As the debate over “skin in the game” in higher education continues, Income Share Agreements (ISAs) are being explored as a potential solution. ISAs allow a student to raise the money they need to pay for their education. In exchange, the student will agree to pay back a percentage of their post-graduation income. Students enrolled in an ISA will only pay back money if they earn over a certain amount, and those who are very successful will never pay back more than a capped limit. This means that the incentives are aligned between the student and the institution: if the student gets a well-paying job, the school will earn a good return on their investment. On the other hand, if the student gets a low-paying job or becomes unemployed, then the institution will earn a low return — or indeed no return — on their investment. ISAs are starting to become more common among colleges and coding bootcamps around the world, with institutional and individual investors starting to take an interest in the ISA market and how these agreements could act as an investment opportunity.

ISAs allow students to raise the money they need to pay for their education in exchange for a percentage of their post-graduation income.

The original concept of an ISA was developed by Milton Friedman in his famous paper “The Role of Government in Education.” Friedman noticed that student loans — unlike mortgages or auto loans — were not securitized to any underlying asset. This means that lenders have to assume a higher level of risk when giving students money because there is no asset they can recover if the student fails to pay. Friedman, therefore, proposed a system whereby an investor could buy a “share” in an individual’s future earnings, in exchange for providing them with the upfront capital they needed to pay for their education. In essence, ISAs would act as a type of equity financing: students would commit a percentage of their future earnings and an investor would give them upfront capital to learn. In the 1970s, Yale University launched the Tuition Postponement Option (TPO) which allowed students to raise the capital they needed for their college in exchange for a portion of their future income. However, although the program was well-intentioned, it suffered from many structural problems — high-earners could buy out early, and people had to pay until all money had been returned to the fund — and so it was dubbed largely a failure.

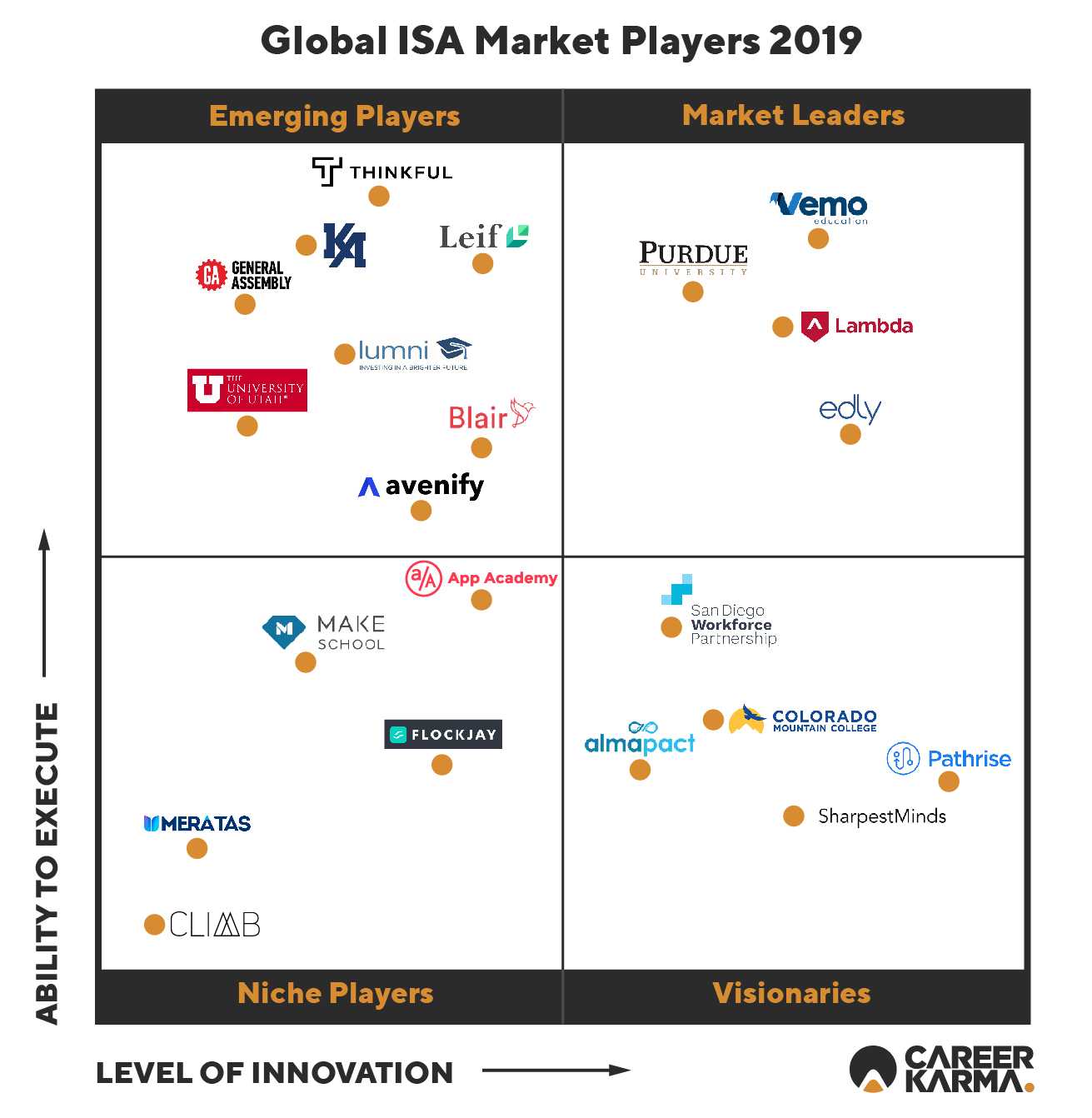

The market has recently seen an influx of new entrants who hope to expand access to ISAs.

ISAs have changed a lot since Friedman’s paper and the Yale experiment. More recently, a number of vocational educational institutions and colleges have started to offer ISAs as an alternative to student loans. Coding bootcamps such as Lambda School and Thinkful allow students to commit a percentage of their future income for a certain period in exchange for being given the funds they need to attend the bootcamp. By using an ISA, the incentives of these institutions are aligned, and so students can feel more confident in pursuing their offerings — they will only pay if they succeed. Colleges including Purdue University and the University of Utah have also started to experiment with ISAs in recent years, which they market as an alternative to student loans for those who have exhausted all of the other available options. These institutions use ISAs to help people who cannot take out a loan or who do not want to take out a loan to attend their dream education program. Most ISAs do not require co-signers, do not account for the financial history of the borrower, and instead rely on evaluating human potential. ISAs take many different forms today. Some ISAs are issued directly by the institution; others are offered by private investors who hope to earn a return from this new asset class.

The market has recently seen an influx of new entrants who hope to expand access to ISAs, and are using new and innovative approaches to offering these agreements. This report will briefly cover the main market players, their contributions to the market, and what trends have emerged in recent months and years that we can expect to continue in the future.

Contents

Income Share Agreement (ISA) Market Leaders

Income Share Agreements are not a new concept, although most of the activity in the industry has been confined to the last five years. The primary market leaders in the Income Share Agreement space have all established their companies or ISA programs within the last five years. The main accelerant for the success of these market leaders has been the rise of the student debt crisis, and the narrative toward developing new options that help schools get more “skin in the game.” ISAs are not a debt-based security and align the incentives of schools and students, and so many companies and colleges are starting to experiment with these agreements to realize these benefits. In this section, we will explore the main market players in each sector of the ISA market — college-based, bootcamp-based, financial infrastructure, and ISA support — and outline their contributions to the market.

The main accelerant for the success of these market leaders has been the rise of the student debt crisis and the narrative toward developing new options that help schools get more “skin in the game.”

Purdue University

Purdue University of Indiana was the first higher education institution to offer ISAs in their current form. Indeed, Yale piloted an ISA program in the 1970s, although there have been many structural changes made to the agreements since then. Purdue University is a public research university founded in 1869 by John Purdue, who donated land and money to establish a college of science, technology, and agriculture in his name. In 2016, Purdue University partnered with Vemo Education to offer Income Share Agreements, and started the “Back a Boiler” ISA Fund. The goal of this fund, spearheaded by President Mitch Daniels, a former governor of Indiana, was to provide students who had exhausted all of their available options with the capital that they needed in order to attend the college. Purdue markets its ISA program as an alternative to private student loans and Parent PLUS loans with high interest rates — a form of federal student loan — but does not consider the agreements to be a full replacement for student debt.

Purdue’s ISA fund is accessible to students who are in their second year or later, and who have chosen the major that they are going to study. These terms were implemented in order to combat adverse selection, according to Purdue’s study on adverse selection in its ISA program, and also to ensure that students did not need to convert their ISA if they change majors. Students in the Purdue program can borrow no more than $33,000 throughout their time at the university. The specific terms that students are offered by Purdue University depends on their major — which is used to evaluate future earnings potential — and how much they are borrowing. For example, a student of economics at Purdue would share 0.34 percent of their income per $1,000 they have borrowed, and their obligation would last for 100 months; a student of English would share 0.45 percent of their income per $1,000 borrowed for a period of 116 months. The income prospects in a career that requires an English degree are lower than those of a career that requires an economics degree, and so the terms are different.

Purdue set a precedent for future use of ISAs in the context of colleges and universities.

Varying the ISA terms by degree will help ensure that the fund can earn a good return while offering students the most appropriate terms based on their future earnings prospects. Students who raise capital for their education through Purdue’s ISA fund will only pay when they earn over $20,000 per year, and payments are capped at 2.5 times the initial amount borrowed. This ensures that students who are unemployed or command low salaries are not left with a disproportionate amount of debt to pay, and students who earn high salaries will never pay more than a fair amount for their education. Since the launch of the fund in 2016, Purdue has issued around 800 contracts, and in December 2018, they announced the launch of the Back a Boiler Fund II. Fund II received investments from 11 investors, ranging from family offices to institutional investors, totaling $10.2 million, which is expected to fund the program for three years.

Contributions to the ISA Market

Purdue has had a large impact on the development of the ISA space. Perhaps the most important impact they have had is that they set a precedent for future use of ISAs in the context of colleges. Indeed, we have realized this already — dozens of other colleges around the United States have launched or are planning to launch similar ISA funds. Purdue University, in collaboration with their partner, Vemo Education, has created a good structure for an ISA program and has demonstrated the potential of ISAs in the context of higher education. Further, Purdue University has also commissioned studies such as their report on adverse selection in their ISA program and has offered support to other institutions who are looking to start their own ISA programs. Purdue has more recently been involved in lobbying Congress to pass ISA legislation and was a cosignatory on a recent letter of 20 major market players which advocated for Congress to create a strong regulatory framework around ISAs. Finally, Purdue University has also demonstrated the economic viability of an ISA fund in the context of further education, and by facilitating outside investments, it has shown that an ISA fund is indeed a viable investment opportunity.

Lambda School

Lambda School, founded in 2016, was one of the first major coding bootcamps to explore ISAs. [*See note] Lambda School is a coding bootcamp that provides students with online classes taught by live instructors and one-on-one mentoring in a variety of areas, from iOS development to full stack web development. Lambda School’s course lasts for a total of nine months and claims to offer students 1500 hours of interactive programming experience — similar to that which one would acquire in a four-year college degree. Lambda School has recently invested heavily in their career services and has developed a series of hiring partnerships with employers to help graduates find a well-paying job as soon as they have graduated from the school.

In exchange for the capital they need to attend Lambda School, students can agree to share 17 percent of their income with the school for a period of two years. The total amount that a student can pay back is capped at 1.5 times the initial amount borrowed, to ensure that students do not have to pay back more than is fair for the education they have been provided. Students will only start paying when they earn a salary of over $50,000. This is based on the higher salaries commanded by people who work in the industries which Lambda trains students for, such as iOS development, and demonstrates Lambda’s commitment to students. In sum, If you don’t earn over $50,000, you don’t need to pay anything back. This means that students who pursue Lambda School do not need to worry about the risks associated with attending a bootcamp over traditional college — they are guaranteed to succeed, otherwise after 5 years earning less than $50,000 they will pay nothing to Lambda School.

Lambda School recently partnered with Leif, who has committed $50 million to finance Lambda School’s ISAs. This has become increasingly common among bootcamps and vocational educational institutions, whereas colleges traditionally have raised money from outside investors for their funds. When a student takes out an ISA from Lambda School, it is often sold to Leif for a certain amount of money, which gives Lambda School the capital they need to cover overhead and provide quality education to students. Leif assumes the responsibility of ISA compliance and collects payments from students, which means that Lambda School can focus on education over developing a compliance solution. Lambda School has also piloted programs such as the Living Stipend, which allows students to receive up to $18,000 in monthly payments of $2,000 to cover students’ living costs in the nine-month program. Students who borrow money through the Living Stipend ISA will pay back 10 percent of their salary for a five year period, capped at $50,000, with the same minimum income threshold as the standard Lambda School ISA.

Contributions to the ISA Market

Lambda School has made a variety of contributions to the market which make it the most dominant ISA player in the vocational education space. Firstly, Lambda School has demonstrated the viability of ISAs in vocational education. They have shown that by aligning the incentives of students and the institution, they are able to provide a higher quality education that can compete with traditional college degrees in computer science, and offer students the ability to quickly break into a career in technology. Indeed, Lambda School has inspired many other market players to offer ISAs, and more vocational bootcamps are offering ISAs in order to compete with Lambda School.

In addition, Lambda School has also shown that the ISAs have a variety of other benefits aside from incentive alignment. The Living Stipend is an example of how ISAs can be used to address one critical problem people face when going to school — how they will pay for their living costs. Many people who go to college or a bootcamp end up getting a job to finance their school costs, rent, food, and more. Lambda School’s living stipend allows people to focus on their education, rather than finding a job to pay for their living costs. Lambda School has also set a strong precedent for how ISAs should be structured in the vocational education space, and have fiercely advocated for the benefits of the agreements. Indeed, the founder of Lambda School frequently discusses the strengths of ISAs, and the institution has also been involved in lobbying for future legislation, namely as a co-signatory on the aforementioned letter to Congress. Lambda School has also expanded its ISA-based financing options to the European and some African markets and is piloting programs in other regions such as Canada, thus helping ISAs become more recognized outside of the U.S. market.

Edly

Edly was one of the first platforms developed to help facilitate investments into Income Share Agreements. Edly bridges the gap between schools and accredited investors who want to invest in ISAs, and makes it easier for schools to source the capital that they need in order to finance their ISA funds. Edly has developed an ISA marketplace, which allows accredited investors to commit capital into ISA funds, and earn a return if a student succeeds. The platform aligns the interests of schools, students, and investors — schools have a financial incentive to invest in increasing student outcomes and have an incentive to ensure that investors are satisfied with the stability of their investment. Edly provides schools with comprehensive support in designing their ISA program and raising the capital they need to succeed. This involves evaluating the course structure, expected student outcomes, and reflecting on the needs of the institution and its students. Edly will then handle student onboarding and compliance and allows students who list cohorts on the edly marketplace to encourage more investors to commit capital to their program.

Edly is helping ensure schools can access the investors they need to finance their programs.

The other side of the edly marketplace is for investors. Edly allows investors to buy “shares” in a pool of ISAs offered by an institution, which will reflect the overall returns of ISAs in the pool. Investors will provide the school with the capital they need to finance the student’s education, and students will repay the money only after they find a job that pays over a certain amount. This means that accredited investors have the ability to access this asset class and can reliably commit capital to ISAs as an investment class. For investors, edly offers access to diversification, a fixed minimum return while students are still in school and incentive alignment which will help increase student outcomes and maximize the investors’ prospects for returns. Thus far, edly has announced its partnership with Holberton School, a San Francisco-based coding bootcamp with schools around the world. Edly will advance Holberton $2 million, and allow Holberton to list ISAs on the platform for professional investors to invest in.

Contributions to the ISA Market

The most important contribution Edly has made to the market is that they are pioneering a new form of financial infrastructure around ISAs, aiming to turn ISAs into a professional asset class. Edly has developed a marketplace for ISAs which allows both schools to raise the capital they need to finance their programs, and allows institutional investors invest in students and earn a return if they succeed. Indeed, in order for ISAs to grow, more capital will need to be available to institutions that want to start ISA programs. Edly is bridging this gap and is helping ensure that schools can access the investors they need to finance their programs, without worrying about managing investor relations in-house. Further, edly is creating a stable financial instrument and is advocating for professional investors to commit capital into the space, which will help increase the availability of capital for ISAs in the future. Although edly is still at a relatively early stage, they have still set a strong precedent around ISAs as a financial asset, and have inspired helped significantly increase the availability of capital for ISAs.

Vemo Education

Vemo Education, founded in 2015, has established itself as a market leader in designing and implementing Income Share Agreements. Vemo specializes in partnering with higher education institutions and skills training organizations to help them design, develop, launch, and maintain their ISA programs. Vemo’s services allow schools to become more transparent around outcomes, and help them improve their services to meet the changing needs of students. In the context of higher education, Vemo has partnered with dozens of institutions to start and maintain their programs. Vemo uses their experience to help institutions design programs that meet their specific goals, and ensure that the terms offered by the school are appropriate for the people who the school wants to serve. Thus far, Vemo has partnered with Purdue University, the University of Utah, Messiah College, Norwich University, and more, to help them launch and maintain ISA programs. They have also partnered with vocational bootcamps such as General Assembly to help administer their ISA programs.

Vemo plays a role in the entire ISA stack — from conception to maintenance. They develop technology that helps administrators understand their ISA fund and student financing needs, and use their insights to incorporate best practices in ISA funds to mitigate the potential for abuse. They also work diligently to highlight the benefits of ISAs — signaling value, increasing access to and the affordability of further education, aligning incentives, increasing student choice, et cetera — which helps colleges and private companies gain a firmer understanding of the potential of ISAs.

Contributions to the ISA Market

Vemo Education has made a number of contributions to the market. They have clearly established themselves as a market leader by supporting in the design and development of many different ISA programs, and have helped ensure that those programs are designed with the needs of students in mind. Vemo has been able to acquire detailed insights regarding how to structure an effective ISA program, and what does not work, which will help them become a more prominent market player in the future as more colleges and vocational educational institutions get involved with ISAs. In addition to supporting the creation of ISA programs, they provide schools with analytics and data insights to help them gain an insight into the success of their ISA fund and how they can improve their educational programs to better meet the needs of students. This demonstrates the power of incentive alignment which is inherent in ISAs, and how Vemo plays a major role in data gathering in the ISA industry. Vemo has also been actively involved in advocating for ISA legislation — Vemo Education and board member Governor Jack Markell both signed the letter to the House and Senate Finance Committees about ISAs — and overall have helped raise awareness for ISAs.

Emerging and Visionary Income Share Agreement Players

There are a number of players in the market who have the potential to have a strong impact on the industry and have not yet reached the status as a market leader. Due to the nascent stage of the ISA industry, however, some of these players are close to achieving the title of a market leader. As the landscape develops, it is likely that these players will accompany a larger section of the ISA market, and have a greater impact on the ecosystem. The definition of an “emerging market player” is a company or institution that is involved in the space and is having an impact, but has not yet dominated the section of the market in which they operated, or proven the long-term viability of their solution. The definition of a “visionary” is a company or institution that is involved with the space and is having an impact, but has not yet proven their ability to execute far enough for it to be considered an emerging player. This section explores a few of the top emerging players and visionaries who are inspiring the most innovation in the space.

Emerging Income Share Agreement Market Players

Blair

Blair is a college financing platform that allows students to borrow money for college through an Income Share Agreement. Blair allows students to borrow up to $50,000 for college, in exchange for a certain percentage of their income for a certain number of years — depending on the students’ major. Students will only make payments when they earn over $25,000 which means that if they become underemployed or unemployed after graduation, they will not have to make payments until they earn over the minimum repayment amount. Student ISAs are financed by investors on the platform, who can invest in ISA funds on the platform and earn a return if students succeed. Students who use Blair can apply for funding and learn about payment terms online and will be given a quote in minutes if they meet the ISA requirements; funding will be received within a couple of days of applying, if a student is eligible.

In addition to providing financing, Blair provides additional support to students to help improve their employability. After a student borrows money from Blair, a team member will help place students in internships, give them access to industry mentors, and coach students to help them reach their full potential. Blair also crafts a unique career plan for each individual student which will cover topics such as preparing for interviews or optimizing application documents, in order to help students find a job after graduation. Blair takes a 2 percent cut of the repayments made by students and receive a share of the profits if an ISA fund returns a certain amount. Blair has raised the first fund for 50 students and has disbursed money for the first 10 students. The company also plans to deploy a larger fund that will offer access to ISA-based financing for 200 students. Blair has received applications for over $4 million of funding, as of August 15, 2019, many of which are for students from underprivileged backgrounds. Blair is demonstrating strong progress toward their vision and has also helped pave the way for new ISA securities in the future. Therefore, they have been awarded the classification of an Emerging Player in this report.

Avenify

Avenify is a peer-to-peer lending platform for Income Share Agreements, which allow accredited investors to commit capital into specific students who are attending college. Avenify, unlike edly, allows students attending any college to finance their education through an ISA. Students who use Avenify to finance their education will pay a percentage of their income after they graduate for a certain number of months, depending on their field of study. Students will only make payments when they earn over $20,000, and students will only make payments if they have a job — if they become unemployed or go back to school, their payments will pause. Like other ISA lenders, Avenify does not use credit scores to evaluate borrowers, and also does not require a co-signatory in order for people to borrow money from the platform. Avenify sets the specific terms for an ISA based on a student’s future earning potential.

Students who use Avenify can apply for funding online and will be presented with an offer based on the information they have provided, if they are eligible to raise money through an ISA on the platform. Avenify then gives the students the money they need to finance their education, and handles compliance for payments. Accredited investors can commit capital through Avenify to individual contracts, and earn a return if a student succeeds. Avenify is a new company and has not yet started an ISA fund, although is in the process of accepting applications for their Fall 2019 batch as of July 2019. Avenify is developing a new financial infrastructure based on peer-to-peer lending, which could become more popular as demand among students for ISA-based financing increases.

Thinkful

Thinkful is a coding bootcamp, founded in 2012, which provides access to a high-quality education in various areas of computing science, including engineering, data science, and full-stack web development. Thinkful offers access to one-on-one mentorship, a strong support team, and career services such as a career coach to help students succeed in the program, and find a well-paying job after graduation. Thinkful will guide students through the job market, how they can apply for positions, how they can succeed in interviews, and prepare them to get hired.

The Thinkful program consists of a series of workshops, peer reviews, mentorship sessions, and portfolio project opportunities that help students acquire the skills they need to succeed. Thinkful offers students access to ISA-based financing, alongside a variety of upfront payment options and also student loans provided by their partner, Ascent Funding. In exchange for attending Thinkful’s web development bootcamp, students will pay 15 percent of their income for three years, but only when they find a job that pays more than $40,000 per year. If a student switches jobs, payments will pause until the student moves back into a job earning over $40,000 per year, for a total of 24 months of pausing. Students will never pay back more than $28,000 in total.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Students can also take out the Thinkful Living Stipend ISA, which allows them to receive $1,500 per month while they are studying at Thinkful, in exchange for 15 percent of their income for four years. Thinkful has further demonstrated the viability of ISAs in the bootcamp space, and also shows how ISA-based financing options can co-exist with debt-based financing.

University of Utah

The University of Utah announced in January 2019 that they are launching the “Invest in U” ISA program. This pilot is designed to help students pay education-related costs so they can complete their degrees faster and succeed. The University of Utah is the first major university in the Western region to offer students access to ISAs, according to their announcement. This program allows students to borrow up to $10,000 per fall, spring, and summer academic semesters. The aim of this program is to help address financial barriers that may result in a student dropping out or extending their time in college — 27 percent of people who start college in Utah never graduate. In exchange for the money, students will agree to share 2.85 percent of their income for three to 10 years, depending on their major and the amount they have borrowed. This is similar to the Purdue program in that the specific terms offered depend on major, although dissimilar in the fact that the University of Utah offers a flat 2.85 percent income share percentage.

This program, although new, demonstrates another way in which ISAs can help students succeed — providing continuity capital so that people can finish their degree. The University of Utah allows students who are struggling to find capital and who may need to drop out because they can no longer afford college the ability to raise the money they need to graduate and earn their degree. This means that students are more likely to finish their degrees, and therefore command a higher salary after they finish their education. The University of Utah has partnered with Vemo Education, an ISA servicing company, to help maintain the program — a prominent ISA servicer in the higher education space.

Leif

Leif helps schools design custom ISA programs and manage payments and compliance of ISAs. Leif has developed a platform that makes it easy for companies that offer ISAs to onboard new students quickly. Leif also provides schools with a dashboard to manage and analyze their ISA program and manage income verification and payments — two major components of running a successful ISA fund. Leif also provides money to companies already using ISAs to help finance their operations and has committed $50 million to Lambda School, as well as $50 million to Modern Labor.

Leif plays an important role in developing the supporting infrastructure that schools need in order to create a strong ISA program. Managing ISAs in-house is not efficient for most institutions, and so Leif takes away that responsibility from institutions and allows them to focus on providing a high-quality education. Leif could become a market leader in the near future if they continue to expand access to their services and administer more ISA programs. As of July 2019, however, Vemo has commanded a lead in the ISA servicing space based on the number of institutions they support and their strong history of developing ISA funds, most notably the Purdue University ISA fund.

General Assembly

General Assembly is a coding bootcamp that helps people develop new skills in design, marketing, technology, and data science professions. General Assembly allows students to attend their school either in-person at one of their campuses around the world, or through the internet. In exchange for attending General Assembly, students can enter into the “Catalyst Program ISA” and share 10 percent of their monthly income for a period of 48 months, but only if they earn at least $40,000 per year. The total amount a student will pay back is capped at 1.5 times the tuition of the program the student chooses.

General Assembly has helped demonstrate the potential of ISAs in the context of vocational education, and has also commissioned research into the ISA space such as through their report “Untapped Potential: How Income Share Agreements Work”. Although the company has not made significant unique contributions to the ISA space — unlike Thinkful and their Living Stipend, for example — they have still made a lot of progress and helped expand access to ISA-based financing. Therefore, they merit consideration as an emerging player in the ISA space.

Lumni

Lumni, founded in 2003, is a company that provides students with access to ISA-based funding options. Rather than taking out a loan, students can instead seek funding for their education from Lumni and agree to share a set percentage of their future income, depending on their college and major. Lumni also offers students access to workshops, mentorship opportunities, and personal and professional development resources to help them become job-ready and find a well-paying job after graduation. Lumni first started operating in a number of Latin American countries, namely Chile and Colombia, but has since expanded into the United States. Lumni also allows investors to pledge capital into an ISA fund which includes dozens of students who have raised money from Lumni, and earn a return based on the aggregate success of those students.

Lumni acquired Patronage in May 2018 to finance their growth and is a very active player in the ISA space. Based on Lumni’s extensive experience in the ISA space, their advocacy efforts for ISAs, as well as their strong work toward developing financial infrastructure for ISAs, they merit inclusion in this report as an emerging market player.

Kenzie Academy

Kenzie Academy is a campus-based and online school based in Indianapolis that teaches software engineering, digital marketing, UX engineering, and more. Kenzie Academy provides students with a comprehensive education in their field of study and offers them access to career support to help them get hired. The average salary of Kenzie graduates is $55k-$90k, according to Kenzie Academy, and most students land a job offer before graduation. The Kenzie program lasts from between six months and two years, depending on the program. Students at Kenzie can pay upfront, through a payment plan, or through an Income Share Agreement. The ISA option allows students to share 17.5 percent of their income for 4 years after graduation, with a $100 upfront commitment fee. Alternatively, students can also apply for the half-ISA option, which allows a student to pay $12,000 upfront, then 17.5 percent of their income for 25 months.

Kenzie Academy has demonstrated strong progress toward their goal of offering a high-quality coding and design education to students, and have been early pioneers of ISA-based funding options. Therefore, they have earned the position as an emerging market player.

Income Share Agreement Market Visionaries

San Diego Workforce Partnership

The San Diego Workforce Partnership, in collaboration with the UC San Diego Extension School, announced in early 2019 their new ISA fund. This partnership will allow students to attend nine-to-twelve-month certificate programs at UC San Diego Extension in areas including digital marketing, business intelligence, and front-end web development. The fund will also provide students with job placement and mentorship support to help students find a well-paying job after graduation. The goal of this fund was to help expand access to technology courses for people who are looking to “upskill” or break into a career in technology, based on the new influx of technology jobs available in San Diego. This fund also aims to help provide access to capital so that people can create new skills to thrive in the modern workforce, and will help the SDWP expand their offerings after recent cuts to local workforce development boards.

Students can raise money to pay for school from the SDWP fund in exchange for 6-8 percent of their salary for between 36 and 60 months, and their payments are capped at 1.8 times the cost of the program. Students will only make payments if they earn over $40,000 per year. SDWP raised money from Strada Education Network, Google.org, the James Irvine Foundation, and a private philanthropist to start the fund, and have since started to offer contracts to students attending programs at UC San Diego’s Extension School. This program aims to be self-sustaining by 2023 — students will pay back money into the program which will fund the next generation of ISAs — which means that they will not need to rely as much on federal funding in the future to finance some of their operations. The SDWP Fund sets a strong precedent regarding how ISAs can be used in the context of workforce boards, and has since received interest from other boards looking to adopt similar programs. As this program becomes more popular, it is likely that it will emerge into a market leader as an example of ISAs in the context of upskilling and creating perpetually-operating community funds.

Colorado Mountain College

Colorado Mountain College (CMC), in partnership with Vemo Education, launched Fund Suenos in early 2019. This program aims to help DACA students and others who are not eligible for federal financial assistance to raise up to $3,000 to cover their education at CMC. The fund allows students to raise the money they need for their education in exchange for a percentage of their earnings after graduation. The money goes back into the fund to help other students access CMC’s educational offerings. The $3,000 offered by the Fund is enough to cover tuition which is $2,400 per year, as well as student fees and books for in-district students. Payments begin six months after a student graduates and only when they are making more than $30,000 per year. Students will share 4 percent of their income for a period of up to 60 months until they reach the payment cap — the same amount they borrowed — or their ISA expires.

This fund is also new, and so very little data is available about its long-term viability. However, this fund demonstrates how ISAs can be leveraged to help people who cannot access traditional aid — DACA recipients, for example — attend college and pursue a degree.

AlmaPact

AlmaPact is a company that provides access to private ISAs for students. AlmaPact advances students the funds they need to pay for their tuition, in exchange for a percentage of their future income. AlmaPact also connects investors — social impact funds and for-profit investors, namely — to students looking to raise money on the platform. AlmaPact institutes a payment cap of between 2 and 2.5 times the initial amount borrowed, depending on the terms offered to each student. The term of the ISA and minimum income threshold also vary between ISA. In addition to providing student financing, AlmaPact also provides access to career development and networking activities, as well as the ability to connect with other people in the AlmaPact network, which is designed to help students build their network when they are looking for a job.

AlmaPact is still a new market player — they have only just started issuing contracts — and access to information about the platform is limited. However, they are working on unique financial infrastructure and offer students access to career support, and have demonstrated that they are working hard toward their goal of increasing access to ISA-based financing options for students. AlmaPact also acquired BASE Capital in June 2019, an early pioneer of ISAs, which will assist them in their goal of expanding access to ISAs.

SharpestMinds

SharpestMinds is experimenting with ISAs in the context of mentorship. SharpestMinds allows people interested in data science to find a professional mentor who can help them become job-ready. SharpestMinds mentors help people practice for interviews, build their portfolio and resume, and offer access to career support to help people get hired.

Thus far, SharpestMinds has mentors in companies such as Instacart, Airbnb, Microsoft, and Tesla. SharpestMinds is still at an early stage, yet has on-boarded dozens of mentors and mentees, and has demonstrated quick progress in the field. SharpestMinds is working on a new use case for ISAs that is within education but focused on mentorship, and so they merit being included as a visionary in this report.

Pathrise†

Pathrise is a career accelerator that matches people with advisors that fit directly into their goals and will assist them along their journey of finding their ideal job. Pathrise provides both industry-specific and career curriculums to students that help ensure students acquire the skills they need to succeed in the modern labor market and navigate the specific intricacies of finding a position in their desired field. Pathrise, a Y Combinator alumnus, was the first company to leverage ISAs in the context of mentorship and has demonstrated the viability of ISAs outside of vocational bootcamps and colleges, which, at the time of Pathrise’s founding, were the primary institutions leveraging ISAs.

Pathrise has made significant progress in advancing the conversation around ISAs part of their mission and have published a large range of content regarding pursuing careers in technology and the opportunity in their ISA-driven mentorship model. Further, Pathrise has also retained a strong focus on the income-share portion of the agreement and has helped advance the conversation around how ISAs can be used for shorter-term non-vocational programs, too. Based on their significant contributions to the space — namely, their early work on proving ISAs are effective outside of vocational institutions — Pathrise has been classified as a “Visionary.”

Niche Income Share Agreement Players

There are a few companies and institutions that have established themselves as niche players in the market, as can be seen in Figure 2. These companies and institutions are operating within the industry, but have not yet achieved a certain level of progress or success so as to be classified as an emerging player or a visionary.

Meratas, a financing company that offers people access to ISA-based financing options, can also be considered a niche player. They have made strong progress toward developing an ISA program for graduate students which allows them to access the capital they need to pay for school and living expenses. While the company has made progress toward their goals, they have not yet demonstrated enough innovation or progress to be considered in another category.

Better Future Forward, a company that offers ISAs to students who participate in select college access and success programs, has also been labeled a niche player. They allow students to raise between $1,000 and $35,000 in exchange for a percentage of their income for 240 months depending on how much the student need to finance their education. Better Future Forward has partnered with five institutions to create ISA programs in Illinois, Minnesota, and Wisconsin, and has demonstrated progress toward their vision of increasing access to ISAs in colleges and vocational programs.

App Academy, founded in 2012, is also a niche player in the space. App Academy piloted the first ISA in a coding bootcamp environment. They have demonstrated the potential of ISAs in the coding bootcamp space which may have encouraged more players to experiment with ISAs in vocational educational institutions. Further, App Academy has played a key role in educating the public about the benefits of Income Share Agreements and were one of the first institutions that had to face the problem of figuring out how to pitch ISAs to students — a key issue that many market players are still facing today. However, they entered into the market years before ISAs became a major financing tool — Purdue University’s program founded in 2016 is generally considered to be when ISAs became popular—and so were not able to reach a certain level of success so as to be considered an “Emerging Player”. That being said, they are still worth mentioning in this report and are on-track to make significant contributions to the space in the future.†

Make School, a computer science college that confers Bachelor’s degrees in Applied Computer Science, offers access to ISA-based financing for students who want to attend the school. Make School’s program lasts for two-years — shorter than the traditional four-year time span of a college — and helps students acquire critical skills and access the career support they need to thrive. Make School has demonstrated progress in the space and also offers students “Living Assistance ISAs” for those who need capital to help them cover living and study costs, similar to that offered by Thinkful or Lambda School. However, Make School has not demonstrated enough innovation in the space yet to be considered an emerging player or a visionary. This is primarily due to the heavy competition in the space and the fact that they have not been as involved in lobbying or ISA advocacy as other education providers.

Holberton School, another coding school that specializes in teaching subjects such as machine learning, AR/VR, full stack web development, and more, also merits inclusion as a niche player in the market. Students at Holberton School can enter into an ISA and agree to share 17 percent of their earnings for 42 months after graduation, only when they start earning over $40,000 per year. There is an $85,000 cap on repayments, and if a student does not find a job, or if they only earn under the minimum threshold, then no payment is required. Holberton School has further demonstrated the potential of ISAs in vocational education and was also a co-signatory on the aforementioned letter to Congress about ISAs. Holberton School has helped advance the conversation around ISAs and increase awareness of the agreements but has not yet reached a certain level of progress so as to merit classification as either an emerging player or a visionary.

FlockJay is a 12-week vocational bootcamp and offers students access to a high-quality education from industry experts in technology sales. FlockJay is one of the first non-coding bootcamps to explore ISAs, and are using ISAs to both increase access to their services — students don’t need to take out a loan to attend FlockJay — and align their incentives with those of their students. Students who attend FlockJay will pay nothing until they are hired, after which point they will share 10 percent of their salary for one year, capped at $9,000. Alternatively, students can pay $5,000 upfront to attend the course. FlockJay has made good progress and demonstrated the viability of ISAs outside of coding bootcamps and colleges, but is still at an early stage and therefore should be considered a niche player.

There are other niche market players which were considered for this report but upon further consideration did not merit inclusion based on their lack of progress and/or innovation at present.

Income Share Agreement Market Trends

The ISA market is rapidly changing, although there have been a number of trends which have emerged over the last year in the space. These trends range from how colleges and bootcamps structure their funds, to investor participation in the space.

Terms and Specialization

The first trend that has emerged in the marketplace is that most ISA programs incorporate a cap on total payments in order to mitigate the prospects of adverse selection. The payment cap ensures that a student stops making payments toward their ISA after they pay a certain multiple of the amount they initially borrowed. For example, Lambda School caps payments at 1.5 times the amount received; if a student enrolled in an ISA and was very successful, then their payments would stop after they have paid back $30,000 — 1.5 times the tuition for the program. These caps typically range from 1 times the initial amount borrowed to 2.8 times, depending on the goals of a program. Colorado Mountain College, for example, sets the payment cap at 1 times the initial amount borrowed; the San Diego Workforce Partnership sets the payment cap at 1.8 times the cost of the program. If a student does not reach the cap, they will continue making payments until the term of their ISA is complete.

Most ISAs also include a minimum-income threshold, which is the minimum earning point under which students are not required to make payments toward their ISA. Students who make less than a certain amount do not need to make payments toward their ISA until their income increases past the minimum income threshold, or the term of their ISA expires. This term was developed to ensure that students do not have to pay back money when their earnings would be best spent on living essentials, and protects students who are unemployed from having to pay back money when they are not in a position to do so. The minimum income threshold is generally around $20,000 to $30,000 in colleges — primarily for the reason that they often offer ISAs across many majors with different projected salaries — whereas coding bootcamps have historically offered thresholds of between $30,000 and $60,000 because projected salaries are higher in jobs that graduates are likely to get.

ISAs also include a term limit, which is the number of months or years a student is required to make payments toward their ISAs for. The term limit in bootcamps is typically between nine months and three years, depending on the course being offered. Living stipend ISAs typically extend the term by between one and three years of a school’s standard ISA. This ensures that the school can still earn a good return on their investment and that they have more opportunities to collect the large amounts of capital they have invested in a student. In the context of college, ISAs typically range from between two and 10 years. Typically colleges offer lower income-share percentages, which means that the term limit is justified — coding bootcamps usually use higher income-share percentages. Most ISAs in bootcamps offer income-share percentages between 8 percent and 20 percent of a students’ income after graduation; most colleges offer income-share percentages between 2 and 10 percent of a student’s income, depending on the duration of the ISA.

Many ISAs also include deferment periods, which mean that students who do not earn money go into deferment, and only when they have used all of their deferment months will the term of their ISA decrease. For example, if a student has an ISA with a term of two years and a deferment period of two years, then if they earn under the minimum income threshold then the deferment period will decrease first, and then if that expires, then the term of the ISA will decrease. This helps investors maximize their returns and ensures that students who suffer from temporary financial hardship or unemployment are not burdened with payments.

The future of the ISA market will likely be comprised of highly specialized ISA programs, based on the emergence of such programs in recent years. Indeed, we will likely see more funds like the Purdue University Back a Boiler Fund in the higher education space, and more ISAs in the vocational education space. However, it is likely that future ISAs include certain structural changes to adapt to the goals of the institution. The University of Utah, as aforementioned, is using ISAs as a way to help people finish college; Thinkful is using ISAs for both tuition and living stipends, designed to make it easier for students to focus on their studies; the SDWP is using ISAs for workforce development. Therefore, future ISAs will likely be more variable than we see today and have specific goals in mind. At present, many ISA programs have been designed with the goal of increasing access to and the affordability of education and providing institutions with skin in the game, but new programs are starting to look for additional benefits to explore further. Overall, the market can expect to see new ISA concepts designed to address a specific issue in a certain market.

Coding Bootcamps and Income Share Agreements

Another trend that has emerged is that coding bootcamp income share agreements are becoming the preferred method of financing these accelerated programs. Over the last few years, dozens of coding bootcamps have started to offer ISA-based repayment terms. The reason for this is that ISAs have allowed companies like Lambda to acquire a competitive advantage — their incentives are fully aligned with those of their students, which has allowed them to attract new students. Coding bootcamps typically use shorter ISA terms and higher minimum income thresholds than those seen in colleges, based on projected earnings. Further, the majority of coding bootcamps are unaccredited and are not eligible for funding under Title IV. This means that students cannot access traditional student aid — Pell Grants, Stafford Subsidized loans, et cetera — and so they have to turn to the private market for financing. ISAs allow institutions to remove capital as a barrier and provide people with an alternative — indeed a more flexible alternative — to students loans, which further demonstrates how ISAs can be a competitive advantage.

Further, ISAs have allowed companies like Lambda to increase access to education and give people who cannot access debt another chance at pursuing their dream education. Therefore, many coding bootcamps, in order to stay relevant, have started to offer ISA programs. It is likely that this will also extend over to higher education in the future as well. More universities, and perhaps university coding bootcamps, will offer ISAs to compete with other universities that offer favorable ISA-based tuition repayment plans.

ISAs have also been used by coding bootcamps to build trust among their students. Indeed, it can be riskier for students to attend a coding bootcamp — especially if they have a limited track record — than a college because the credentials conferred by bootcamps are traditionally less valued than those offered by colleges. ISAs, however, allow a bootcamp to align their incentives with those of their students and signals to students that the school holds an economic interest in the success of their students. Students who finance their education through an ISA will not have to pay back their tuition if the bootcamp did not help them find a well-paying job, and so they have to assume less risk. This is part of a much broader trend in terms of how ISAs are being positioned in the market. Many analysts are now interested not just in how ISAs can increase access to education, but how they can move the risk of pursuing an education from the student onto the institution. At a time when people are starting to more actively question the value of college — a 2018 survey by PayScale found that taking out a loan was a top regret among graduates, second only to their chosen field of study — perhaps ISAs will be used more broadly as a tool by colleges to signal their continued value.

Financing Income Share Agreements and Capital

In terms of financing ISAs, there have been a few interesting trends to observe. The first would be that ISAs have started to receive interest from philanthropic partners, who provide access to “first loss” capital. Philanthropic institutions, by donating to ISA funds, can help subsidize initial losses from an ISA fund and therefore support a fund in its earliest stages. ISAs have been considered by philanthropists as an impact investment — they can support students who would traditionally not attend further education because of their inability to access capital to do so. For philanthropists, ISAs can be considered an alternative to donating money to finance scholarships, with the added benefit that as someone repaid their ISA, the fund would be able to issue an ISA to a new student.

A new market of secondary ISAs is also being formed, which can be attributed to the creation of financial infrastructure by platforms like Avenify and edly. This means that some ISAs are now not being issued directly by the institution, but rather by an outside investor or an intermediary platform. The main difference is that payments are made not to the school but rather the investor, and so the terms for each individual ISA will be very different depending on the student, their college, and their major. One concern highlighted with this trend is that it decreases the incentive alignment of schools and students. However, because schools will need to help students succeed and earn high salaries after college in order to raise money in the future from investors, then incentive alignment still applies — indeed, it may be stronger because schools are also accountable to outside investors. The infrastructure for such secondary ISAs is still in a nascent stage, but it will play an important role as demand for ISAs increases.

According to Tonio DeSorrento, the CEO of Vemo Education, “returns are very inconsistent across school programs, and the majority of our programs are funded by the schools themselves.” There are a few trends to take away from this. The first is that many ISA programs are financed in-house, by the schools themselves, rather than from outside investors. Indeed, although colleges such as Purdue University have raised outside capital, many colleges are still using their own capital to finance their programs. This makes sense due to the size of some endowment funds, which would eliminate the need for a university to raise outside capital and complicate their ISA program.

Secondly, returns are indeed inconsistent across programs. Market estimates project a 4-7 percent return on an ISA fund — the profits from the aggregate of all contracts issued in a fund. However, this return will vary depending on the objectives of the program, their structure, and other factors. Colorado Mountain College, for example, has set their payment cap at the same amount as the student borrows, which means they cannot earn a return. Lambda School, on the other hand, is a for-profit business and has a payment cap of 1.5 times the initial amount raised from the school, which would allow them to earn stronger returns. It is difficult to speculate on returns at present due to the lack of information available from major ISA funds. In the future, though, we can expect more information to become available regarding the viability of ISA funds, their returns, and what factors influence the returns they realize.

In the context of investment into the space, there has been a trend toward more venture capital involvement in ISAs. The growth of companies such as Lambda School, as well as the general increased interest in ISAs as a method of education financing, has made many venture capitalists interested in the space. Lambda School, for example, raised a $30 million Series B financing round in January 2019 to expand their offerings at a valuation of $150 million; Holberton School raised a $8.2 million Series A in April 2018 to finance their growth. Y Combinator, the Silicon Valley-based startup accelerator, has invested in many of the top ISA startups right now, including Lambda School and Make School. More recently, YC has committed capital into more companies experimenting with ISAs, including Modern Labor, a company that helps companies source, qualify, and hire technical talent, and Microverse, a global school for remote software developers. More VCs are starting to track the ISA space as it is prime for disruption and now has a history to refer to regarding the viability of ISAs. Other investors including Village Global, Slow Ventures, University Ventures, and CRV are either interested or have invested in companies, in the ISA space.

Income Share Agreement Legislation

A larger trend in the ISA marketplace which has become more prominent in 2019 is the move toward new legislation in the space. In June, as aforementioned, a group of 20 prominent players in the ISA space sent a letter to Congress — the House and Senate Committees on Finance, specifically — and advocated for Congress to regulate ISAs. This would involve appointing a federal regulator, and creating legislation that protects both students and innovation in the space. Thus far, market players have developed their own set of best practices based on research, experimentation, and the history of ISAs in order to ensure their programs meet the needs of students. However, most market players agree that a strong regulatory framework is prudent. A regulatory framework would ensure that students can confidently enter into an ISA as they will be clearly protected under the law, which may encourage more students to explore ISA-based financing options. A strong regulatory framework would also encourage more investors to commit capital toward ISAs, because the future of the agreements would be more certain.

On July 16, 2019, the ISA Student Protection Act was proposed in the Senate by Senators Todd Young (R-Ind.), Marco Rubio (R-Fla.), Mark Warner (D-Va.), and Chris Coons (D-Del.). This bipartisan bill would, among other things: set a minimum income threshold at 200 percent of the federal poverty level ($29,980 in 2019); appoint the Consumer Financial Protection Bureau as a federal regulator for ISAs; make ISAs dischargeable in bankruptcy AND; prohibit ISA providers from issuing agreements that require students to share more than 20 percent of their income for shorter-term contracts, with the cap decreasing to 7.5 percent for the longest contracts permitted. This legislation was developed with support from many market players, including Chok Ooi, CEO and Co-founder of Kenzie Academy, President Mitch Daniels of Purdue University, and Former Governor Jack Markell of Delaware. Although it is unclear whether this legislation will pass, it shows a renewed interest by regulators in exploring ISAs, and sets a precedent regarding how future legislation may be structured.

Finally, ISAs are also starting to gather interest as a replacement — or at least an alternative to — federal student loans. A recent report by the Manhattan Institute outlined the argument for a federal ISA program that would replace all of the existing student financial aid options. The Department of Education has indicated an interest in exploring ISAs, and Diane Auer Jones, the principal deputy undersecretary at the Department said in April that they were “thinking about how we can use the federal programs to do an experiment with income-share agreements”. This statement was quickly criticized by Sen. Warren, among other Congressional Democrats, who then sent a letter to Betsy DeVos, the Secretary of Education, where she shared her criticisms. Despite this, a federal ISA program could make sense: it would replace the dozens of old programs which are confusing for many borrowers, it would reduce the need to rely on outside loan servicers, loans would not default and interest would not accrue, and compliance would potentially be easier because payments could be calculated from IRS tax returns. Although these are just ideas, this narrative has become more popular recently and signals a trend toward potentially rethinking the position of debt in education financing in the long-term.

Barriers to Income Share Agreement Adoption

Income Share Agreements currently face many barriers that will affect the growth of the industry. There are indeed dozens of barriers affecting the growth of ISAs, but this section will cover many of the main obstacles: legislation, lack of awareness, lack of information about how to structure ISA programs, and potential competition with the federal government. The first, and perhaps most important barrier to the adoption of ISAs, is the lack of adequate legislation. Indeed, as aforementioned, there has recently been more interest by regulators in developing a strong regulatory framework under which ISAs would be governed. However, regulation, or the lack thereof, is still a major barrier that is preventing innovation in the space. The lack of legislation has discouraged some organizations from pursuing ISAs because while there is a precedent regarding their viability, the lack of a clear legal framework makes offering ISAs more difficult.

There has also been some hostility toward ISAs recently — namely from Sen. Warren — which fuel concerns about the state of the current regulatory environment. Investors are also rightfully hesitant to invest in a market where there are no legally required consumer protections and there is no clarity regarding how future legislation may affect the enforceability of past contracts — setting a national minimum income threshold higher than those present in some contracts, for example, may affect some investments. The fact that major market players operate within best practices — and also the development of new financial infrastructure — has helped mitigate the extent to which this barrier affects the market, but it is still a major concern among investors and school.

The lack of legislation has discouraged some organizations from pursuing ISAs because, while there is a precedent regarding their viability, the lack of a clear legal framework makes offering ISAs more difficult.

Another barrier to consider, highlighted by many industry leaders, is the lack of awareness of ISAs as a method of education financing. According to a January 2017 report by the American Enterprise Institute of “400 college and high school students and 400 parents of current and future college students”, only 7 percent of students and 5 percent of parents knew about ISAs. However, when participants were presented with a side-by-side comparison of ISAs and private loan options, more than half preferred the ISA over the debt-based option. This suggests that while awareness is indeed low, people can see the benefits of ISAs over student loan debt and view it as a good alternative to traditional student loans. This lack of awareness has made it difficult for market players to acquire new customers as they need to invest more resources in educating students — a critical step to ensure that customers are fully aware of the terms to which they are agreeing. It has also meant that the potential market has been limited because students are not aware of ISA-based financing options. Although the market has developed significantly since the aforementioned report was published, low awareness of ISAs continues to remain an issue. Many market players already invest resources in educating the public about ISAs, but there is still relatively low awareness of ISAs among many students and parents.

One potential barrier to adoption — although not prominent right now — would be if the federal government were to start offering ISAs to students. The Department of Education has already shown an interest in pursuing ISAs and although any pilot program or national program would likely not affect coding bootcamps, it would render most in-house college ISAs obsolete. The private ISA market would not be able to compete with a federal ISA fund as the government has no motive to maximize returns, and so could offer very favorable terms to investors. Many analysts have expressed an interest in how ISAs could replace the federal student loan program as well. These concerns, however, are in the distant future, as it would take years for any such federal program to be developed.

The growth of ISAs is also limited by the lack of resources regarding how to establish an ISA fund and the long-term viability of the agreements. Indeed, companies like Vemo Education, Leif, and Better Future Forward assist in the creation and maintenance of ISA programs — they play a very important role in the market. However, for colleges or startups who want to find out more about ISAs, there are very little resources available online to help them make a more informed decision about whether to start their own ISA fund. As the market becomes more mature, then it is likely that players like Vemo Education and Lambda School will make more resources public so that companies and colleges can better evaluate whether they should pursue creating their own ISA program.

At the moment, however, this lack of availability of resources means that some companies and colleges may be discouraged from establishing their own funds. There is a heightened level of risk right now due to this lack of information and very few free resources into which they can tap before they decide to hire a professional servicer to develop their program, thus limiting the amount of potential new market entrants in the interim. This lack of information also means that there is no exemplary structure regarding how an ISA fund should be structured based on research — most statistics about returns are not public — which makes it more difficult to evaluate the economic viability of ISAs and what degree of subsidy, if any, is needed from colleges, companies, servicers, or philanthropists to make an ISA fund function effectively.

Conclusion

Income Share Agreements have only recently gained mass popularity — most innovation in the space has occurred within the last five years. Despite the nascent stage of the market, however, the market is quickly growing and new market players are entering to help expand the growth of ISAs. Indeed, ISAs still account for a very small section of higher education financing, especially in the context of higher education where only a few colleges offer in-house ISA programs. However, one estimate by edly suggests that 175 schools will offer ISAs by the end of 2020, collectively issuing upwards of $500 million in agreements. As more companies and colleges enter the market, more contracts will be available to students, which will have various impacts on the further education market as a whole.

ISAs have recently gained a lot of interest in the context of coding bootcamps. These institutions are using ISAs to increase access to the capital people need to attend their schools — federal financial aid is not available to most bootcamps — and align the incentives of the school and the student. Indeed, if a student succeeds, the school will earn a good return; if a student does not succeed, they will pay very little or nothing back to the school. This has been very powerful in coding bootcamps as it has allowed them to signal the value they provide to their students — prospective students know that if they attend a bootcamp and do not succeed, they will not have to pay anything back. This has made more people feel confident in pursuing a vocational education at a bootcamp, and has also resulted in more bootcamps starting to offer ISAs. An ISA was once a competitive advantage, but it is quickly becoming just one more of the many options to pay for a coding bootcamp.

A number of colleges are also exploring ISAs as a method of education financing. Purdue University, for example, allows students of any major to raise the money they need to pay for their education in exchange for a percentage of their future income. Lackawanna College, the University of Utah, among other institutions have followed suit and developed similar ISA programs based on their unique needs. ISAs have also started to gain interest from a number of workforce boards after the San Diego Workforce Partnership launched their ISA fund. This fund provides capital to local workers who want to learn new skills or break into a new career in technology. Although only one workforce board has thus far launched an ISA fund, other workforce boards have started to become interested in the idea.

Existing programs offer a number of lessons about how ISAs should be structured. Most ISA programs currently offer payment caps between 1 times and 2.5 times the initial amount borrowed, which ensures that very successful students do not have to pay back disproportionate amounts of money back to the school. These caps play a crucial role in mitigating adverse selection and vary depending on the specific goals of the fund. Colorado Mountain College has a payment cap of 1 times the initial amount borrowed because it is not looking for a profit; Lambda School’s ISA offers a payment cap of 1.5 times the initial amount borrowed as they are a for-profit enterprise and Leif aims to earn a return on their investment.

Perhaps the most notable trend in the market right now has been toward marketing ISAs as a way to align incentives between students and institutions. Because schools can only earn a return if their students succeed, their incentives are aligned. This is welcomed due to the ongoing debate about whether schools should have skin in the game, and how much for that matter. There have also been trends toward developing new financial and supporting infrastructure around ISAs so that investors can participate in these offerings and increase access to the capital needed to provide ISAs. In the future, it is likely that more companies enter the space to help administer ISAs and create new investment structures for people interested in the asset class.

The ISA market will likely change significantly over the next year as more colleges and bootcamps offer ISAs, and more investors start to research ISAs as a potential investment opportunity. There are a lot of obstacles to overcome before ISAs reach a critical mass. Firstly, the regulatory environment will need to be addressed, which will introduce more stability in the market and increase consumer confidence in the agreements. ISA providers will also need to invest more time and resources in educating people about the costs and benefits of ISAs and how they function in comparison to debt — awareness of ISAs is still very low, as aforementioned. However, the promise of ISAs is large, and the agreements have potential applications in both colleges, bootcamps, and other areas as well. As the problem of student debt becomes more important and the debate over whether schools should have skin in the game, interest in ISAs will only heighten.

Addenda & Errata

* The following line, published in the original report on August 26, 2019, has been removed, as it mistakenly claimed App Academy does not market ISAs as their primary source of finance. In fact, over 50% of App Academy’s students finance their education through ISAs (marketed by App Academy as their Tuition Limit Option / Alumni Engagement Agreement):

- The first coding bootcamp to offer ISAs was App Academy back in 2011, although Lambda School, unlike App Academy, markets ISAs as their primary method of financing their education.

† Pathrise has been upgraded from the “Niche Players” classification to a “Visionary.” This was based on a new assessment of their latest progress, and further research into their contributions toward the broader ISA industry which shows a reclassification was a prudent course of action.

‡ This description of App Academy is a revised version of the description that appeared when the report was first published on August 26, 2019. The following is the original text that has since been revised:

- App Academy, founded in 2012, is also a niche player in the space. While App Academy did indeed pilot the first ISA in a coding bootcamp, they have since pivoted toward offering a Tuition Limit Option, similar to an ISA but with slightly different terms. They have demonstrated the potential of ISAs in the coding bootcamp space which may have encouraged more players to experiment with ISAs in vocational educational institutions. However, they entered into the market years before ISAs became a major financing tool — Purdue University’s program founded in 2016 is generally considered to be when ISAs became popular — and so were not able to reach a level of success. That being said, they are still worth mentioning in this report.