If you’re here, you’re probably looking to make a career change. When you’re trying to find a new path, it can be daunting to look through every option you have at your disposal. Beyond that, it can be stressful figuring out how to pay for the education you need for a fresh start.

There are plenty of choices for people like you that want to make a change without going back to college. But even those options can sometimes seem unattainably expensive when you’re already working long hours for low pay.

Luckily, many organizations offer multiple financing options to help people like you get over that financial barrier. One of the most appealing options for students is an Income Share Agreement (ISA) loan.

ISAs allow students to pay little or no money while enrolled in a coding bootcamp or skills-training program. Instead of paying the entire tuition upfront, ISA students commit to paying back a percentage of their income after graduation (but only if and when they’re gainfully employed).

As the education landscape has changed, ISAs have gotten more prominent in the national conversation around financing education. Though a few misconceptions around ISAs have also gained traction as ISAs have spread, they haven’t discouraged students or providers. More educators are implementing ISAs every day, from traditional four-year universities to online coding bootcamps.

ISA platforms like Meratas work with schools and skills training programs to ensure that students get a fair deal during their reskill experience by creating tailor-made ISA programs for institutions. Meratas does not finance ISAs, but rather, provides the infrastructure for schools and skills training programs to quickly offer ISAs of their own.

Using a platform approach, Meratas seeks to democratize access to continued education by hosting a marketplace where students can easily access ISA resources, research, and apply to schools offering ISA tuition programs.

Meratas’ ISA programs are structured to incentivize students, schools, and capital providers to work together to promote and finance only the best educational programs that lead to solid careers.

What’s an Income Share Agreement (ISA)?

An ISA is a type of loan that is a commitment between a funder (or school) and a student, where in exchange for educational funding (or admission into a program), the student agrees to pay back a percentage of their income after they graduate and only if that education leads to a qualifying job.

The ISA designates a specific amount of payments that recipients must make over a specific timeframe. But, these payments only begin once students start earning above a specific income threshold, meaning that the ISA is typically only paid back if and when that education leads to a better career

ISAs allow students to attend a school or skills-training program without stressing about the upfront cost. These loan agreements are an alternative to the private loans many organizations rely upon for financing students’ education. Although ISA loans still incur debt, they help level the playing field for students that can’t afford to make upfront payments or keep up with regular installments while trying to make a positive change.

When you enter an ISA, every term of your repayment path is defined from the very beginning. You’ll know exactly how much you’ll be paying off in the future, and exactly how much you need to be earning to start paying.

The percentage and other terms of your ISA can vary between schools or skills-training programs. There are some benefits to ISAs to keep in mind as you look for the right program for you.

Aligned Risk and Reward

ISA programs rely on recipients finding a job above a certain salary before they can start earning money. If the student doesn’t get hired, then the funder or school doesn’t get paid.

Students and funders have aligned risk and reward in an ISA program, which ensures both sides of the agreement work as hard as possible to fulfill their side of the bargain. Schools and skills-training programs have to employ a modern curriculum with in-demand tools and training.

The faster a student gets hired at a good job, the faster they can start repaying their contract. If a student doesn’t find a qualifying job during a predetermined time frame known as the payment window, the school never gets paid.

The aligned risk and reward differ from private or federal student loans, as ISA loan recipients only make payments once they have a job above the minimum income threshold. ISAs aren’t a job guarantee, but they incentivize schools to help students launch their careers quickly.

Different Schools, Different Standards

Though the aligned risk and reward are common to every ISA, each ISA solution is different and should be considered by the student seeking financing.

This variance means that different schools and skills-training programs each have their own criteria when deciding to accept a student’s application for an ISA. So even if your application is refused from one school or skills training course, it’s not guaranteed that each school will decline your application.

With an ISA, you’re more than just a credit score. Most schools look at the full picture when reading over your application. If you show drive to improve your career and the will to stick to a course and pass with flying colors, many schools will weigh those qualities pretty heavily while reading your application.

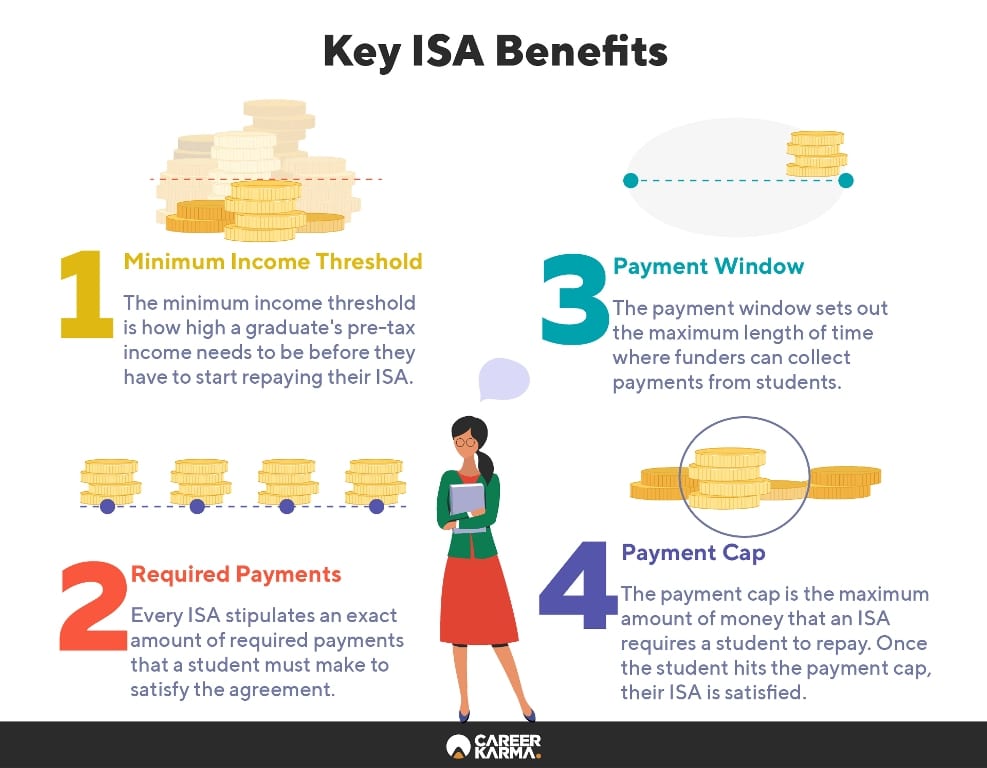

Key ISA Benefits

We’ve previously touched on some key benefits that make ISAs appealing to people looking for a new career. Though every ISA has these benefits, the details of each benefit may vary from school to school.

Some schools may have lower minimum income thresholds than others, some may have longer payment windows than others, along with other differences. Meratas makes suggestions to keep ISAs appealing when working with schools and skills-training providers. The best ISAs ensure that both students and funders get a fair deal.

But ultimately, it’s up to the funders and schools themselves to decide on the features of their contracts. This fact means that there’s some variety from one ISA to the next. Because all ISAs aren’t created equal, there are a few things you should be looking for when you’re reading through an ISA contract to ensure it’s meeting your expectations.

ISAs offer four key benefits that make them an appealing option for financing your education: a minimum income threshold, required payments, a payment window, and a payment cap.

Minimum Income Threshold

The minimum income threshold ensures that students know exactly how high their pre-tax income needs to be before they have to start repaying their ISA. This threshold protects your earnings if it takes you longer than expected to find a job with a qualifying income after graduation.

Some programs’ agreements have no defined time frame on when your payments begin so you can get settled after graduation. Once you reach the minimum income threshold, you’ll start paying based on a percentage of your pre-tax income. This way, you always have peace of mind knowing your payments will be manageable.

For example, John Doe has just graduated from a coding bootcamp. When John Doe entered the ISA with his bootcamp, both parties agreed upon a minimum income threshold of $50,000. If John Doe finds a job that pays $49,000 in his chosen field after graduation, he wouldn’t have to start paying the bootcamp just yet.

However, Doe would have to make sure the bootcamp knows about his income, or his lack of income if his job search lasts longer than usual. Most schools have some reporting guidelines to ensure students keep their deferment status. In these cases, recipients are required to report their income or unemployment status every month to ensure they’re actively looking for a job.

If students go above their minimum income threshold and start paying, but unfortunately lose their job, they’re still protected. Payments pause if students sink below the minimum income threshold at any time. Payments only resume after students find another job above the minimum income threshold.

Required Payments

Every ISA stipulates an exact amount of required payments that a student must make to satisfy the agreement. These payments are indexed to a specific percentage of a student’s pre-tax income.

For example, let’s say that John Doe’s ISA stipulates that he has to make 24 required payments over a 48-month payment window. He agrees to payments that are indexed to 10% of his income. If John Doe finds a job that reaches the minimum income threshold within a month of graduating, he would make those 24 required payments over the remaining 47 months.

The majority of ISAs are satisfied by the student making all of their required payments.

Contract Term

The contract term is how long an ISA’s payment obligations last, and it varies from one ISA to the next. Some contract terms stipulate a set amount of required payments that must be made, while others only stipulate a set payment window where funders can collect on the ISA.

So, for example, a contract term could say that a student has to make 48 payments to satisfy their ISA, unless they hit the payment cap. A different contract term could give students a 48-month payment window to satisfy their ISA, unless they hit the payment cap.

As in John Doe’s ISA, many contracts combine both required payments and the payment window into one contract term.

Payment Window

The payment window sets out the maximum length of time where funders can collect payments from ISA recipients. This differs from other financing options which require students to continue paying until the principal and interest are satisfied, no matter how long it takes.

For example, a classmate of John Doe from the previous example isn’t as lucky, and their job search lasts for around eight months. This student also agreed during the ISA process to make 24 required payments over 48 months. Because this student spent eight months on their job hunt, the coding bootcamp has a 40-month window to collect those same 24 payments.

Different ISAs treat the payment windows differently. Some ISAs count months where you’re under the minimum income threshold as part of your payment window, while others extend the window if you have to go into deferment. It’s important to spot which sort of payment window you have in your ISA when looking over the agreement.

At the end of a student’s payment window, the ISA is satisfied, even if the student hasn’t reached their payment cap.

Payment Cap

The payment cap is the maximum amount of money that an ISA requires a student to repay. Like the payment window, once the student hits the payment cap, their ISA is satisfied, regardless of any other stipulations.

Different funders have different payment caps which can range from the exact cost of your tuition to two times the tuition or more. Meratas suggests that students look for schools and skills-training programs that don’t exceed two times a student’s tuition for their payment cap (assuming it is a long-term ISA). However, shorter duration ISAs should have caps well below 2x.

Let’s say that John Doe agrees to pay back 10% of his income each month, and he starts paying once he reaches his exact income threshold at $50,000. John Doe’s classmate has also agreed to a 10% income share, but they land a job making $90,000.

The classmate would end up paying $750 per month compared to John Doe’s $417 per month. Because of their higher payments, they’ll be able to reach their payment cap more quickly than John Doe, which means less time and money spent on the ISA.

This benefit ensures that higher-earning students don’t end up paying more than they thought they would when they signed the initial agreement. Students that earn more money spend less time paying off their ISA, and students that earn less money still know there’s a limit on what they’ll have to pay back.

Once a student reaches the payment cap, the ISA is satisfied. So if you decided to pay more than the required payment every month, you could end your ISA obligations earlier than anticipated.

Conclusion

With the aforementioned benefits, it’s easy to see why an ISA loan may be a strong financial aid option for many students.

ISA recipients avoid paying a seemingly endless amount of money with no fixed ending in sight. You start paying once you have a job above the minimum income threshold. Your payments will always remain manageable no matter your salary because they’re indexed to your income.

Programs look for more than just a credit score when deciding on whether they want to award students an ISA or not. If you can do the work to earn a new job in your field of choice, then many programs will look beyond your past and into what may be a brighter future.

Now that you know the basics of an ISA, head over to Meratas.com to access their income share agreement resources, and find and fund your future with an ISA.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.