There’s a promise deeply embedded within the higher education system. It’s a promise that has withstood the test of time. It persisted during the Great Recession of ‘08 and even as the country saw the alarming rise of the student debt crisis. That is, education is the great equalizer.

Year after year, high school students are seen joining as many extracurricular activities as they can. They work as interns for local businesses and volunteer in animal centers. They sit in their rooms racking their brains as they write what they hope would be memorable admissions essays. All of these they do in the hopes of standing out in a sea of candidates who carry the same goal.

Behind them are parents driven by the desire to provide a bright future for their children. Some work overtime. Others juggle two jobs. Most dip deeply into their retirement savings. Everyone breaks the bank.

All of them—students and parents alike—have done their share of gambling, propelled by one simple belief: the outcome will surpass the risks. Education, after all, is the great equalizer.

At least, that’s the dream.

A Crisis of Confidence in Higher Education

Among millions of Americans, 62% from the 2012 college class earned four-year degrees within six years. Put the numbers together and this means over one third of students dropped out of their programs. Most of them are left with student debt, likely to default. Those who graduated, meanwhile, face rising unemployment and underemployment rates.

In 2017, The Atlantic published the article, “The Broken Promise of Higher Education”. In it, an interesting point was raised: “Come graduation time, who is responsible for the graduates who made it to the finish line? And, more importantly, who is responsible for those who did not?”

In the current system, students shoulder the full burden of succeeding, not the schools. In the current system, getting a job post-grad or even graduating at all is posed as a certainty, not a risk.

To that end, the return on investment in education evades scrutiny, yet it’s a question that needs addressing. If one should pay thousands of dollars for years of hard work, what happens afterward? When the bows are taken and the degrees are handed out, what then?

For student lender Climb Credit, the answer lies in a risk-sharing mechanism where the schools take a significant portion of responsibility alongside their students.

Education as an Investment

Climb Credit took off in 2014 to rectify the mismatch of incentives within the education system. As Climb’s co-founder Zander Rafael pointed out, “They [schools] get paid when the [student’s] butt hits the chair.” Given this, it’s obvious why the school’s focus is directed toward increasing student headcount, not on whether they graduate on time—if at all—or land a job post-grad.

Climb seeks to rewrite this narrative through a rigorous evaluative approach. First, it measures a school’s value to students against a set of criteria. These include graduation rate, job placement rate, starting salaries, and salary growth.

To provide a picture: If, for instance, a student attends School A, how likely is she to finish the program? What are the odds of her landing a job that matches her skill set? Actually, what are the odds of her landing a job at all? Does her salary fall within the role’s expected compensation rate? Lastly, is she likely to see an increase in pay consistent with the trends in the jobs market?

Climb Credit collects the answers to these questions and creates a database of the school’s outcomes. It then uses these insights to determine whether or not they will offer financing for that program. This way, students and parents can feel confident in their decision to pay for a program before signing on the dotted line. The question of whether a school is worth the investment—both in money and time—thus takes front and center.

Climb Credit: Your One-Stop School Evaluator

That a school delivers the quality of education that it promises to deliver is reflected when it secures Climb’s Verification Badge. In other words, schools that carry the badge are those that have undergone Climb Credit’s proprietary diligence process and passed.

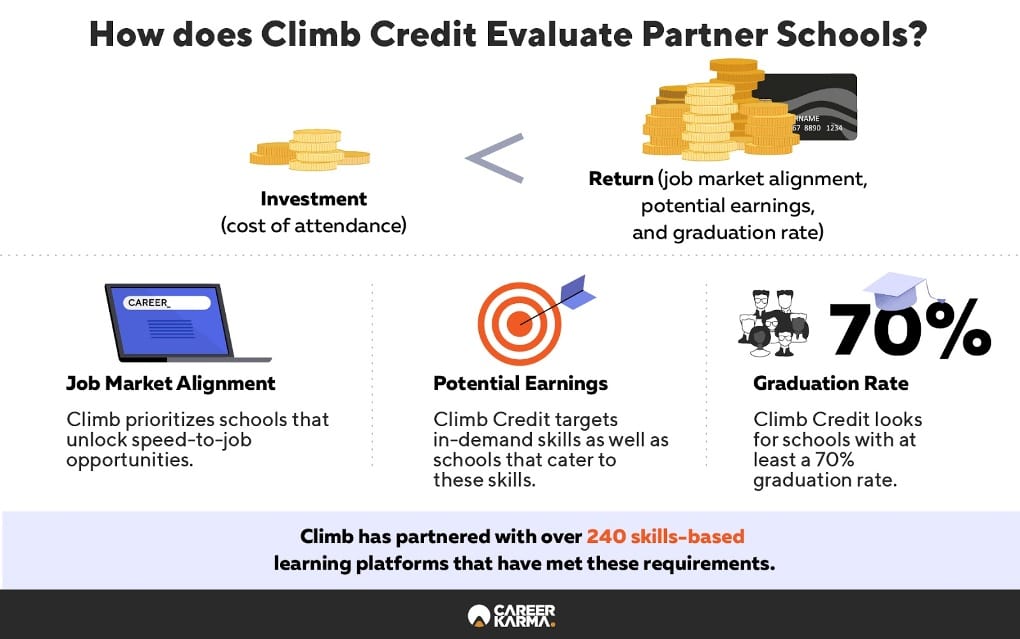

In discerning which schools deserve the badge, several factors come into play. If you pull each variable apart and combine them to formulate a single equation, you’ll get a picture of Climb’s proprietary ROI calculation. That is:

Investment [i.e. cost of attendance] ≤

Return [i.e. job market alignment, potential earnings, and graduation rate]

Job Market Alignment

Climb Credit is currently partnered with around 240 skills-based learning platforms, including coding bootcamps, technical schools, and professional and continuing education programs. The reason behind its choice of programs is two-fold.

First, skills-based programs usually do not qualify for federal aid. As such, Climb took on the responsibility of providing support for those who opt for the non-traditional route.

Secondly, Climb prioritizes schools that unlock speed-to-job opportunities. It does so by determining current market trends. These include identifying which skills are presently and slated to be in demand, and then narrowing in on schools that provide training for such.

Take the healthcare industry, for example. A 2018 report published by the analytics software company, Burning Glass Technologies, said the healthcare industry exhibited one of the most acute skills gaps.

Job openings exceeded the number of available practitioners by 44%. Moreover, the demand for these occupations is projected to grow by 25% over the next 10 years. To shore up the shortfall, Climb Credit partnered with around 30 schools that provide short-term healthcare programs.

It’s a pattern that Climb has followed over the years when choosing target industries and potential partners. Also in its roster of partners are schools that specialize in cosmetology, heavy equipment, maintenance and repair, trucking, and tech bootcamps.

For Climb Credit, linking skills-based learning to labor market demands meets two intertwined goals: (1) to bridge the skills gap and (2) to fill the talent shortage. Put another way, students of its partner schools can expect a surplus in job opportunities that match their skill set post-graduation. Conversely, industries can fill their pipeline with highly-qualified candidates. This brings us to the next variable: potential earnings.

Potential Earnings

This variable is inherently tied to a program’s alignment with job market demands. Basic economic theory suggests that wages are determined by the intersection of supply and demand. If the demand is high and the supply low, the price of labor is likely to rise.

Using the same example, there’s a surplus in demand and shortage in supply in the healthcare industry. That is, the need for healthcare practitioners exceeds the available workers. How does that translate into their salaries?

According to the US Bureau of Labor Statistics, the median base salary for healthcare practitioners and technicians stands at $68,190. This is double the median annual wage for all occupations in the economy which is at $39,810.

Looking at the figures, it’s easy to see why Climb Credit targets in-demand skills as well as schools that cater to these skills. Doing so guarantees decent compensation for its borrowers.

In turn, schools have a financial upside to their students’ success. After all, landing a high-paying job makes one more financially secure. And financial security signals a stronger guarantee that they fulfill their tuition repayment obligations quickly.

Climb’s loan terms are also contingent on the income forecast. For instance, there’s a wage disparity between software engineers and truck drivers. On average, software engineers earn an annual salary of $107,510 while heavy truck drivers get paid $45,260.

Clearly, the former earns more than the latter. So, Climb Credit adjusts the terms of what tuition level they approve based on what would be reasonable for the skills and the industry the students are aiming for. After all, the tuition investment should be proportionate to the expected return. By doing this, Climb positions itself away from the so-called “student debt trap” where students take on loans they can’t repay.

Graduation Rate

Of course, all the factors mentioned above are moot if students are unable to finish the program. While a low graduation rate should not necessarily be an instant dealbreaker, it is a strong indicator of a school’s accountability system.

As mentioned, nearly four in 10 students drop out of their programs midway, leaving them saddled with debt and no credentials to show for. Several factors underpin a school’s graduation rate.

There could be a lack of institutional support—both academically and financially—or little admissions preparation criteria for a highly difficult program to set incoming students up for success.

Climb Credit addresses these factors by shifting accountability to schools, not just the students. Instead of assuming that a student’s decision to drop out was done of her volition or fault, it redirects the questions to the school.

Does it make sure its students are on track to completing their program? Are students equipped with the skills, resources, and credentials they would need to break into the jobs market?

Generally, Climb Credit looks at numbers above 70. In other words, schools with at least a 70% graduation rate have higher chances of earning Climb’s Verification Badge. While it places a strong emphasis on the numbers, it also collects insights from the students themselves while conducting other qualitative research to inform the ROI evaluation.

Examining a program’s value for money hinges on the outcomes listed above. It may make sense to pay $50,000 for a certain program based on market demand and salary growth. On the other hand, a $5,000 tuition fee may be more reasonable if potential earnings and salary increase are not as big of a jump post-program.

Either way, Climb determines a program’s value for money by evaluating whether the students’ expected outcomes offset the costs incurred during their studies. For Climb, bridging the information gap is key to students taking control of their investments. It’s also a wake-up call for schools and programs to realign the goals of the education system.

Delivering the Climb Credit Promise

“… [A]nd there was something that I was reading about Climb. You only provided loans for these bootcamps on the premise that these are the ones that have the highest job placement… I chose Galvanize partially because you guys were choosy lenders, and one of the places you chose to lend for was Galvanize.”

This was what David Sudia, a special education teacher turned software engineer, said when asked why he chose to break into the software development world via tech bootcamp Galvanize.

On the other end, Juha Mikkola, the co-founder of Wyncode, said his school saw the effects of Climb soon after their onboarding. “At the end of the day, it’s allowing more people, who maybe wouldn’t have the opportunity, to attend Wyncode and eventually become web developers.”

Although the main thrust of Climb Credit is to advance a student-centered policy, its partner schools don’t get short-changed. For Climb, an incentive realignment is a win-win approach where schools and students enjoy an equitable exchange of benefits.

The immediate benefit that a verified school receives is the expansion of its student base. The Climb Verification Badge means that a school has been vetted and determined to provide a positive ROI.

Put another way, it boosts the credibility of the school and gives prospective students the confidence to enroll in it. Meanwhile, Climb Credit’s diligence process helps students quickly whittle down which schools offer a good value for money.

Changing the Status Quo

Education is a series of tradeoffs. Every minute spent sitting in a classroom is a minute you could have spent training for other skills. Likewise, every dollar spent for a four-year course is a dollar you could have spent for a much shorter but equally profitable program.

Climb Credit was born out of this perception where it treats education as an investment. And rightly so. By putting the return on education at the forefront of every student’s decision-making process, the higher education system as a whole is de-risked and proper learning goals are accelerated.

To date, Climb Credit has originated $100 million in student loans to over 10,000 students. Around 92% of its borrowers completed their respective programs, of whom 87% secured jobs post-graduation. Three out of five graduates who were unemployed before their programs found full employment and most saw a 66.7% median salary increase.

Beyond the numbers, Climb Credit has proven true to its commitment: To build a fairer system that positions students at its core. So now we’re back to the earlier question. When the bows are taken and the certificates handed out, what happens next? With Climb Credit, you reap the maximum return on your investment.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.