The cost of higher education and further training has been on the rise. At the same time, 30 percent of adults in the US are laden with student debt as of 2020, and every quarter, about 250,000 students default for the first time on their loans. The financial struggle, on top of personal and work obligations, hinders many adults from furthering their education.

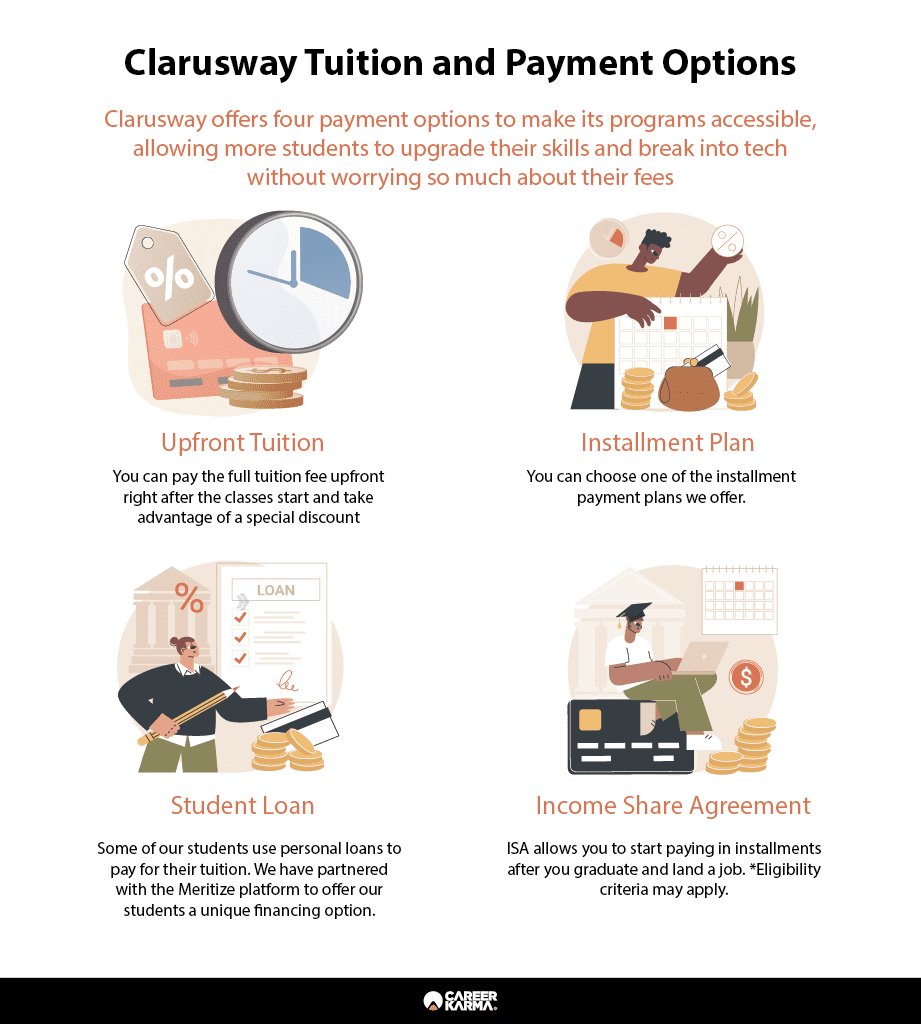

To ease the struggles of adult learners who want to upskill in tech, Clarusway has since offered four payment options to make its programs accessible, so that more students can upgrade their skills and break into tech without worrying too much about their fees.

Clarusway frees you of worries about steep tuition while you are attending a tech bootcamp so that you can focus on learning.

Learn more about Clarusway’s payment solutions.What Is Clarusway?

Clarusway is an online IT bootcamp meant to empower both novices and advanced learners, as well as those who might be looking to reinvent their careers. It specializes in the following fields.

- AWS Solutions Architect

- DevOps Engineering

- Data Analytics

- Data Science

- Salesforce Admin and Developer

- Machine Learning and Deep Learning

- Cyber Security

- Full Stack Development

- Front End Development

- Back End Development

The programs at Clarusway are conducted on a full-time and part-time basis, so you can choose which one works best for you. Students are advised to plan to allocate 16 to 20 hours a week for classroom work and projects.

To boot, Clarusway provides career coaching, aimed at building a student’s chances to succeed. The coaching sessions help students develop a compelling resume, prepare for interviews, and negotiate salaries. According to their website, Clarusway’s placement rate is 91 percent, with graduates earning an average income of $90,000.

Clarusway Tuition and Payment Options

Upfront Payment

Clarusway offers upfront discount if you pay in full before the bootcamp’s start date, making it one of the preferred options for those who afford to settle the fees upon enrollment.

However, it understands that many students might need help to manage hefty tuition prices, hence the creation of three other payment options.

Installment Plan

Clarusway provides an installment payment option, depending on which program package you choose. For example, you can opt for a 12-month installment for a nine-month training package. Installment payment plans start with the application process and continue until the end of the payment period that you choose upon signing the contract.

Income Share Agreement (ISA)

ISAs are income-tied loans that allow students to finish school without paying up front. Monthly payments kick in once you graduate and secure a job that pays a gross salary of at least $40,000. If you choose this payment option, you would not have to pay any fee while attending a Clarusway training program. In other words, you study now and pay later.

The amount you are expected to pay is determined by your annual gross salary, the ISA rate, and maturity options defined within the scope of the program you choose. These details are reflected in the contract.

The ISA is offered for training lasting four months or longer, and you must meet the eligibility criteria to be approved for this payment option. The terms vary per program duration.

- Terms for nine-month programs:

- Pay after graduation at a fixed 9.9% pre-tax income

- Pay for 24 months

- Start paying when you start earning $40,000 or higher per year

- Payment cap at $25,000

- No interest or principal balance

- Maximum deferment period of 60 months

- You are not considered withdrawn from the agreement if you get a job before graduation. Your ISA will be due in full.

- Terms for six-month programs:

- Pay after graduation at a fixed 9.9% pre-tax income

- Pay for 15 months

- Start paying when you start earning $40,000 or higher

- Payment cap at $16,000

- No interest or principal balance

- Maximum deferment period of 60 months

- You are not considered withdrawn from the agreement if you get a job before graduation. Your ISA will be due in full.

Student Loan

Clarusway partners with Meritize to offer flexible payment options to students, including deferring full principal and interest payments until three months after training completion. The MERITIZE Partnership Program provides loans at a minimum amount of $1,000. The maximum equals the list price of the program that you take. Special campaign discounts can be applied to those who choose student loan payment options in certain periods, to be deducted from the list price.

The interest starts to accrue when the fund is sent to Clarusway and continues to accrue even while you’re still in school. Although there is no prepayment penalty, if you make monthly principal and interest payments via automatic deduction from your savings or checking account, there is an automatic 0.25% interest rate.

Likewise, you must meet the eligibility criteria to be approved for this payment option. However, you may have a co-borrower to help improve loan options, and you may reapply if your loan is denied.

Alumni Reviews: Is a Clarusway Tech Training Affordable?

Yes, Clarusway tech training is affordable, and two DevOps bootcamp alumni attest to this.

Burcu Sevgican Dikec is a pharmacist who moved to the US and found an opportunity to pursue her long-time dream of an IT career. She decided to explore bootcamps to build some technical skills to switch careers. In the end, she chose Clarusway’s DevOps program for its features and payment options.

“I could not [settle the tuition] all at [once],” Burcu said, referring to the time when her husband was the sole breadwinner in the family. She chose the ISA payment option but paid the first half in installment. “I will pay the other half starting next month [February] because I got a job,” she explained.

The financing option Burcu chose made it possible for her to learn DevOps without worrying about her family obligations. “I paid [half] in installments, so it didn’t disturb our family. We could afford it at the time,” Burcu said, sharing how Clarusway was very helpful.

Like Burcu, Merzet Aliv chose the ISA payment option.

Merzet wanted to study DevOps to reskill in tech, but faced difficulty paying the fees at one go, having three kids and a part-time job only. “Clarusway gave me a chance to pay an amount I wasn’t able to afford at the time.”

She shared how she finished a DevOps program at Clarusway without breaking the bank, saying that the payment option became a “big support in my journey”.

Upon finishing her program, Merzet secured two interviews and received a job offer soon after. She now works as an AWS engineer in an American healthcare insurance company. “It’s really amazing,” Merzet enthused, referring to Clarusway’s payment option that allowed her to complete the bootcamp. “It was a difficult time [for me], and [Clarusway] helped me a lot.”

Similarly, Burcu landed a job a month after graduation and now works as a cloud support engineer. “They [the companies] called [me] because we learned the most important DevOp tools,” Burcu said, explaining that the companies noticed the “tools” in her resume.

Both Merzet and Burcu have started paying their remaining tuition amount under the ISA option.

Upskill in Tech Without Breaking the Bank

While tech bootcamps cost far less than a college degree, they still don’t come cheap. Clarusway’s payment options ease individuals’ tech training experience and increase access to much-needed tech education. “It can’t be better. I’m pretty sure about that,” Burcu asserted.

Asked to share some advice to bootcamp applicants, Burcu replied, “Just try to learn what they teach. And if you can’t understand anything, you can ask any time because our instructors are really great. They are doing their best.”

Taking all of these into consideration, you should be able to undergo tech training free of financial worries. Find out the Clarusway payment option that works best for you, or talk to an advisor to learn more about Clarusway’s payment solutions.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.