Did you know that over 60 percent of Americans aged 25 years and over have no degree? Due to biases formed by financial status, race, and gender, not everyone has the same opportunities to train for the career paths of their choice. How can everyone be part of a competitive environment where education is seen as a passport to a better life?

Fortunately, bootcamps and training institutions that offer immersive programs are growing. The programs they provide tackle the hottest skills in the industry, like data science, software engineering, tech sales, and can be completed within a year or less. Whether you’re a high school or college dropout, someone in your mid-30s or 40s looking for a tech career, or just tech curious, many tech bootcamps are admitting students from all walks of life while providing excellent training and career coaching.

Despite being less expensive than traditional schools, the cost can still be a barrier for many, especially if the tuition fees are paid up front. This leaves many students to consider applying for affordable loans.

Climb Credit is redefining the student loans of today by offering accessible and affordable financing options, thus reducing barriers to education access. Hear how they did just that for a stay-at-home mom turned software engineer and machine learning specialist.

With flexible and accessible Climb Credit financing options, you are one step closer to a fulfilling career in tech.

Discover how Climb can help fund your training.A Student Borrower’s Review of Climb Credit

Gurpreet Kaur is among the thousands of students that Climb Credit was able to help with career advancement.

A computer science graduate, Gurpreet did not have the chance to practice her profession as she chose to become a devoted mother and a homemaker for 12 years. However, after consulting some of her friends, she was advised to pursue her career aspirations or risk living a boring life once her kids leave to pursue their own dreams.

Gurpreet shares, “Their kids were older than mine, so they [have been] stay-at-home moms longer than I have. With kids gone, they lost their purpose in life. There is nothing that is driving them to [be] busy in their routine.”

Add to that, more mature women with no recent work experience have more difficulty finding employment. “The industry is cruel to them because they think that these women don’t have much to offer. Going back to work was too difficult for them. They told me that [I] have time. [I] should not go through what they are going through.”

After researching the recent trends in her industry, she realized that her knowledge was outdated. The industry had changed immensely and contained many advanced tools and systems beyond her background knowledge. Gurpreet says, “When I started to look at the job descriptions, it did not match what I had done in the past.”

Pursuing another bachelor’s degree was out of the question, as it would have demanded four years of her time and thousands of dollars she didn’t have. Coding bootcamps came under her radar, so she applied for a course in software engineering with App Academy, which she completed.

A few months after graduation, she landed a job as a software engineer for Bluecross Blueshield, where she worked with data scientists and dabbled into the realm of machine learning. Gurpreet explains, “I started to feel like I’m enjoying my life as a software engineer, but I really love the mathematics side of AI and data science. So, I thought maybe that is where my interests are. Why not try it?”

And so, she did.

She decided to enroll with Springboard. However, after fully funding her studies with App Academy, she could no longer afford to pay for another bootcamp up front. Springboard suggested a lending platform, and Climb Credit came to her rescue.

Financing Your Education with Climb Credit

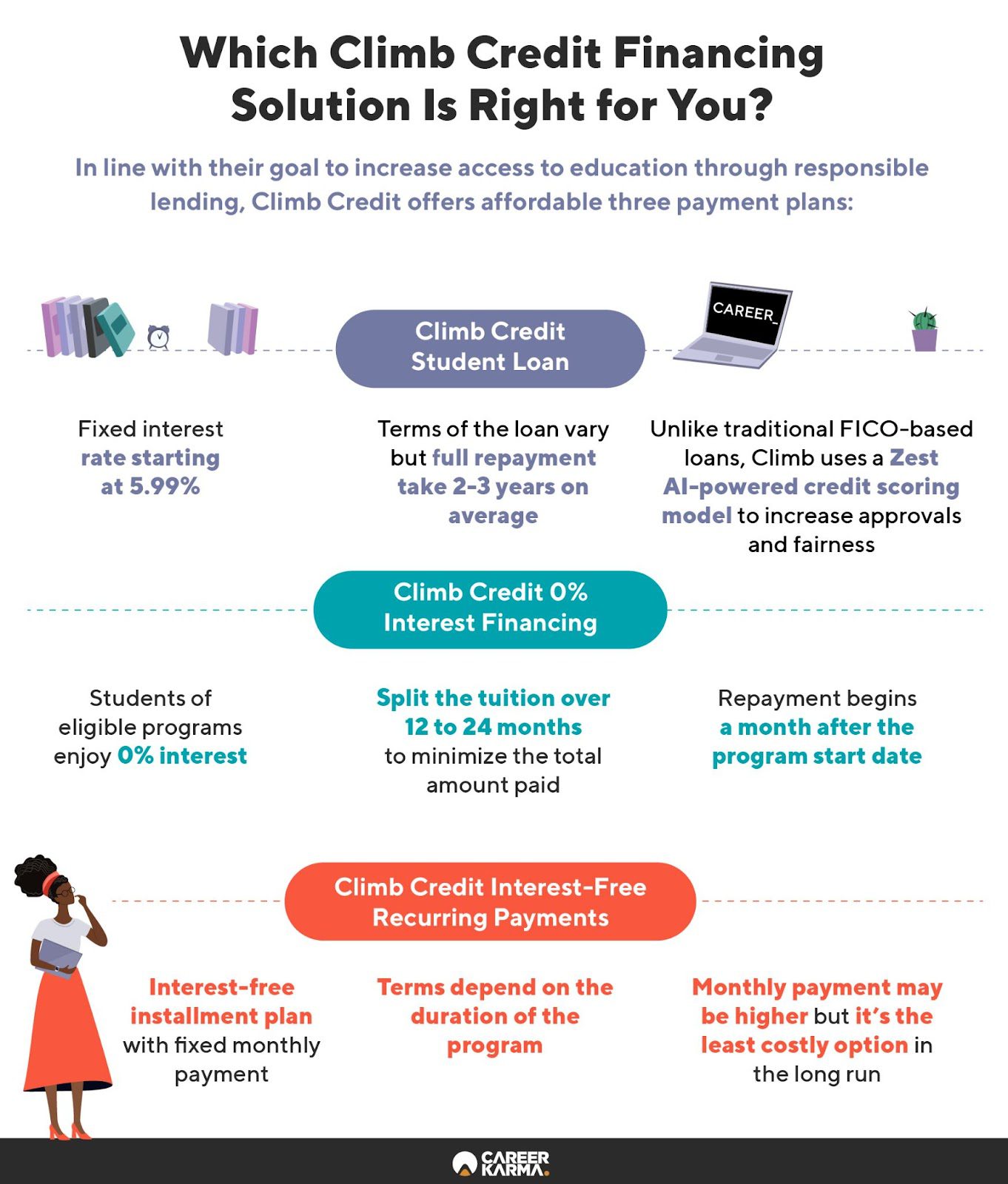

Gurpreet says, “It took two days for my Climb loan to get approved. All it took was two documents, and I was approved.” She recalls that the Climb Credit team was very accommodating, and she was able to take advantage of the 0% interest loan option, which allowed her to pay off the loan interest-free in 12 monthly payments.

The loan terms were pretty straightforward for her. “I can come to learn, get a job, and then pay [them] back,” she adds.

Gurpreet enrolled in Springboard’s Data Science Career Track program. The lessons were spread over six months, covering Python, data wrangling, statistical inference, basic and advanced machine learning, software engineering, and data science. They were also tasked to complete capstone projects that allowed them to explore, strategize, and implement solutions first-hand.

Springboard follows a remote-first and mentor-led model, allowing students to adapt their studies according to their work schedule and other activities. An industry mentor and a student adviser are assigned to each student to ensure that learners receive all-around support.

Gurpreet found her experience at Springboard eye-opening, and the mentors helped her a lot by guiding her to explore her options. She was assigned 50 small tasks and three major projects to complete until she had a strong foundation and essential competencies in machine learning and deep learning.

She explains, “…[Springboard] wants you to succeed and [so] they guide you really well. And the best part of Springboard was…the job search program. The mentors bake you really well, then the career counselors come and put the icing on you. You become a [well-made] cake.”

As of December 15, 2021, the program cost for the Data Science Career Track course is $11,340. With Climb Credit, students can pay between $57 to $152 per month during the program, depending on the approved interest rate. After graduating from the program, they can pay the monthly principal plus the interest rate, totaling $346 to $400.

For Gurpreet, she took advantage of the 0% financing option, which is ideal for those who need a loan but can pay it off quickly. In this case, students can start paying their tuition while enrolled in the program with no interest for the first 12 months. Doing so leaves them with a minimum loan balance after graduation.

Why Trust Climb Credit?

Climb Credit is well aware of the challenges that come with student loans. Many companies offer loans with a high interest rate, leaving students with heavy financial stress. This leads them to quit school or default and have their credit profile immensely affected.

Climb believes that everyone should have access to education, and loans should be an obligation that ends—not a lifelong struggle to carry. They are intent on helping people like Gurpreet discover their potential by breaking financial obstacles to education.

One of the vital changes they adopted was the Zest Artificial Intelligence (AI) system instead of the Fair Isaac Company (FICO) scores that most lending companies use. Climb reduces the biases of lending models when evaluating underserved and marginalized applicants as a result of this adjustment.

This is a huge game-changer because every American can have a better chance at pursuing their education goals and have a more fair shot at success so long as they pass the assessment process of Climb Credit.

Climb Credit also takes pride in partnering with institutions that have proven high outcomes. Take Springboard, for example, the bootcamp that Gurpreet attended. Over 50 percent of Springboard’s graduates were able to get a job before the program ended. In terms of compensation, many of them reported a $25,700 average increase in their salary post-course.

Climb’s student loan products may differ from one institution to another. Some bootcamps defer the tuition fees until students can secure a job, while others have similar terms to Springboard, where they start paying the interest rate during the program.

In addition to the Climb student loan and the zero-percent financing option, Climb also offers an interest-free recurring payment. With this method, students can split their tuition costs based on the duration of their program and make monthly payments accordingly. That means a student enrolled in a 9-month program also has nine months to pay. The upside? Anyone can take advantage of this payment plan, and there is no interest to pay.

Apply For a Student Loan With Climb Credit

Climb Credit collaborates with over 200 partner schools with a proven track record of molding industry-ready graduates that are sought after by various companies. It’s no wonder that over 30,000 students have trusted Climb for their career advancement.

Like Gurpreet, nothing is impossible if you have the grit, determination, and a little help from Climb. She shares, “[Taking a loan with Climb] was very manageable…They took the total [loan amount] and divided it into 12 parts. I paid back in eight months.”

Gurpreet adds, “If somebody comes to me [asking] ‘Do you think Climb is right [for me]?’ …[I will say] just go do it.”

After completing her course at Springboard, Gurpreet found her dream job as a machine learning and natural language processing engineer at Jama Software, a Portland-based software company.

It’s never too late to chase success—you can get inspired by more Climb success stories here. Find out which Climb Credit option fits you and get the training you need to launch the career you want.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.