Critics have pointed out the many issues surrounding credit scores and their impacts on the wealth and opportunity inequalities in America. The Urban Institute, for example, said that credit scores can further “prevent financially struggling people from gaining traction in the economy”.

Others have questioned the accuracy of the credit scoring models in place, suggesting that they’re riddled with “inherent racial bias and incorrect data”. In a Forbes report, Professor of Sociology at Princeton University Frederick Wherry said that history plays a huge role in creating this disparity.

“The data used in current credit scoring models are not neutral; it’s a mirror of inequalities from the past. By using this data we’re amplifying those inequalities today. It has striking effects on people’s life chances,” Frederick, who is also the Director of the Dignity and Debt Network, said.

What often follows is that members of historically underprivileged communities have a hard time gaining access to the education they want and deserve, especially in fields like tech where growth and opportunities are abundant.

As credit scores prevent people from accessing technical training, they’re left wondering, “What’s next? And what options do I have left?”

Enter, Climb Credit, a payment option provider championing responsible financing in education.

Who Is Climb Credit?

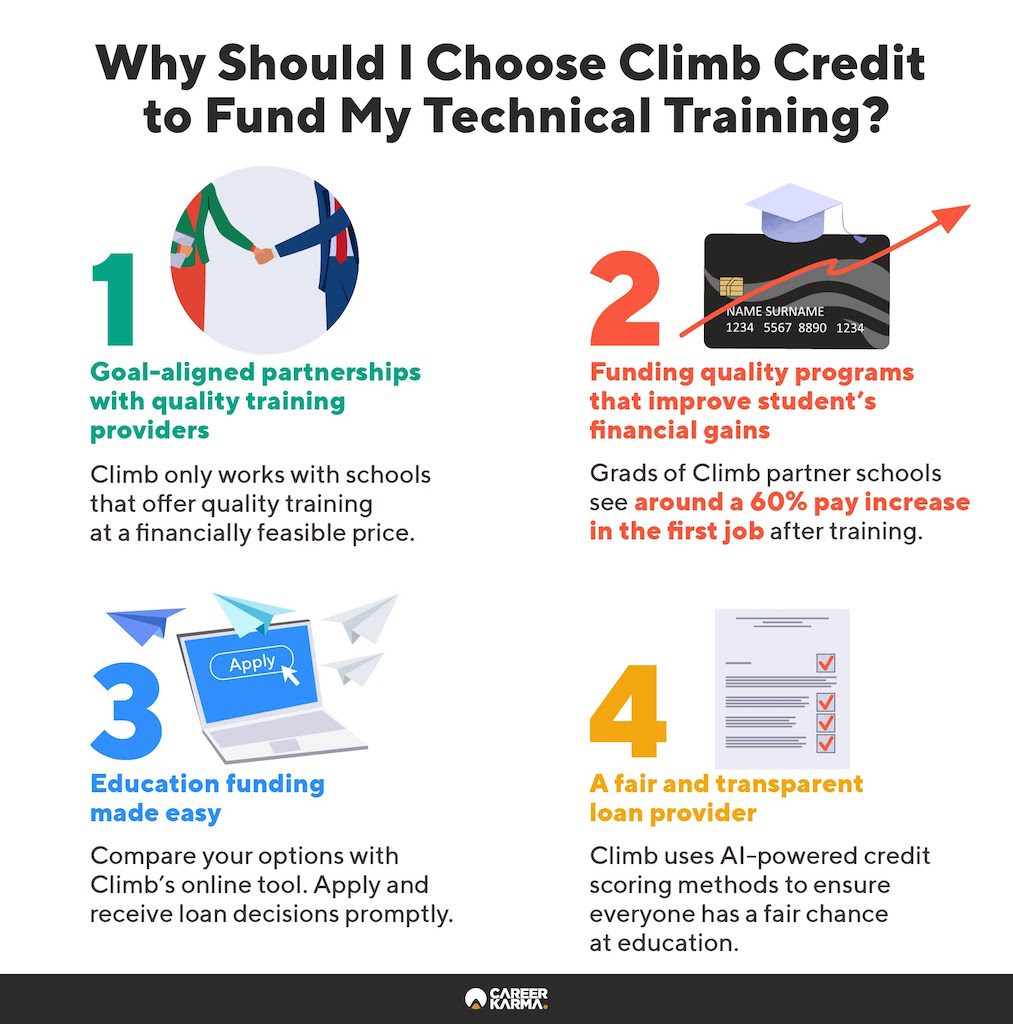

Climb Credit seeks to help students obtain the training they need toward career advancement by providing payment options, including loans, for training programs. Climb Credit works with various institutions and coding bootcamps to offer reliable, affordable, and realistic financing options—a reminder for those looking for a life-changing education that funding can actually be manageable.

From the onset, Climb Credit aims to partner with schools that drive success with verifiable numbers that matter: strong results and job outcomes. It’s critical that student borrowers feel confident that they are investing in institutions that can actually set them up for success.

According to Climb Credit, it also actively deviates from the habits of traditional student loan processes by employing underwriting models that do not unfairly discriminate against financially underprivileged communities. With Climb, all of your options will be laid out clearly so you can make an informed decision.

All you have to do is answer a few questions that would give Climb Credit a better idea of your area of interest and learning capacity. In less than five minutes, you will be presented with a catalog of schools and programs, along with a comparison of Climb Credit’s financing plans at each school.

Climb Credit partners with verified tech bootcamps and training programs to offer funding options for aspiring tech professionals.

Apply for a Climb Credit loan today.How Climb Credit Works

Climb Credit exercises a thorough vetting process when proposing a partnership with a school. First, Climb Credit identifies and assesses if the school can help students hit their goals in a financially responsible way. Next, it curates accessible payment plans so students can attend the school.

More importantly, the school’s goals have to align with Climb Credit’s own vision. “Our vision is to improve the alignment of school motivations with student goals to ensure that our students see a tangible, life-changing impact from their education,” the lending platform said.

Climb Credit Loan Repayment

The repayment amount of your Climb Credit loan depends on the program and the plan that the student chooses. However, it should be noted that Climb Credit strives to ensure that graduates of its partner bootcamps benefit from career advancement after graduation.

So far, Climb Credit has lived up to its goal, as evident in the numbers: graduates of partner schools see a median pay increase of over 60 percent in their first post-bootcamp job and a median pay increase of 31.6 percent in their subsequent job.

Students have the option to prepay their loans if they wish—this can be done at any time. Additionally, making on-time payments throughout the repayment period will help borrowers ensure that their credit scores are not affected at any point during the process.

Students can also sign co-borrowers on their loans. Co-borrowers are individuals who agree to make payments in place of the borrower if they cannot make a payment for any reason.

Climb Credit Resources and Transparency

Climb Credit offers a handful of payment plan options, depending on the program and school you enroll in. It also provides resources like finance and loan tips to help borrowers navigate through the process with ease. The support team is also ready to answer any questions you may have about Climb’s services.

Climb Credit values your time. As such, decisions about loan applications are made quickly and effectively. Transparency is also important to this lending platform. The interest rates are fixed, so there is no risk of inconsistent repayment amounts over the life of the loan.

Climb Credit Loan Application

When you apply to Climb Credit, you can be sure that the school you’re looking to attend is already a verified partner. If not, you can always make a suggestion to Climb Credit and it will do the due diligence before pursuing a partnership.

If you’re worried about the quality of your student loan application, Climb Credit has tips on how you can apply for a student loan. Once Climb has reviewed your initial application, they perform a soft pull, which is a soft credit check, and a hard pull, which is a risk assessment inquiry.

You can apply multiple times with multiple cosigners to see your best rate options. And you can do so without impacting your credit score until you accept the loan offer as the hard pull will only be performed when the loan is actually accepted and funded.

Climb Credit seeks to ensure students don’t take out loans they can’t repay based on projected outcomes. Rather, it presents short-duration and affordable loan options to cover your training costs.

Climb Credit-Zest AI Partnership

Climb Credit has been working hard to make sure that transparency, honesty, and complete fairness are at the core of its operations. In April 2021, Climb announced an exciting partnership with Zest AI, a software company developing a credit underwriting AI that assesses borrower risks and develops credit scores.

By using Zest AI’s underwriting methodology to enhance accuracy and fairness, Climb Credit aims to reduce “disparate impact when compared to traditional credit scoring methods”. Climb said, “This is done by reducing the weight of some credit bureau data points known to correlate with protected class characteristics.”

Why Choose Climb Credit-Funded Education?

There’s no shortage in Climb Credit’s successes. Representative of this success is Climb Credit borrower Natalie Dinkins.

Natalie found herself laid off with no warning while she was in the process of buying a new home. Amid the stress of the situation, she chose to make the best of it and switch up her career. When she realized she didn’t need a computer engineering degree to pursue tech education, she knew Wyncode was the way to go.

The costs came up and Natalie was discouraged. But, she did her research and discovered that she could employ Climb’s help to reach her goals. According to Natalie, one of the most striking parts of her Climb Credit experience was that Climb reached out to her with an option of funding her Wyncode training with a co-borrower.

Natalie’s mom signed on, the loan was approved, she went through her training, and the rest is history. Now a project manager at EveryMundo, Natalie said she’s discovered a new passion in the process. She also feels a sense of security with her new job.

“I actually enjoy coming to work,” Natalie said. “I enjoy the challenge that it poses. I feel like I’m in the right place, and I also feel like the things I’m learning here will serve me well in the future.”

Don’t Let Your Credit Score Stop You from Getting Career-Building Training

Climb Credit aspires to be the bridge that connects passionate individuals with quality training that leads to meaningful employment. To ensure that students are well-informed at every step of the process, Climb Credit’s Help Center is available to address any issues or answer any questions you may have.

For more information, you can take a look at Climb Credit’s website. If you’re ready to start your tech training, apply for a Climb Credit loan today.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.