this plan. Therefore, Congress allowed anyone who had been enrolled in the program for 25 years to have their loans forgiven, as at that point it would be unlikely they would fully repay their loan anyway. These plans were not very popular, as 20 percent of monthly income is high, and waiting for 25 years for forgiveness was seen as too long.

Congress created the income-based repayment program in 2007. This program worked the same way was ICR, but borrowers only had to pay 15 percent of their discretionary income, and any debt was forgiven after being enrolled in the program after 20 years. Public servants, under the PSLF program, were given the ability to request forgiveness after 10 years, assuming they met the strict requirements imposed by the program and were enrolled in a plan where they would make payments based on their income. In 2012, the Obama Administration passed the Pay as You Earn program, which was another form of income-based repayment where borrowers would pay 10 percent of their income instead of 15 percent, and later the Revised Pay as You Earn program was passed. In order to be qualified for the PSLF program, borrowers had to be enrolled in one of these programs:

- Income-contingent repayment (ICR);

- Income-based repayment (IBR);

- Pay as You Earn (PAYE); or

- Revised Pay as You Earn (REPAYE).

Any payment made under another repayment plan such as the standard or graduated plans would not qualify under the 120 payments that need to be made toward a loan to apply for PSLF.

Why Have So Many Public Service Loan Forgiveness Applications Been Denied?

Around 99 percent of applications for the Public Service Loan Forgiveness program have been denied, according to the Education Department. One big reason for this was because the Public Service Loan Forgiveness program has a high barrier for entry. In order to qualify for forgiveness, borrowers needed to make 120 payments while employed full-time in a qualifying public service job. If a borrower put their loan into deferment or forbearance, those months would not qualify toward the 120 payments. Also, if a borrower had made payments in another repayment plan such as the graduated or extended plans, or if they had made payments toward a non-Direct Loan, they would not be eligible for the program.

These requirements were difficult for early applicants to meet for a number of reasons. Firstly, the income-based repayment program could not be used until early 2009, and income-contingent repayment was not widely used at the time. Therefore, the number of people at the start of the program who were making qualified payments through a plan based on a borrower’s income was low. Most borrowers had a Federal Family Education Loan at the time, and were not aware of the strict requirements around the type of loan borrowers had to have or the payment plan they had to be enrolled in.

Further, the financial crisis hit soon after the PSLF program was signed into law, which made many people unable to make qualified payments on the standard payment plan. Many borrowers then moved their loan into another repayment plan such as graduated, extended, or forbearance — none of which qualified toward the necessary 120 payments. There were only a few people who moved their loans at the start of the program to an income-based or income-contingent repayment plan. In sum, most people who applied for forgiveness in October 2017 had not made the requisite 120 qualifying payments because of a number of complexities in the program.

Another reason why so many people have been denied loan forgiveness is that some loan servicers made mistakes when managing student loans that affect a student’s eligibility. Loan servicers are paid a flat rate for each borrower for advising them on how to repay their loan, and to process their payments. The more time a student loan servicer has to work with an individual borrower, the less money they make from that student. If a borrower needs a lot of in-depth advice around ensuring their job qualifies for a program, they are in the right repayment plan, and are paying money toward a Direct Loan, the loan servicer will perhaps lose money.

According to recent complaints, and those outlined in a lawsuit filed by the American Federation of Teachers about the PSLF program, loan servicers have failed to advise people correctly on how to make qualifying payments toward their loan that would make them eligible for the PSLF program. Servicers have also been accused of failing to tell people how to enroll in PSLF, failing to tell borrowers that consolidating their existing Direct Loans into one single loan would reset the 120 payment count to zero, and telling people payments that are ineligible were actually eligible, among other things. In addition, in order to qualify for an income-based repayment plan, borrowers must file a new set of forms each year with information about their income, family, and other details. Some servicers have taken longer than expected to process these forms, and any payments made until the forms had been processed were not counted toward the 120 payments requirement.

These problems meant the number of people who were eligible for loan forgiveness in October 2017, exactly 120 months after the program had been passed by Congress, they would have to: make 120 qualifying loan payments on-time; make payments toward a Direct Loan or consolidate their loans into a Direct Loan; have a good servicer who had not made any mistakes; be employed in a qualifying full-time public service position; and moved into the correct payment plan quickly. The number of people who actually met these requirements was limited. Indeed, many people who applied for the PSLF program later were still denied because they did not meet all of these requirements.

What is Temporary Expanded Public Service Loan Forgiveness?

The Temporary Expanded Public Service Loan Forgiveness program, or TEPSLF, was an expansion program created in 2018 by Congress in response to the low acceptance rates for the program. Thousands of borrowers complained that they were ineligible for loan forgiveness due to the complex requirements associated with the program. Congress heard these complaints and designed an expansion program that was intended to ensure more people were eligible for the program. The TEPSLF program expands the list of repayment plans that students can use to make the requisite 120 payments to qualify for loan forgiveness. The PSLF program only accepts students who are enrolled in a form of income-based repayment (e.g. IDR, IBR, PAYE, or REPAYE), whereas the TEPSLF program allows borrowers enrolled in the following payment plans to request loan forgiveness:

- Graduated repayment plan

- Extended repayment plan

- Consolidation graduated repayment plan

- Consolidation standard repayment plan

Those who apply for TEPSLF must meet the other requirements for the PSLF program, such as working in a full-time public service position and making 120 qualified payments toward their loan (although a qualified payment includes payments made in the above repayment plans).

In order to qualify for TEPSLF, borrowers should also first apply for the PSLF program, even if they are not eligible for the plan. While this is not a requirement set out by Congress, the Education Department has denied applications on the grounds that borrowers have not applied for PSLF.

Why Were So Many People Rejected for TEPSLF?

Ninety-nine percent of loan forgiveness requests under the TEPSLF program were rejected in the program’s first year, from May 2018 to 2019. A recent report by the Government Accountability Office, the investigative arm of Congress, the U.S. Department of Education processed around 54,000 requests and approved 661. Further, only $27 million of the $700 million appropriated for the expansion plan was given out to students. There are a few reasons why the expansion program suffered similar acceptance rates to the PSLF program.

Firstly, in order to be eligible for TEPSLF, borrowers must first apply for the PSLF program, even if they will not qualify. This requirement was not created by Congress, but rather the Department of Education when they were implementing the program. Thus, borrowers were confused because they had to both apply for a program that they would likely not be accepted for, even though Congress did not create such a requirement for the program. Indeed, when Congress authorized the TEPSLF program, lawmakers directed the Department of Education to make the expansion easy to access: “The Secretary shall develop and make available a simple method for borrowers to apply for loan cancellation.”

According to the GAO’s report, 71 percent of all rejected TEPSLF applications were denied because borrowers had not applied for the PSLF program that they knew they would not qualify for. The GAO’s report further states that the Education Department has “not created a borrower-friendly TEPSLF process”, which has resulted in a program designed to support public servants looking for loan forgiveness to become difficult to access. The GAO report also states that when borrowers are rejected for TEPSLF, the letter they receive does not explain the options available to them with regard to requesting a second review of their application. This means that when people have been rejected, they have been left with insufficient information around what they need to do to reapply.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Overall, 10 percent of requests were rejected because borrowers had not made 120 qualifying repayments, according to the GAO’s report. 6 percent of requests did not meet a new requirement made by Congress, which stated that when borrowers apply for TEPSLF, their most recent payment, and the payment they made 12 months before applying, but be equal to or greater than what they would have paid on an income-based repayment plan. This requirement was not clear for many borrowers, and so many people did not qualify for the program. Due to the low acceptance rate of this program, the GAO has encouraged the Education Department to streamline the application process, make it easier for borrowers to find out about the program’s requirements, and be clearer about the process of receiving loan forgiveness.

The Future of Public Loan Service Forgiveness (PSLF)

The Public Service Loan Forgiveness Program has suffered from a series of problems since borrowers could apply for forgiveness in 2017, but the future may be hopeful. In 2012, the Department of Education began allowing people to submit a form that would pre-certify the public service that people have earned as they work toward making 120 qualifying payments. By the end of 2013, 84,000 borrowers had been certified; by the end of 2015, 335,000 borrowers had been certified. In March 2019, over one million borrowers had received approval for their certification forms. Also, nearly half of the $870 billion in outstanding Direct Loans — the type eligible for loan forgiveness — are being repaid through an income-based repayment plan.

Indeed, the confusing requirements for the PSLF program have resulted in many people being denied for loan forgiveness. But this is in large part due to how long the application window has been open for. Borrowers could only start applying for PSLF after October 2017, and the complex requirements made many people ineligible when they applied. However, as the program gets older, more people will likely meet the eligibility requirements and have their loans forgiven by the federal government. The Congressional Budget Office has continued to raise its estimated cost of the program in recent years, in anticipation of more borrowers becoming eligible. In 2016, the CBO estimated the annual cost of providing forgiveness to graduate school loans to be $4 billion. In 2019, that projection was increased to $12 billion, as more people are expected to become eligible for the program.

As stories of more teachers and nurses who depended on loan forgiveness and have been denied for the PSLF program come to light, more will likely be done to ensure the program succeeds. Many of the mistakes made by the Education Department around implementing the program could have been prevented, and the same applies to the misadministration of some loans by servicers. However, more public service will likely become eligible for the program in the near future and will be able to benefit from having their loans forgiven. The 99 percent rejection rate is not sustainable, and so the future of the PSLF program and TEPSLF programs are strong.

Public Service Loan Forgiveness (PSLF) FAQ

The payments required in order to qualify for PSLF do not need to be consecutive — if you do not make a payment one month, you will still be able to qualify when you make 120 qualifying payments.

Borrowers who have met the requirements of the PSLF program and have been making payments for ten years toward their loan could qualify for loan forgiveness. Anyone interested in the PSLF program does not need to apply until they have made 120 qualifying payments toward a Direct Loan (the type of loan eligible for the program).

There is no cap on the total loan balance that can be forgiven through the PSLF program.

While the PSLF topic has received negative publicity lately, there is no information to suggest the program will be shut down. Borrowers who are eligible for the program can find out more on the Education Department’s website.

Many borrowers do not qualify for the PSLF program, and there are other options available to borrowers. These include:

Consider refinancing. Refinancing student loans can save borrowers money and help them make more manageable payments toward their loans. However, when student loans have been refinanced, they will not be eligible for PSLF, TEPSLF, or any income-driven repayment plans.

Continue to make payments through income-driven repayment. Depending on the plan, income-based repayment options come with loan forgiveness after 20 or 25 years.

Explore other discharge or forgiveness programs. There are other forgiveness programs available to borrowers in certain circumstances which borrowers can explore.

Information about the PSLF program can be found on the Education Department’s student aid website and on the StudentLoans.gov PSLF help tool.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.