As any student knows, simply relying on hard work, passion and penny-pinching thrift is no longer a tenable formula in attaining a post-secondary education. For those who come from low- to middle-class families, such an aspiration means greater financial sacrifices.

In the academic year 2019-20, the cost of attending four-year institutions in the United States averaged at $26,820 for public universities and $36,880 for private ones, a report by The College Board revealed. The figures represented up to a three-fold increase from 1990 to 2019, marking an upward trend in education cost.

It comes as no surprise why for most American households, the struggle of financing education has somewhat turned into one of their defining features. Education, famously purported as the ‘great equalizer’, has become yet another way to widen socio-economic inequalities in the country. The upshot: both public and private sectors are offering ways to supplant funding and promote accessibility in higher education.

Alternative Funding Sources: The Basics

Deciding on how to finance your education comes with a three-point checklist: free money first, earned money second, and borrowed money last. The first one comes in the form of scholarships and grants, collectively known as gift aids. Both are free and are either merit-based or needs-based.

The second one may either refer to work-study programs or employer tuition reimbursement. Both are pretty self-explanatory. Whereas the former necessitates working part-time while enrolled to afford education expenses, the latter means paying for the tuition upfront and being reimbursed by your employer upon completion of the program. Only once you’ve exhausted these options should you consider other funding mechanisms.

Payment Plans

Though there isn’t much coverage on Tuition Payment Plans, these are fairly easy to understand. Think installment plans. In a nutshell, this method warrants paying for tuition over an extended timeframe by splitting the full cost into convenient monthly payments.

The immediate upside is it helps students avoid having to pay for hefty bills in one go or incurring debt by taking out loans. On the other hand, payment plans do not cover fees beyond the tuition, so you’ll still be shouldering additional costs such as paying for books, course materials, housing, and other personal expenses.

Another important note to keep in mind is that despite the tuition being paid in small parts, the monthly payments are typically higher than loans while the payment period is shorter, that is, within the academic year. Given this, students should only consider payment plans if the installment costs truly fall within their budget.

Student Loans

Student loans can generally be obtained through one of two ways: (1) through the federal government or (2) through private lenders, such as banks and other financial institutions.

1. Federal Loans

The Federal Student Aid is the largest student financial aid provider in the United States, providing well over a $120 billion fund, including loans, each year to support some 13 million students.

There are several benefits to taking out a federal student loan. For one, federal loans have fixed and usually lower-than-most interest rates – 4.53% for undergraduate borrowers and 6.08% for graduate or professional borrowers. These also come with certain protections in the form of flexible repayment plans, such as the income-driven repayment plan and the public service loan forgiveness plan.

However, these loans come with a hard cap. In general, undergraduate students are eligible to borrow between $5,500 and $12,500 annually while graduate or professional students are capped at $20,500 each year. This ceiling means the loan provided may not always be enough to cover a student’s financial needs.

The reach of federal loans is also limited, as students under trade schools and coding bootcamps are often not eligible for the aid. This is unfortunate as these schools lead the way in providing what has been dubbed as ‘last-mile’ training. That is, creating an accelerated pathway to a career and making students deployable from Day 1 by focusing on specialized technical training that is otherwise only broadly covered in colleges and universities.

Although an attempt to expand federal aid access to these non-traditional education providers was launched in 2016 through the US Department of Education’s pilot program, Educational Quality through Innovative Partnerships (EQUIP), the initiative never fully took flight. To date, only one program offered by one of its eight selected providers has been approved by the Education Department.

2. Private Loans

Private lenders, on the other hand, offer more flexibility in determining the terms of the loan. Interest rates may be fixed or variable and repayment may either be done upfront or be deferred. They also have more freedom to expand accessibility to any type of educational institution, giving more room for assistance to those who opt for alternative schooling.

In terms of ease of application, the underwriting process for private loans is more stringent, with most companies banking heavily on the applicant’s credit history. This may not be necessarily bad. But for students who fall short of a 750 credit score, a low-interest rate may be difficult to attain unless they have a co-borrower with stronger credit.

In contemporary American life, ‘student loan’ has evolved into its own character as a staggering number of 45 million Americans has clocked in over $1.6 trillion in outstanding student debt.

The latest statistics from non-profit organization The Institute for College Access and Success showed that 65 percent, or two in three, of college graduates from the Class of 2018 incurred some debt to finance their education, each of them burdened with approximately $29,200. A survey conducted by Payscale also revealed that nearly 70 percent of graduates reported regrets on their schooling, the leading reason being student loans. The bleak figures show that while funding channels have, for years, been made available to boost the equity of opportunity in education, such solutions are failing.

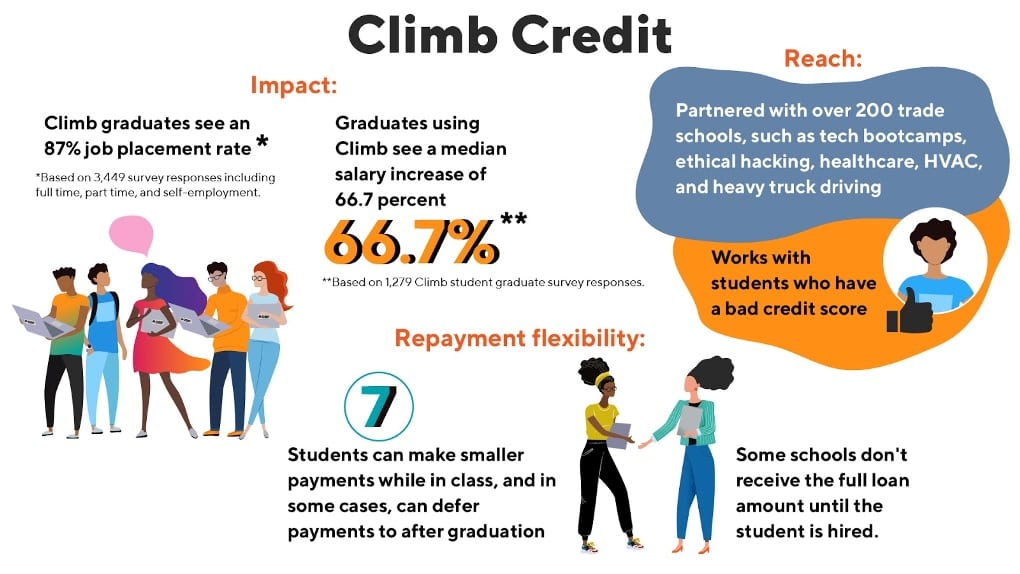

Enter Climb Credit, an innovative student lending platform that expands access to ROI-driven education.

How Climb Credit Makes Funding School Easier

Climb Credit was built out of the evident lack of sustainability in the current education system where the demand for competent workers is high yet economical ways to reach such qualification fall short.

The startup, which was founded in 2014, offers affordable loans for students and sends them to low-cost, high-opportunity career paths by ensuring that student borrowers only invest in schools that produce positive and tangible outcomes in a fraction of the time and cost. The criteria? Climb focuses on skills-based programs that have a proven high return on investment, that is, focused training for in-demand jobs with high-earning potential.

Diligence Process

Currently, Climb Credit is partnered with over 200 trade schools across various disciplines, such as tech bootcamps, ethical hacking, healthcare, HVAC, and heavy truck driving. While its roster seems to be a collection of randomly-picked fields, it actually proves Climb’s anticipative mindset.

As an example, data gathered by the cybersecurity nonprofit, ISC2, indicated that the global cybersecurity workforce needs to grow by 145 percent, equivalent to roughly four million professionals, to bridge the skills gap in the industry. In the US specifically, the workforce gap stands at 62 percent or a lack of nearly 500,000 workers. Aware of this, Climb partnered with several cybersecurity training schools to readily respond to the deficit, reflecting its commitment to delivering tangible career-growth opportunities to students.

So how does the vetting process work? The first thing Climb does is create an outcome database of a potential partner school, gauging how much students can expect to reap from their educational investment. This is done through Climb’s proprietary ROI calculation formula, which measures the overall value of the program – covering financial and opportunity costs – and compares it against the career trajectory, including job placement, graduate performance, starting salary, and salary growth, of the school’s alumni.

This process creates a win-win situation for everyone involved. On one hand, it closes the gap between quality education and affordability, thus benefiting students largely. On the other, graduates, now equipped with in-demand skills, have more room for financial stability and can easily pay back loans.

Signing Up with Climb Credit

Climb Credit offers a fixed interest rate which starts from 6.99%, with an additional 5% origination fee.

While the figure may appear higher than other private loans, Climb’s range allows for a high approval rate, making it accessible even to people with lower FICO scores. It also covers up to the full cost of the tuition fee and presents an interest-only grace period payment of up to seven months while in school, as well as a job-hunting period, depending on the program taken. This significantly lowers the amount one would have to pay once he or she graduates.

For other programs, repayment may be fully deferred until after the student completes the program. A 0% interest rate for short-term loans is also on the table, capped at a 12- to a 24-month loan period. The standard loan tenor lasts from three to five years, allowing student borrowers to pay their loans comfortably and focus on their studies.

For those in need of immediate financing, Climb’s application process is straightforward and does not involve tedious paperwork. Simply visit Climb’s website and fill in its online application form with your personal information, loan amount, and co-signer, if applicable. Climb may ask for additional documents showing proof of income, residency, or other verification of identity which can be sent through the partner school’s Student Portal.

As soon as the loan is approved and enrollment is certified, Climb will work with the partner school to send the funds directly to them. The process generally takes no more than one business day to complete. Aside from the tuition, Climb also offers additional financing for many of its partner schools, including living expenses and even laptop purchase.

For those still on the fence about Climb Credit, perhaps one more point to consider is how it often incentivizes a student’s success by affording him or her some degree of protection through the risk-share agreement. For some schools the full payment of the tuition is only received by the partner school until after the borrower is employed and able to start paying back the loan. For instance, if you took out a loan worth $15,000, the school may only receive 80% of the amount upfront while the remaining 20% gets deferred until after you start paying off your loan. The rationale behind this is simple: these schools will be motivated to scale up student success in exchange for financial gain.

Finding the Right Method For You

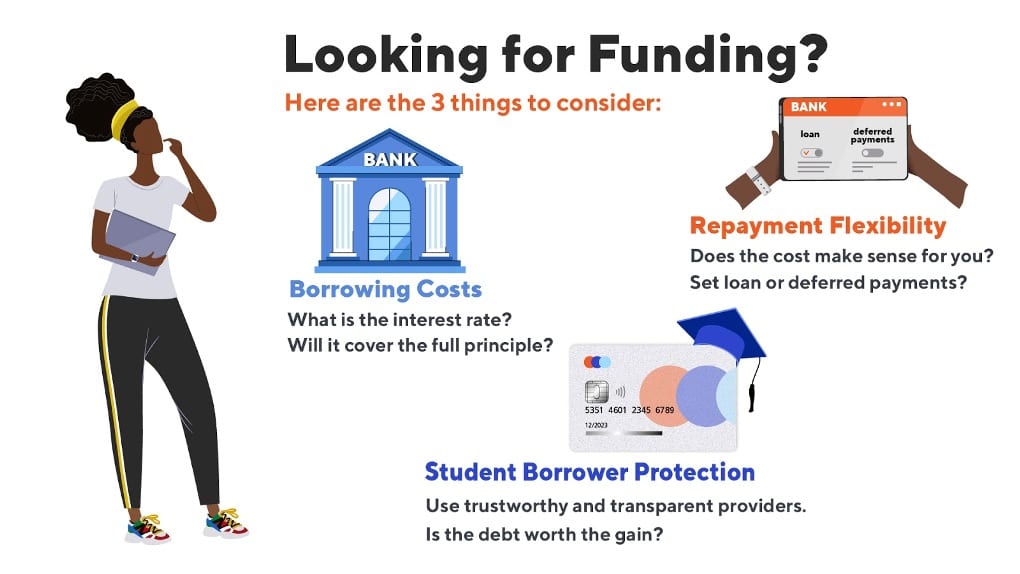

With the financial-aid season always in full swing, there are several factors that you need to evaluate before signing on the dotted line. A good rule of thumb is to select the plan that offers the following incentives: a low-interest rate, repayment flexibility, and guaranteed student borrower protection.

Borrowing Costs

One number you’ll want to pay close attention to when deciding on a loan is the interest rate. Remember that when you take out a loan, you would soon have to pay for the principal amount and the interest so choosing a program that offers the most reasonable rate is crucial.

Federal loans, in general, offer lower and fixed interest rates. However, they often do not provide full coverage of your educational costs. On the other hand, while this may be provided by private lenders, their interest rates vary.

Repayment Flexibility

Another important point to consider is whether you’ll be making in-school payments or deferred payments like an ISA loan. While the former allows you to reduce your total outstanding debt, the latter may prove viable for you if you’re expecting numerous career opportunities with high-earning potential after finishing the program.

Once you have that sorted out, do the math. Look into the monthly payments and make sure that it matches your budget. Keep in mind that although a longer repayment period will mean lower monthly payments, it would also mean higher total cost and vice versa.

Student Borrower Protection

Borrowing thousands of money to fund your education is already a high-risk investment so you should choose a loan provider and university that you can trust.

Ideally, loan providers are there to help ease the financial distress of students. In some cases, however, unfair servicing practices of such companies only add to the struggles of student borrowers. As much as possible, connect with loan providers which are easily accessible and transparent with their terms as well as placement outcomes.

When it comes to loans, one thing you need to do is understand the impact of debt. Will it be a positive investment or not? Factor in the school’s incentives such as employability rate, earning potential, and so on. If you sift through the list of loan providers thoroughly, you’ll see that some, like Climb, have a system of institutional oversight that guarantees better outcomes for the students, thus mitigating borrower risk.

Invest in Success

As students today find themselves at the center of a debt crisis, mounting skepticism on the true worth of higher education has emerged. Climb Credit responds to these crises by catering to the underserved communities and realigning graduate outcomes with school incentives. Through Climb’s university outcome database, students can comfortably invest in career-building programs that are significantly untouched by federal loans yet grant high financial payoff in investments.

The statistics speak for itself with three out of five of Climb’s borrower graduates landing full-time jobs immediately after graduation, registering a median salary increase of 66.7 percent. Climb Credit has one goal: to increase opportunities for students in today’s changing economy by offering instant funding with lasting profitable impact.

If you’re ready to pursue a career-advancing education, apply at Climb Credit and take their payment quiz to find the best payment option for you:

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.