Last year, we published our State of the Bootcamp Market 2020 report, a retrospective on the bootcamp space over the last decade. In 2019, the coding bootcamp market grew 4.38%, and we estimated 33,959 people attended and graduated from a bootcamp, according to the publicly-available bootcamp graduate data we gathered.

Since we wrote our last report, COVID-19 has changed the way we live, impacting our work, education, and social lives. In the context of work, 55 million people in the United States had already filed for unemployment by early August. The pandemic is not isolated to one country—the entire world has been affected. In early 2020, governments ordered lockdowns and social restrictions. To this day, there continue to be stringent lockdowns around the world.

The pandemic highlighted the importance of skills development, but the need for upskilling and retraining has been a topic of discussion for years. According to a 2019 World Economic Forum report, 54% of the workforce will need to be reskilled by 2022. This number may be higher due to the businesses that will no longer need as many staff, or who will be unable to afford as many staff, when the pandemic ends.

Coding has persisted as a valuable skill, perhaps more so during the pandemic. We saw that online technologies brought us together in times of struggle and continue to do so.

After initial slowdowns, technology companies stabilized and resumed hiring, looking for talented people with the requisite skills to contribute to their organizations. Learners across the U.S. turned to bootcamps to gain new tech skills so they could pursue these open jobs.

This report will chronicle the growth of the bootcamp market in 2020 and seeks to answer one big question:

Are bootcamps still a viable path to acquire in-demand skills?

To answer this question, we have analyzed the following areas:

- Total bootcamp market size in terms of revenue and student body.

- Bootcamp tuition

- Skills students learn at coding bootcamps

- Cities where students attend bootcamp

- Venture capital flow and acquisitions

- Income share agreements (ISAs)

Whether bootcamps are growing is particularly important given the current discussions about employment across the U.S. and around the world. Many people have been forced to reskill or think about upskilling. Bootcamps present a method by which people can acquire new skills that can lead to long-term careers.

According to General Assembly’s 2018-2019 Outcomes Report, for instance, 91.4% of graduates from its full-time career services program “accepted a job offer in their field of study within 180 days of graduating.” We also found that bootcamp graduates are working for top companies like Microsoft and Amazon in significant numbers, as we note below in the “Top Bootcamp Employers” section of our report.

A 2018 study by McKinsey reported that 62% of executives “believe they will need to retrain or replace more than a quarter of their workforce between now and 2023 due to advancing automation and digitization.” This is a stark reminder that reskilling needs are not going away anytime soon and workers need new skills to catch up with the changes in the labor market.

The question is:

Can bootcamps fill this gap as they expand their offerings online?

Key Findings

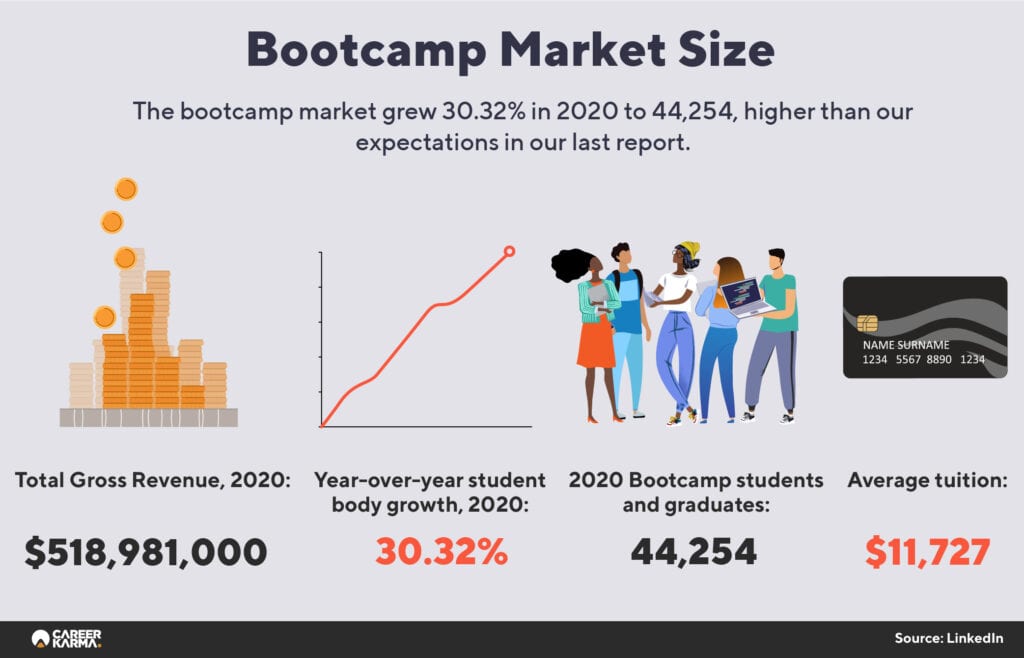

| MARKET SIZE | In 2020, 44,254 people attended or graduated from the bootcamps we studied, a 30.32% increase from 2019, due to the shift to online learning. |

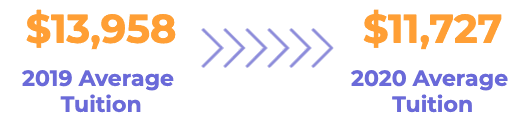

| TUITION | The average bootcamp cost $11,727 in 2020. |

| REVENUE | We estimate that bootcamps earned a total of $518,981,000 in 2020. |

| ISAs | 47 bootcamps offered Income Share Agreements (ISAs) in 2020. |

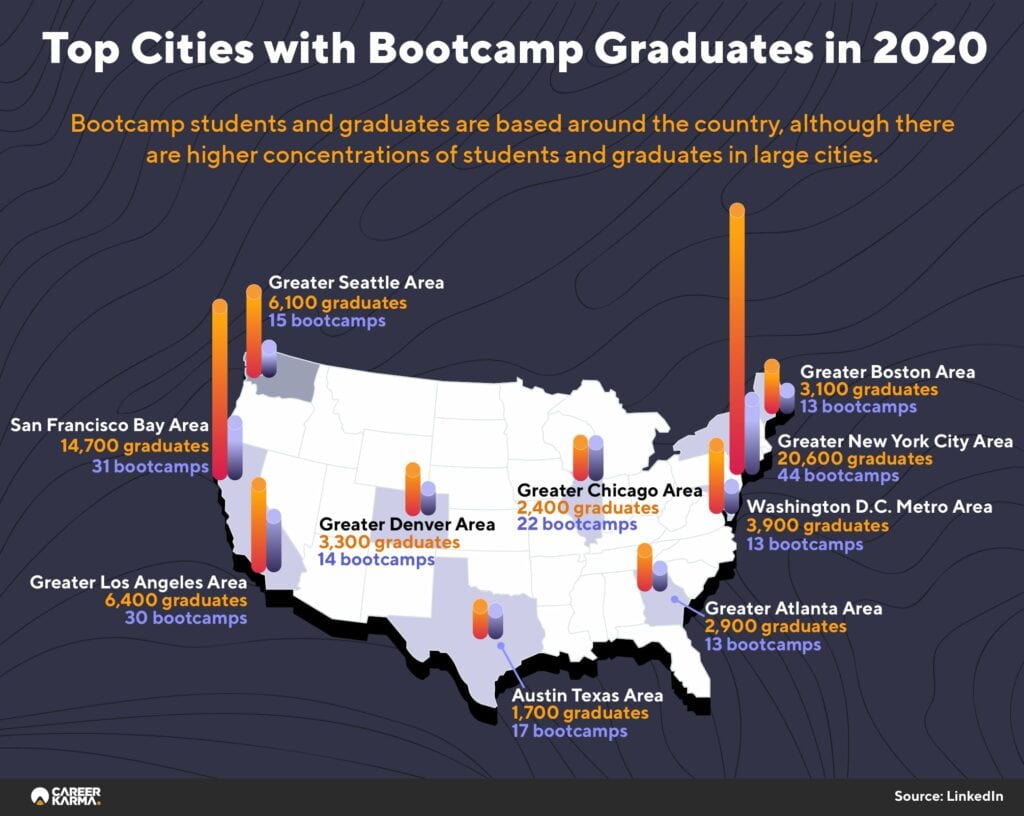

| CITIES | New York, San Francisco, Los Angeles, Seattle, and Washington, D.C., were the top cities where students lived in 2020. |

| SKILLS | Web development and software engineering skills dominated in 2020. HTML, CSS, JavaScript, SQL, and Python were the most popular skills learned. |

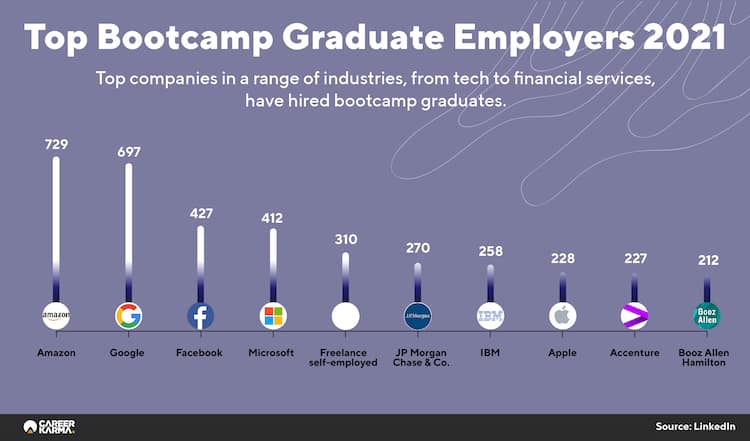

| EMPLOYERS | In order of total people employed, Amazon, Google, Facebook, Microsoft, and JPMorgan Chase were the top employers of bootcamp students. |

Methodology

This report analyzes the state of the bootcamp market in 2020, looking specifically at student enrollment figures, skills development, and revenue. This research uses the same methodology as our last report, with a few exceptions.

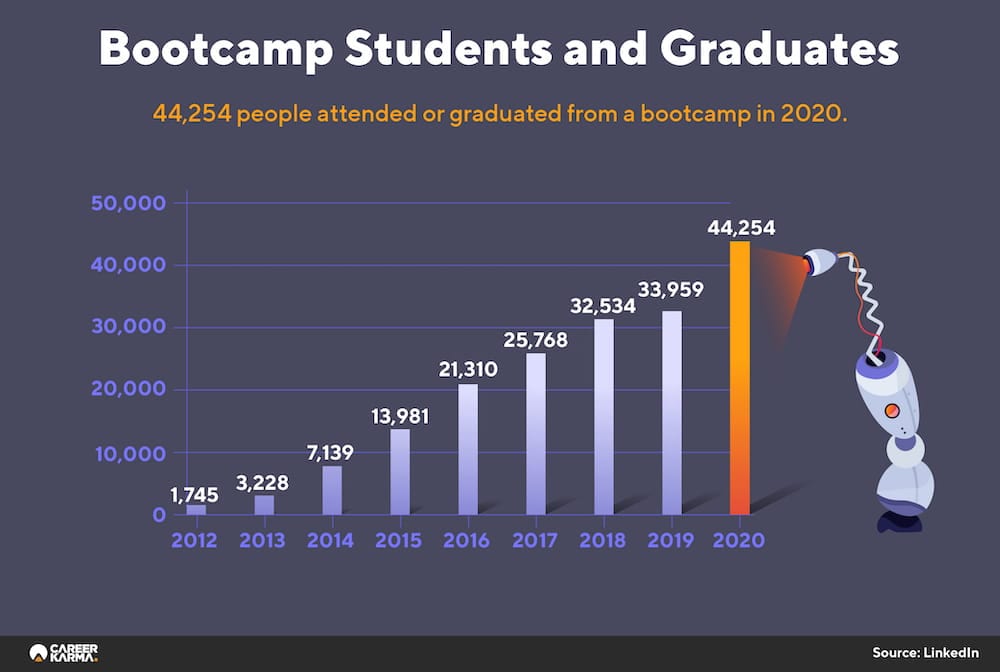

To conduct this report, we gathered data on 100 bootcamps using various sources such as LinkedIn, bootcamp websites, and Career Karma’s internal directory of schools. In total, we studied 44,254 bootcamp students and graduates in the year 2020. We collected data from LinkedIn on January 15th. We collected data from bootcamp websites between January 15th and January 29th, 2021.

In our last report, we defined a bootcamp as:

An immersive, employment-focused educational program of typically three to twelve months, designed to help adults develop industry-oriented skills relevant to pursuing careers in tech.

For this report, we added four criteria for what constitutes a tech bootcamp. A tech bootcamp must:

- Offer full-time instruction totaling at least 30 hours per week

- Offer instruction in at least one technical discipline

- Have a campus in the U.S. or enroll students based in the U.S.

- Have a complete LinkedIn profile

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

We began by researching the same bootcamps we studied in our last report. (See Appendix A for the bootcamps studied in this report.) We chose this method because our previous list represents a majority of the U.S.-based bootcamps that meet our definition. Through research, we could not identify any significant new players whose LinkedIn data would meaningfully contribute to our dataset.

We have continued to use LinkedIn data to analyze the state of the bootcamp market. This is because LinkedIn data is self-reported, which means that it is independent of any specific bootcamp’s claims and its definitions of what constitutes a “student.” Further, LinkedIn data is structured in the same way for each school, allowing us to define data points such as “students and graduates” and “skills acquired.”

Not all bootcamp graduates submit data on LinkedIn and some people may submit inaccurate data regarding their bootcamp attendance. But we suspect the impact this would have on our data is limited.

We could not gather 2020 data on 16 bootcamps out of the 101 we studied from LinkedIn. This is because these bootcamps did not have active alumni pages when we conducted this report. We denote these bootcamps by an asterisk (*) in Appendix A. They are included in our list of studied bootcamps because we used data from these schools in our last report. We have included the tuition of these schools in our tuition section.

Market Size

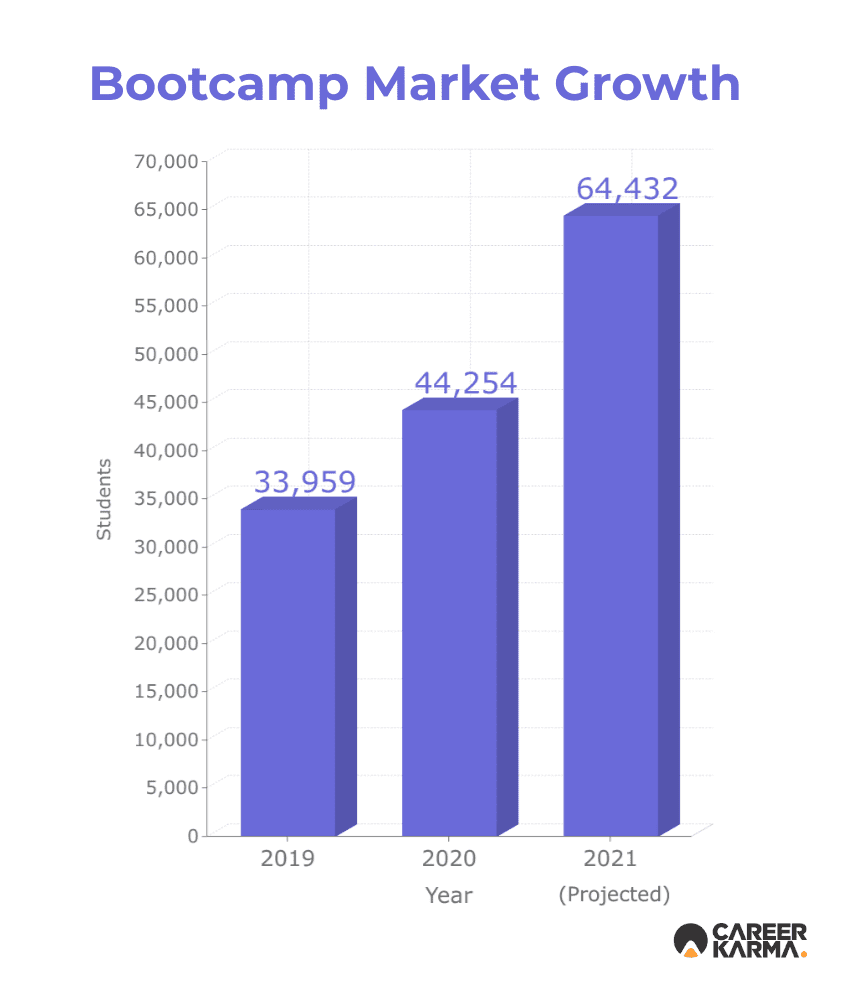

In 2020, 44,254 students graduated from or attended a bootcamp. This is a 30.32% increase since 2019. In terms of revenue, we estimate bootcamps earned $518,981,000 in 2020. This is a 9.48% increase since 2019. Because the average tuition was lower in 2020 than it was in 2019, the revenue increase is not as dramatic as the growth in student numbers.

While we cannot verify how many of these students attended school online, the majority of bootcamps studied here are now offering online classes. This is either through a temporary arrangement or as a new program offering.

Thus, we have merged our market size statistics into one number rather than calculating a separate online and in-person student statistic as we did in our last report.

We project bootcamps will enroll 64,432 students in 2021. This projection is based on the average rate of growth in enrollments since 2012. We calculated this number by determining the rate of increase year-over-year since 2021 and then using the average of those rates for our projection.

In our last report, we projected bootcamps would earn $480,900,000 in 2020. We calculated that bootcamps earned $518,981,000 in 2020 according to the average tuition multiplied by the number of graduates. Thus, the growth of the market has exceeded our expectations.

There are surely a number of factors that influenced the growth of the bootcamp market. These are:

- Employment uncertainties and their impact on job security due to COVID-19.

- Bootcamps offering online learning.

- The employment-driven value proposition of bootcamps.

We must note that some of the people defined as students and graduates in 2020 may have participated in bootcamp corporate training programs. These programs, usually developed in partnership with an employer, work to directly train staff who are already employed. This is a method of corporate upskilling or reskilling that has become common among a few technical employers.

Our market size statistic reflects anyone who attended or graduated from a bootcamp program, rather than those who specifically enrolled in a bootcamp while looking to retrain for another career entirely.

Employment Uncertainties

Last year was full of uncertainty in terms of employment and personal finances. According to Statista, the unemployment rate in the U.S. was above 10% from April to July 2020. In June, the U.S. was officially in a period of recession. A September 2020 study from the Pew Research Center found that one in four adults in the U.S. struggled to pay their bills as a result of the pandemic.

The fear of automation also remains prevalent. The World Economic Forum reports that one in three jobs “could be at risk of automation.” Bootcamps offer training in technology jobs, widely considered to be a growing career path in terms of salaries and job openings. The Bureau of Labor Statistics projects software engineering jobs, for example, will grow at a rate of 22% between 2019 and 2029.

To ensure bootcamps can continue to reskill students in times of uncertainty, bootcamps are looking to offer “hybrid” or “flex” models. These options offer more flexibility to learners who can spend some time in class and the rest of their time learning at home.

Galvanize and Le Wagon are two examples of bootcamps investigating such arrangements.

Online Learning

Before the pandemic, we reported that only 13 coding bootcamps had a focus on online learning. This has changed. During the early stages of the pandemic, many bootcamps closed for safety. They then launched online programs, most of which are still active.

Bootcamps doubled down on offering online courses to their students. General Assembly, for example, moved thousands of students to online learning in March 2020. Flatiron School, another prominent bootcamp, made a similar announcement.

Turning to online learning allowed bootcamps to remain operational. However, some coding bootcamps were unable to adapt and closed permanently.

Successful bootcamps determined how to transfer their services to an online environment. Ironhack, for example, noted in March 2020 that it would offer instructor-led, real-time classes, online mentorship, small remote private rooms for group projects, and more.

Overall, bootcamps have been able to adapt to the new reality of online learning being the predominant education model. This can be seen by the amount of guidance issued by bootcamps not just at the start of the pandemic but also in subsequent months as circumstances changed. Challenges still remain, however, and it is too early to tell whether online-only students will have smooth transitions into the job market.

Employment-Driven Offerings

The value proposition of staying focused on employment is a crucial aspect of bootcamps and resonates with most people who decide to attend. In our studies, we found top bootcamps have maintained a similar focus on employment as in previous years, actively advertising how they help students find jobs.

At the core of the employment focus is an emphasis on projects. These projects allow students both to reinforce the theoretical skills they have learned and to practice crucial interpersonal and organizational skills required in a development environment.

A further benefit of project-based learning is that candidates can show real-world examples of their skills. Projects can be mentioned on resumes, portfolios, and in interviews as proof of a student’s abilities.

We expect to see more one-on-one support offered to students. Kenzie Academy, a bootcamp based in Indianapolis, offers one-on-one career services counseling with coaches from its student services team.

SV Academy, a technology sales bootcamp, even provides career support after finding a job, which can help graduates improve their long-term career prospects.

Byte Academy‘s Spryte Sprints model, an experience where students participate in real-world software sprints to get a better sense of how classroom topics apply to actual development projects, helps students learn about agile methodologies. This is a crucial method of project management used throughout the technology industry.

Largest Bootcamps by Students and Graduates

To show the biggest players in the market at the moment, we collected a list of the top 10 bootcamps based on the number of students and graduates reported on LinkedIn in 2020. This tells us which bootcamps were the most active in 2020.

We can see that nine of the 10 largest bootcamps enrolled at least 1,000 students in 2020, and App Academy enrolled 991 students. This demonstrates how bootcamp operations can scale up to support thousands of students.

We suspect these LinkedIn numbers are slightly lower than numbers kept by the schools because it is likely not every student has a LinkedIn profile.

* Data based on LinkedIn data for students and graduates of a particular bootcamp in 2020. These numbers do not distinguish between corporate training and direct student enrollments; they are an aggregate count of people who have been trained by a particular bootcamp.

A new name on our top 10 list that was not present in our last report is CareerFoundry, a user experience and user interface design bootcamp.

Product School, a school known for its bootcamp approach to product management courses, also made its way onto our 2020 list. This shows that there is growing demand for non-programming technical training.

Bootcamp Costs and Financing

Bootcamps charged an average of $11,727 for their programs in 2020. In our last report, we calculated tuition for online and in-person bootcamps separately. This year, we are not separating online from in-person tuition. This is due to the mass transition from in-person to online learning brought on by the COVID-19 pandemic.

To calculate the percentage change between 2019 and 2020, we found the average of the in-person and online bootcamp figures from our last report. This left us with an average tuition of $13,958 in 2019. Therefore, the average price of attending a bootcamp has decreased by 18.62% since last year. This year, we included part-time programs in our study, which we believe contributed to the lower tuition rates.

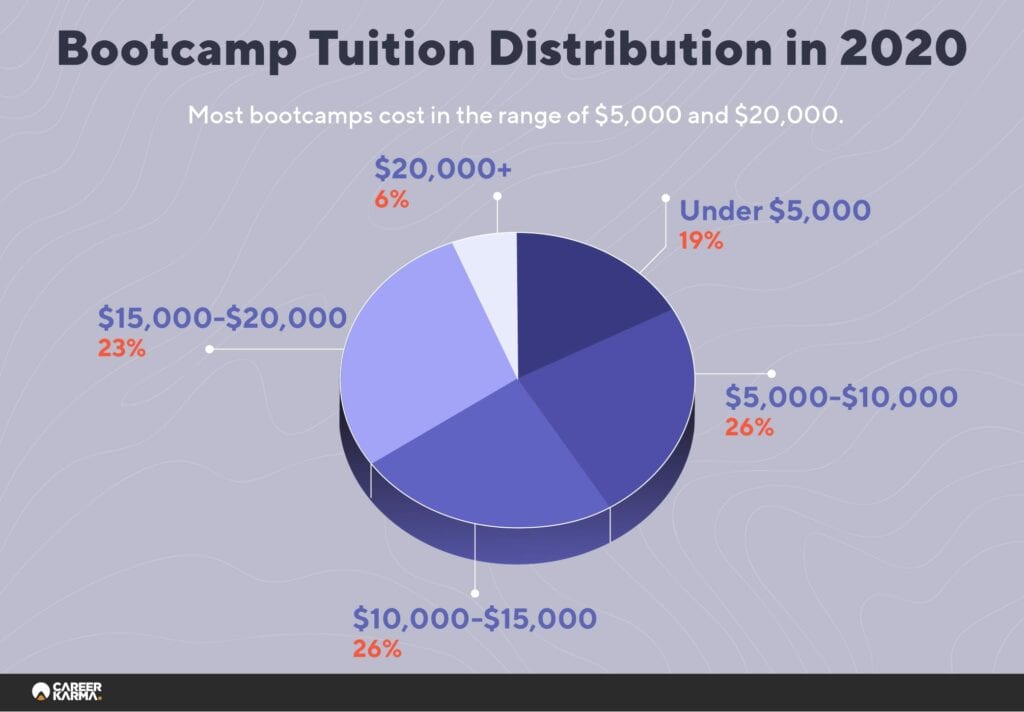

Tuition Ranges for Bootcamps

Bootcamp tuitions ranged widely, just as they did the previous year:

We calculated the average tuition for 2020 by finding the upfront cost of each full-time and part-time software engineering and web development program on our list, adding the values, and dividing the sum by the number of schools.

We excluded introductory and prep courses. Where a school did not offer a software or web development program, we considered the tuition of its flagship program as advertised on its website (e.g., data science, product management, etc.).

Compared to the data from our State of the Bootcamp Market 2020 report, fewer programs cost over $20,000. This year, 21.9% of programs cost between $15,000 and $20,000 compared to 42.4% in 2019. The majority of bootcamps charge between $5,000 and $20,000, which is consistent with last year’s data.

Bootcamps are usually a cheaper option compared to college. A September 2020 study by U.S. News found that the average per-year tuition for public in-state college attendants was $11,171 for the 2020-2021 academic year. College tuition may be defrayed by federal aid; such aid is not available for bootcamps. This year, financing options include:

- Private student loans

- G.I. Bill

- Income Share Agreements

- Deferred tuition Upfront payment

- Living stipends

The diversity of payment options was especially important in 2020 due to the fluctuating employment market. Debt financing is not for everyone, which is the main option people are usually able to access.

This is where ISAs and deferred tuition are useful. ISAs offer a more accessible way to finance their education, spreading out tuition after one has found a job earning a salary over a certain amount known as the “minimum income threshold.”

If the student does not find a job, their tuition, after a specified period of time (usually around five years), is waived.

Living stipends, sometimes paired with ISAs, were available at some points during the year. Thinkful, for example, offered living stipends in 2020. The program gave selected full-time students would receive $1,500 per month to pay for their living costs. The ISA arrangement means that students can feel confident the money they receive from living stipends will only be due if they earn.

Income Share Agreements (ISAs)

Despite the economic circumstances, a number of bootcamps have continued to offer income share agreements (ISAs) as a method of financing. For instance, Lambda School, Pursuit, V School, Launch School, and the Grace Hopper Program all have ISA offerings. However, some programs switched their ISA programs to other forms of financing.

Our research indicates that 47 schools offered ISAs as a method of financing to students in 2020. See Appendix B(A) for a full list of schools offering ISAs. This list includes schools we have not included in the rest of our study. This is because we could not find data on LinkedIn for all the schools that offer ISAs, but we want to specifically comment on the growth of ISAs in this section.

Seven of the bootcamps on our list offer ISAs either in part or fully outside of the U.S. These bootcamps are denoted by an asterisk (*) in Appendix B(A).

ISAs have had a year of ups-and-downs. Indeed, the value of incentive alignment is more powerful than ever. In times of economic uncertainty—and higher unemployment levels—people need extra assurance that the money they spend will lead to a quality education that results in a tangible outcome, which is employment.

Schools need to provide a quality education and career support; failure to do so will result in students who used the ISA to finance their education not making payments because they are not earning. Schools have an additional incentive to invest in employment services, as these services will help students transition into jobs.

The fact that students only pay if they are earning above the minimum income threshold is a proposition that will resonate with many people who are looking to reskill or upskill. The same cannot be said for student loans, where interest accrues and payment is required irrespective of one’s salary.

In 2020 and January 2021, many businesses, some of which are not direct education providers, announced new ISA funding or programs. Below we have curated a list of ISA investments we discovered in 2020 and January 2021:

- Fullstack Academy (Size of financing unknown)

- MentorWorks “Fund and Support” ($2 million)

- Victory Lap ($25 million)

- Burlington Code Academy ($10 million)

- Alchemy Code Lab ($5.8 million)

- Entity Academy ($10 million)

- MentorWorks Students First ISA Fund I (For Boston-based students, Capital unknown)

While ISAs were once a novel concept in the bootcamp industry, today they have become an industry standard. If bootcamps that offer ISAs also focus on other value propositions, such as changes to their pedagogy or new programs, they will be able to better serve new and existing students.

ISAs Outside of Bootcamps

The potential of ISAs continues to extend outside of just bootcamps. The San Diego Workforce Partnership, a non-profit partnership between UC San Diego Extension and the County of San Diego, still offers ISAs to its learners. In an interview for EdSurge, the Workforce Partnership described the utility of its program:

We are not just going to be at the mercy of what the congressional budgeting process is. We have a community need, and we need to figure out a way to meet that need.

Outside of bootcamps, we are seeing more ISA funds popping up, providing students access to capital through an ISA for a range of training programs.

Skills Taught at Bootcamps

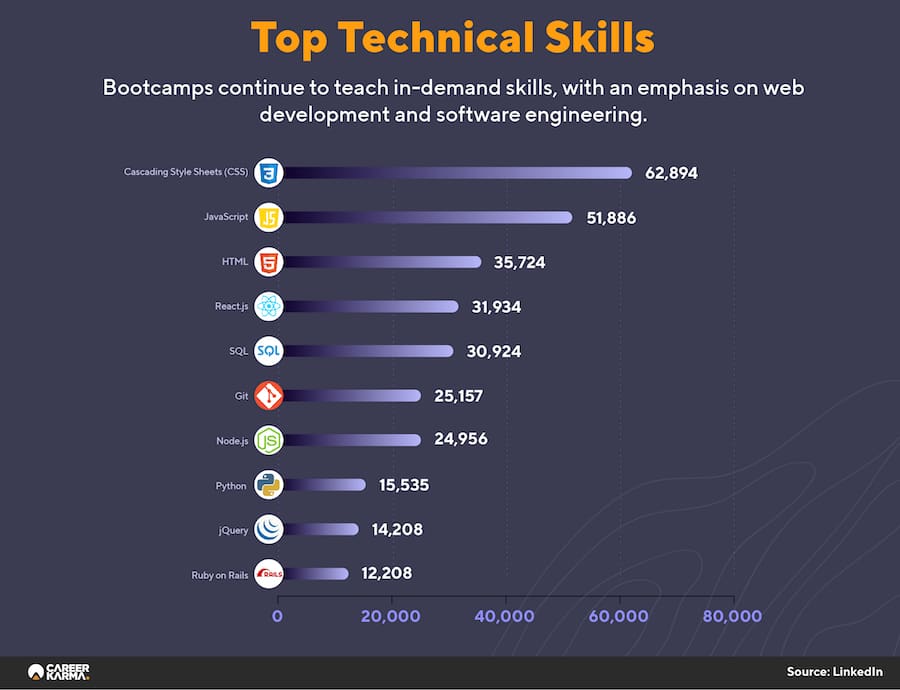

The ultimate goal of bootcamps is to teach their students industry-relevant skills. Like last year, we have analyzed LinkedIn skills data to determine the skills that bootcamp students learn in their programs.

The top five programming languages and technologies coding bootcamp students and graduates reported knowing were:

![]() CSS

CSS![]() JavaScript

JavaScript![]() HTML

HTML![]() SQL

SQL![]() Python

Python

These programming languages are the same as the top languages we noted in our last report.

According to the Bureau of Labor Statistics (BLS), jobs in the web development and digital design industry are expected to grow at a rate of 8% between 2019 and 2029. The BLS predicts jobs in software engineering will grow by 22% between 2019 and 2029.

This suggests the intense focus on web development and software engineering—both in terms of skills and dedicated program offerings—is grounded in expected changes in the labor market.

While the BLS statistics are closely correlated with the skills we mentioned, the Stack Overflow 2020 Developer Survey gives us an idea of how these technologies are used in the tech industry.

We found that all five programming languages mentioned above are incredibly popular among professionals. JavaScript was in the lead, with 69.7% of respondents indicating they used the technology. HTML, CSS, and SQL were close behind, and 41.6% of respondents indicated they used Python.

Hired.com’s list of the 16 “most in-demand coding languages across the globe” is also a good indicator of the usefulness of particular skills. This report analyzes data from 2019.

According to the report, HTML, SQL, Python, and JavaScript are all on the list of the 16 most in-demand coding languages.

As the industry grows, new and existing bootcamps could target emerging careers. We are already seeing cybersecurity bootcamps pop up in response to the growing demand for cybersecurity engineers. This effect is likely to be seen in other career paths as they open up.

Below is a list of the top five non-language technical skills reported on student and graduate LinkedIn proles:

![]() React

React![]() Git

Git![]() Node.js

Node.js![]() jQuery

jQuery![]() Ruby on Rails

Ruby on Rails

All five of these skills are used in web development, although Git and user experience skills are not specific to programming websites.

As the industry grows, new and existing bootcamps could target emerging careers. We are already seeing cyber security bootcamps pop up in response to the growing demand for cybersecurity engineers. This effect is likely to be seen in other career paths as they open up.

Soft Skills

In terms of so-called soft skills—the interpersonal skills valuable to employers—we noticed similarities within our dataset. We feel soft skills are important to mention because bootcamp graduates are being prepared for the job market.

From an industry perspective, the 2019 Global Talent Trends report written by LinkedIn provided new insight on the importance of soft skills. According to a LinkedIn report, 92% of candidates believe candidates with soft skills are “increasingly important.” This report also finds a strong correlation between candidates with poor soft skills and those who turn out to be “bad hires” from the perspective of hiring managers.

Soft skills are important to employers because they indicate a prospective hire will be a good addition to their team from an interpersonal perspective. A great programmer who cannot communicate with others will probably be less effective, for example.

On LinkedIn, it is common for users to report soft skills to present a more professional image and improve their profiles in the eyes of employers.

In 2020, the top soft skills reported by bootcamp students graduates were:

- Customer Service

- Leadership

- Project Management

- Social Media

- Management

From this data, it becomes apparent that bootcamp graduates are not just concerned about presenting their technical skills. Interpersonal skills are valuable to bootcamp students and graduates, at least enough to include on their LinkedIn profiles.

Top Bootcamp Employers

The purpose of bootcamps is to prepare students for a job in technology. The ultimate benchmark to consider, then, is how students and graduates fare in the labor market. Are students getting jobs? If so, where are the students going to work?

According to Hired.com’s 2021 State of Software Engineers report, 72% of bootcamp graduates said that their education helped them prepare for an engineering job. This shows that many people who have been hired think their bootcamp education had an impact on helping them find a job.

The career services offered by bootcamps may help here, as these services help students learn how to apply their skills to the job market and pitch themselves to recruiters and hiring personnel.

To learn more about how bootcamp students and graduates fare in the labor market, we have compiled a list of the top 10 companies that hire bootcamp graduates. This gives us an idea of what kinds of employers trust the talent coming from bootcamps.

While this data does not reflect every graduate—due to limitations with the data available on LinkedIn pages— the employment figures we collected give us an idea of where a lot of graduates are finding jobs.

Top 10 Bootcamp Employers

Below are the top 10 companies who have employed bootcamp graduates or students, alongside the number of students or graduates each company employed.

Bootcamp graduates and students are employed by a range of companies. We can see that the top employers of bootcamp students and graduates are all well-known companies.

The likes of Amazon, Google, and Apple are all big technology companies, in terms of both size and influence. We can see that not all of the top employers are big technology companies. JP Morgan Chase & Co., a financial institution, is on the list of top employers. Accenture, a professional services firm, is also on the list.

That bootcamp graduates have continued to find jobs in well-known technology companies shows that, even throughout the pandemic, top technology companies have been hiring and seeing the value of bootcamp credentials.

Employment Comparison with 2019

Six of the top ten companies we noted as top employers for bootcamp students and graduates in 2019 were still in the top 10 employers in 2020. This indicates that those employers have been successful in hiring students from bootcamps. To track the change, we calculated the percentage increase between the top companies’ hiring activity in 2020 compared to 2019 for those that remained on our top 10 employers list in both years.

Top employers included in both this report and last year’s report have hired more bootcamp graduates and students. Amazon more than doubled its hires from bootcamps, for example. We excluded self-employed people from this chart so we can focus on companies. We rounded our data to one decimal place. We can infer from this growth that the companies mentioned above have had good experiences hiring bootcamp graduates.

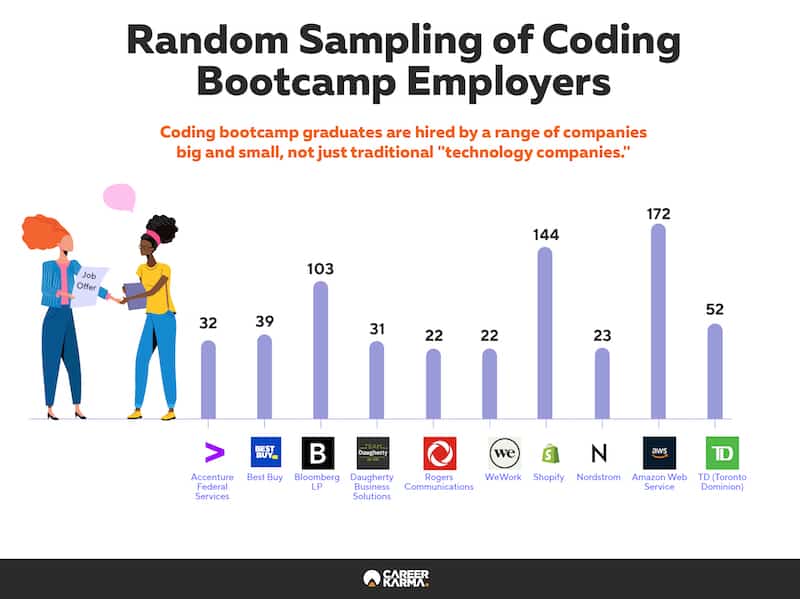

Random Sampling of Bootcamp Employers

To provide another perspective on the types of companies hiring bootcamp graduates, we conducted a random sampling of all companies that have hired at least 20 graduates. This represented 134 companies in our dataset. We excluded bootcamps as employers. Below is a chart showing a list of 10 random companies and the number of students they have employed.

This data allows us to learn more about the types of companies hiring bootcamp graduates. We can see that it is not just blue-chip companies hiring graduates. Daugherty Business Solutions, for example, is a consulting firm that has hired 31 bootcamp graduates.

Therefore, we can see there are a few larger companies that have hired smaller portions of bootcamp graduates than those in our top 10. For instance, TD, a financial services company, has hired 52 bootcamp students or graduates.

AngelList, a site for jobs at startups, lists companies on its platform that have hired bootcamp graduates. According to the list, Scribd, Button, Segment, MakeSpace, Agent IQ, and many other startups have hired bootcamp grads. However, AngelList does state that not every role in the company on the aforementioned list is suitable for bootcamp graduates.

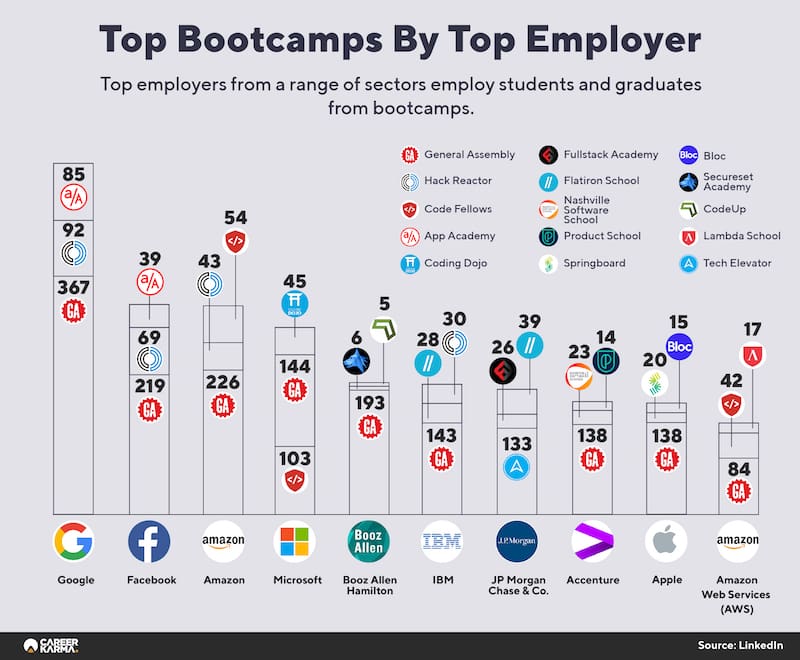

Top Bootcamps Placing Students at Companies

We decided to dig a bit deeper into the data to determine which bootcamps are placing students at these employers. We limited our scope to the top 10 employers to keep our data focused on the companies for which we have sufficient information.

Below is an infographic indicating the top bootcamps that place students at top employers:

We can see a few names come up multiple times in this chart. General Assembly, for instance, is the top bootcamp placing students at eight of the top 10 bootcamp employers. Aside from General Assembly, there is a wide range of other bootcamps where a substantial number of students go on to work for top companies. For instance, Springboard, Lambda School, and App Academy, among other bootcamps, are all placing students at these top companies.

As bootcamps place more students with a company, they may be able to develop a closer relationship with the employer, opening new avenues for collaboration. This may involve the employer hiring more students from the bootcamp or attending the bootcamp’s job events.

Top Cities for Bootcamps

While bootcamps are educating students all across the country, some areas have much higher concentrations of bootcamp graduates. In this section, we focus on the top cities where bootcamp students and graduates were based in 2020. By focusing on just the past year’s worth of data, we will get a better sense of the current landscape.

We can use LinkedIn data to determine where the students we studied are located. Since some people study and work remotely, we cannot say for sure whether a given student or graduate works in their place of residence. Even so, this data gives us a rough idea of how bootcamps affect the talent pools in various cities across the U.S.

As we noted in our last report, the top cities where bootcamp students and graduates live are also top cities for technology talent and companies. This suggests that a large percentage of students are using bootcamps to break into well-established labor markets where technology jobs are common.

Top US Cities for Bootcamps

Below are the top cities where bootcamp students and graduates study or are now located.

LinkedIn classifies each of these locations as an “area.” This means the data may include students and graduates located in the greater metropolitan regions surrounding the cities mentioned above. For instance, a graduate of a bootcamp living in Palo Alto may still be classified as a resident of the San Francisco Bay Area.

All of these cities have access to venture capital, to varying degrees. Venture capital is correlated with the presence of technology companies in an area. More traditional technology hubs like New York City and San Francisco have world-renowned venture capital firms. All the other cities have access to a less robust, but still big, stock of venture capital.

For instance, $2.5 billion was invested across 390 deals in Colorado in 2019, according to PitchBook, a venture capital analysis tool, and the National Venture Capital Association. The more capital that flows to local technology companies, the more likely these companies will hire new employees, and the more valuable technical skills will be.

To get a better sense of the competitiveness of each labor market, we looked at Glassdoor to find the average salary for software engineers in each of the top regions, and then looked at LinkedIn to find the number of software jobs available in each region. We chose to focus on software engineering because many bootcamps offer software engineering courses. We therefore believe software jobs are a good benchmark for evaluating tech talent in a region.

We can see that in all of the top ten cities, vast numbers of software engineering jobs are available. Each city has a high average salary, with differences largely attributable to differences in cost of living. Those who work remotely may earn more or less, depending on whether their company takes into account the local cost of living when calculating an employee’s salary.

Growth in Bootcamp Students by City Since 2019

To put our location data into context, we calculated the percentage increase from 2019 to 2020 of the number of bootcamp students and graduates residing in each location. The table below shows our findings, rounded to one decimal place:

There are two obvious potential causes for these increases:

- Students are moving to these cities to find jobs.

- People who live in these cities have attended a bootcamp.

We believe the second explanation, that people in these cities have attended a bootcamp, is the main reason why there are high concentrations of students and graduates in these cities in 2020.

We have drawn a random sample of our data to learn more about the wide range of places where graduates are based. To conduct this sample, we used a program to select locations from our list at random. We excluded any cities that were not based in the United States. Our program returned the following data:

Because many bootcamps are currently online, it is to be expected that students and graduates are dispersed throughout the U.S. According to the table above, some of the people who attend bootcamps live in areas not known for bootcamps at all, which shows just how extensive the national influence of bootcamps in the U.S. really is.

Miami is an excellent example of how there are growing technology hubs outside of the places people tend to associate with tech (e.g., San Francisco, Silicon Valley, New York City). Miami is investing heavily in ways to reskill Miami residents. For instance, the city has partnered with SoftBank to provide data science training for 10,000 people from underrepresented communities. We can expect that as technology becomes a more important part of our lives, jobs will emerge in more cities that we do not consider “traditional” technology hubs.

The national influence of bootcamps is due, at least in part, to the fact that bootcamps can improve a student’s prospects for high-paying remote work. Many jobs in technology do not require employees to be in a particular location. And the overall trend in the labor force, according to Upwork, is one in which “the number of remote workers in the next five years is expected to be nearly double what it was before COVID-19.”

But businesses all across the country, not just big technology companies, also need tech talent on the ground. This means that students may be able to use skills acquired at a bootcamp to find non-remote jobs in their local labor market.

Top Cities for Bootcamps Outside the U.S.

Although a large percentage of bootcamp students and graduates in the schools we studied are based in the U.S., a significant portion resides outside the country. This is because many U.S.-based schools—or schools that have programs in the U.S.—offer programs in other countries. Indeed, international expansion is another method of growth for bootcamps: the need to reskill is not confined to the U.S., so bootcamps should be able to succeed in other markets.

Below are the top five non-U.S. cities where bootcamp students and graduates reside.

We can see from this data that bootcamp students and graduates are based all around the world. Globally, we still see a concentration of students in well-known cities. This is probably for the same reason that many students and graduates are based in large U.S. cities: technology jobs are more likely to be available in cities than in more rural areas. But bootcamp students and graduates are still less common outside the U.S.

Venture Capital and Acquisition Activity

In our last report, we noted that acquisitions in the bootcamp space are common, with a steady number of acquisitions each year. This past year was no exception. In 2020, there were at least four bootcamps acquired by other companies. In January 2021, it was announced that BrainStation would acquire Wyncode Academy.

Bootcamp Acquisitions

At the start of 2020, Galvanize, a large coding bootcamp, was acquired by K12 (now Stride, Inc.), a massive education technology company.

EdSurge speculates the deal will help K12 provide technical education to their existing students.

In the middle of 2020, Flatiron School was acquired by Carrick Capital Partners, a software investor.

Flatiron School has been a big player in the bootcamp industry for years. But it was being held back by WeWork, which notoriously had issues raising capital after going public in 2019.

The ongoing growth of Flatiron School in spite of WeWork’s troubles was one of the reasons that Carrick Capital Partners decided to invest. With this acquisition, Flatiron School expects to keep all of its 400 employees.

Three months later, The Hacker School, a cybersecurity bootcamp based in India, merged with iCollege Australia for an undisclosed amount. This acquisition will help iCollege offer accredited cybersecurity programs to its students, according to the press release announcing the acquisition.

In November, Tech Elevator was acquired by Stride in an all-cash transaction. In a press release for the acquisition, Tech Elevator notes it will be “combining forces” with both Stride and Galvanize, Stride’s other bootcamp acquisition in 2020.

In March 2021, Kenzie Academy was acquired by Southern New Hampshire University (SNHU), a prominent bootcamp. According to an article by the Indiana Business Journal, Kenzie Academy will become a not-for-profit division of SNHU.

These acquisitions show that consolidation is ongoing in the bootcamp space. We expect the present rate of acquisitions to continue as higher education companies realize the potential in bootcamps.

See Appendix C for a full list of acquisitions in the bootcamp market from 2012 to 2021.

Bootcamp Venture Capital Rounds

The majority of for-profit bootcamps depend on venture capital to fund their growth. This capital allows companies to scale quicker than is usually possible with loans and personal funds. Since venture capitals usually invest in high-growth industries, we can infer that investors expect continued growth in the bootcamp space.

Adding up all the rounds, we calculate that at least $234.3 million was invested in bootcamps in 2020. For context, this is slightly lower than the $241.3 million invested in bootcamps in 2019, as reported by HolonIQ. The average venture capital round in 2020 was $19.5 million. There might have been other venture capital rounds in 2020 that did not turn up in our research of publicly-available information on venture financing.

Looking to the immediate future, an article by Harvard Business School (HBS) noted that COVID-19 is “not slowing VC investment.” Paul A. Gompers, Eugene Holman Professor of Business Administration at HBS, points out that most venture capital investors “are looking to do new deals” and that they are “sitting on a ton of money.” What is more, 91 percent of venture investors “expect their investments to outperform major equity indexes going forward.”

Lambda School, Le Wagon, Springboard, and Microverse all raised capital. The first three of these bootcamps raised double- digit rounds, showing that capital is still flowing into the bootcamp industry in large amounts. The well-known names attached to these rounds, such as Gigafund and General Catalyst, show that even big investors are still interested in bootcamps.

Notably, seven rounds were raised by bootcamps based in countries other than the U.S. These were raised by Masai School, Newton School (which raised two rounds), Henry, Ironhack, HackerU, and Crehana. This shows that there is international interest in bootcamps.

While many students have been learning online as a result of the pandemic, online learning is still not perfect. There is still a long way to go before online learning will be able to navigate all the inherent challenges, from finding the best ways to communicate to remote collaboration.

The Impact of COVID-19 on Bootcamps

Earlier in this report, we noted that bootcamps have continued to grow despite the numerous challenges brought forth by COVID-19.

A Transition to Online Learning

Bootcamps adapted to this pandemic with a simple overriding message: you are to learn online for the foreseeable future. This message echoes the one given by many higher education institutions before the start of the 2020-2021 academic year.

Burlington Code Academy moved to remote classroom setups, and as of February 2021, the school still offers remote courses. Galvanize initially moved all its students to online programs, and only recently has it begun the process of phasing back in onsite classes.

This change has brought more awareness of the services online learning can provide. Bootcamps have adapted to use technologies like Zoom and Microsoft Teams to facilitate classes. This has helped some bootcamps experiment with online learning in ways that they otherwise would not have done. Now most bootcamps know the potential of online learning.

Given that more people enrolled in bootcamps in 2020 despite the pandemic, we can infer that many see online learning as a valid method of acquiring technical skills. One question does remain, however: will this continue? As restrictions loosen, students may once again opt for in-person offerings, and bootcamps may reinstate their in-person programs. Launch Academy has planned a hybrid course, part online and part in-person.

With that in mind, bootcamps that are planning to move back to in-person offerings are a reminder that COVID-19 was a so-called “forced experiment” in online learning. According to a report by GSV Ventures, the online learning market has grown to be worth $160 billion in total as of 2020. The growth in online learning is a sign that we may see more experiments in digital education in the future.

Changes in Remote Working in the Workplace

Students not only use the technology of digital connection to learn the skills needed for a particular position. They can also use a range of online means to find jobs and do work.

The need for companies to adapt to remote work is likely to cause many changes in how they do business. Technologies such as Slack and Zoom have proven their utility in workplace communication, especially for remote workers. Dropbox is one example of a company that announced it was going to move to an online-first policy, favoring remote work.

Many employers are considering whether to continue allowing employees to work from home even after the pandemic is over. A survey by Gartner found that over 80% of “company leaders” plan to let their employees work from home at least part-time after the pandemic. Similarly, a report from WIRED indicates that more employers may offer workers a choice between coming into the office and working remotely.

While many companies will go back to in-person work when possible, it is clear remote work will continue. How does this affect bootcamps? As more companies embrace remote work, bootcamps will have to adapt their curricula. The curricula from 2020 are a good start, as bootcamps have amassed experience using some of the same technologies to teach students that companies use to facilitate remote work.

Tech Companies Continued to Hire (After a Rough Start)

Some industries have been more affected by COVID-19 than others, and the technology industry has had its fair share of issues. With that said, technology companies have continued to hire, which has left bootcamps with a labor pool they can continue to serve. Indeed, as more people look for jobs—and as people continue to lose jobs—bootcamps can solidify their reputation as a valuable career transitioning tool.

In early 2020, when economic conditions were still unsettled, there were concerns about the stability of employment in the technology industry. Many companies stopped hiring. Companies like Candor started lists of hiring freezes to keep track of tech companies that were conducting layoffs or were no longer hiring. Indeed, the stock market crashed in March 2020 as a result of the pandemic, which helps us understand the initial downturn in hiring.

Despite these uncertainties, a substantial portion of tech companies are still hiring. We collected data from LinkedIn to get an insight into the number of open tech jobs as of the writing of this report. In early February 2021, we found:

While this data is only a snapshot in time, it clearly shows that the demand for labor in the technology industry remains high. Furthermore, the top search results included job posts from Facebook, Adobe, Peloton, and Tesla, which suggests that even top companies are hiring actively.

Further evidence of this phenomenon comes from a report in Forbes, which cites Glassdoor data showing that 960 information technology companies are actively hiring amid the pandemic. This surge features companies like Rackspace, Fastly, and Datadog, all established technology companies.

Given the relative health of the technology industry, it should come as no surprise that bootcamps have continued to thrive. Importantly, they have helped students find jobs in technology, even at top companies like Microsoft and Accenture. See the “Top Bootcamp Employers” section for more information.

This data lends credence to the idea that bootcamps are an attractive option for those who want to be prepared quickly for a job in tech.

Indeed, the full range of services that bootcamps offer may make them more valuable than traditional alternatives during times of economic stress.

In addition to the coding education they provide, they also place a significant emphasis on career support, from resume reviews to one-on-one career coaching. These services help bridge the gap between education and employment, which sets them apart from colleges that train students in computer science.

Bootcamp Scholarships

Historically, bootcamps have used scholarship programs to help disadvantaged or otherwise insolvent students finance part or all of their education. These programs have usually been geared toward promoting diversity in a bootcamp. For instance, Coder Academy covers 50% of the tuition of all people who are accepted on their Women In Tech Scholarship.

COVID-19 has brought financial hardship to many, especially to those from non-white groups. For instance, 44% of black Americans said in April that “they or someone in their household had experienced a job or wage loss due to the coronavirus outbreak.” This is eight percent higher than the number of white adults who reported this concern.

The value of scholarships varies between bootcamps. Most are in the range of $1,000 to $5,000, with some schools offering free tuition to some students.

Promineo Tech offered free education to successful applicants of its Promineo Tech Scholarship Program. Springboard offered $3,000 and $4,000 scholarships out of its $500,000 scholarship fund. This program alone promised to finance 10 tuition fees each month until the fund expires.

These scholarship programs show how willing many bootcamps have been to provide financial support to those in need during the pandemic. While some scholarship programs were only temporary, the amount of money given out has gone a long way to help those who were—or who still are— financially constrained by the pandemic.

The pandemic, of course, is not over. Many people still face uncertainties about their jobs and income, and people from minority groups have been hit hardest. For these reasons, we expect bootcamps will continue to offer scholarships in the future, both on the basis of financial hardship and in the interests of diversity.

Looking Forward: Bootcamps in 2021

Bootcamps have proven their ability to teach in-demand skills, as evidenced by the high caliber of companies at which graduates work and the continually high rates of bootcamp enrollment. The industry has, on the whole, adapted to the new circumstances brought forth by the pandemic, shifting to online learning.

There is one big question left: what can we expect in the coming year and beyond? While much is uncertain, we have a few projections.

Continued Focus on Online Learning

As infection rates of COVID-19 increased around the world, it became clear that social distancing was needed to protect the vulnerable. This forced a switch to online learning formats for all educational establishments, from colleges to bootcamps.

Bootcamps have rapidly iterated and experimented with new methods of teaching in response to pandemic restrictions. Whereas some schools did stop accepting students altogether, the majority of schools modified their offerings to support online learning. Technologies such as Slack, Zoom, and GitHub were used to facilitate remote learning, even by bootcamps that had not previously offered online learning programs to their students. As a result, students could still acquire technology skills without having to be in a physical classroom.

In the aftermath of this forced experiment, the bootcamp market will eventually reach a new equilibrium of learning formats. Some bootcamps will transition back to in-person offerings as soon as it is safe to do so, and we are seeing signs of this already. We still expect online options to be available for most bootcamps, even for those that start to offer in-person courses again. Alternatively, bootcamps could increase the availability of so-called hybrid options. Nucamp‘s Baltimore campus already offers a mixture of in-person and online offerings. DigitalCrafts, meanwhile, is actively offering hybrid options in response to the pandemic.

It remains to be seen how common hybrid models will become. On the one hand, hybrid education is attractive to students who would prefer to spend some time learning on a physical campus. On the other hand, because such models require students to live near a campus, many bootcamps will not have the resources to recruit from a small pool of local candidates. It may be more feasible to go fully online like Lambda School, which is free to target people across the U.S. With that said, not everyone is interested in learning completely online, so hybrid programs may become more common as restrictions ease.

In the past, online learning was a competitive advantage, as comparatively few bootcamps were fully or mostly online. While some new online programs may not stick, we expect many bootcamps will continue to accommodate students who are not comfortable with in-person learning, or who would prefer to learn online. As remote learning becomes part of the new normal, we anticipate online courses will be less of a selling point than they once were.

New Employer-as-Payer Training Programs

For many, bootcamps and similar training programs are a gateway into a new career in technology. Others, however, use bootcamps for reskilling and upskilling. In fact, some bootcamps offer corporate training programs for workers who want to reskill and upskill. Whereas reskilling refers to completely retraining workers in new skills, upskilling involves learning skills that build upon what workers already know.

Over the last few years, companies have shown steady interest in financing technical training programs for their workers. Their goal is to prepare for changes in the industry by helping their current staff remain efficient contributors to their organization.

Companies choose to invest in their own employees because it is the smart play. According to a 2016 study by the Society for Human Resource Management, it costs an average of $4,129 to hire a new employee, and it takes an average of 42 days to find a new hire. Delays caused by handling unexpected turnover, managing onboarding paperwork, and training new employees all contribute to the time it takes to find and onboard new hires.

While training does take time, the investment in training is long-term. Newly- trained workers will have the skills they need to respond to imminent workplace changes (e.g., the use of new technologies), and have a better understanding of the tasks that will occupy their time.

A big benefit of investing in employee training is that it boosts employee retention. LinkedIn’s 2018 Workforce Learning and Development Report noted that 94% of employees would stay longer at a company that invested in their career. The higher the retention rate, the less time and money the company has to invest in finding, onboarding, and training new employees.

Some training providers, like Learn In, specialize in upskilling-as-a-service. While not specifically a bootcamp, Learn In helps companies improve the technical skills of their employees. Learn In believes that upskilling attracts and retains talent, a key selling point for clients. Guild Education operates a similar program, styled as “education as a benefit.” It partners with universities and other education providers to help companies find training programs for their employees.

Some bootcamps, like Coding Dojo and Le Wagon, offer programs specifically for companies that want to train their staff. These programs range in implementations. Coding Dojo provides a 12-to-14-week training program, which is perhaps more suitable for reskilling workers.

In these arrangements, a bootcamp will provide onsite or online training to a company’s employees. The corporate training program usually resembles the bootcamp’s regular programs, which means employers can expect their employees to graduate with a diverse set of hard and soft skills.

Flatiron School has an extensive range of corporate training services. On its website, Flatiron School notes that it provides help with onboarding training, reskilling, upskilling, and more. Its onboarding training helps an employee learn about the specific technologies the company uses on a day-to-day basis. Its upskilling courses are short-term, designed to boost employee skills; reskilling programs are longer, focused on helping people build skills in new technical areas.

The case of Flatiron School demonstrates that most corporate training programs still have room to grow. Bootcamps that already have upskilling solutions may follow in the footsteps of Flatiron School, expanding their offerings to cover areas like onboarding and other training needs.

Given the urgent need for reskilling, we expect more bootcamps to launch corporate training programs in the coming years. A 2020 report by the World Economic Forum estimated that 42% of the “core skills” needed to perform existing jobs will have changed by 2022.

One potential obstacle to growth in this area is that corporate training is a slightly different model than consumer-focused training. Bootcamps must handle huge accounts rather than, or in addition to, advertising to consumers. With that said, the clear demand for reskilling in technical skills makes expansion a viable proposition. Since bootcamps are already well-positioned to educate people in technical skills, corporate training is a logical next step.

Differentiation Through New Niches and Specializations

Many bootcamps, especially newer players, are devoted to a specific niche, many of which are underserved by existing bootcamps. By focusing on one area and doing it well, a bootcamp can make a name for itself in that area, at least until competitors start to eat away at its market share. Then, the company can use its growth to expand into new offerings, such as additional courses or new career services.

One market ripe for growth is cybersecurity training. According to the Bureau of Labour Statistics, jobs in information security analysis are expected to grow 31% between 2019 and 2029, which the Bureau describes as “much faster than average.” Given this projected growth, it is clear bootcamps have an opportunity to meet the coming need for cybersecurity skills training.

Some bootcamps, like Evolve Security Academy and SecureSet Academy, already fill this niche. And in 2020, HackerU, a cybersecurity bootcamp, announced a partnership with Kansas State University’s Olathe campus to offer cybersecurity courses, which is one example of the ongoing interest in cybersecurity training.

A similarly promising market lies in technology sales bootcamps. In 2020, numerous bootcamps such as Prehired, SV Academy, and Flockjay offered short-term, career-oriented courses in technology sales. As a representative example, Flockjay’s 10-week course in technology sales covers inbound sales, outbound sales, learning technical sales software, and more. Its career services include interview and job searching support.

Our analysis from LinkedIn data does not give a complete picture of these bootcamps due to the lack of available alumni data. However, we see technology sales bootcamps as an opportunity for expansion in the industry. Whereas most of the established players continue to target more traditional coding roles—like web development, data science, and software engineering— there are comparatively few bootcamps pursuing technology sales.

New University-Bootcamp Partnerships

Dozens of universities across the U.S. offer in-house bootcamps. In our last report, we noted that Trilogy Education is a leading player in this market. Trilogy offers programs in web development, data analytics and visualization, UX/UI design, and cybersecurity, which it hosts on dozens of campuses, including the University of Oregon, the University of Pennsylvania, and UCLA Extension. This year, our research indicates more bootcamps are offering programs in partnership with universities.

University partnerships with education companies are increasingly common. At the end of Q3 2020, according to education research firm HolonIQ, “over 770 Universities across the U.S., U.K., Canada, Australia, India and a handful of other markets have established long-term public-private partnerships for academic programs.” In the first three quarters of 2020 alone, there were 73 new partnerships between universities and bootcamps. This is a significant increase over the 49 partnerships formed in 2019.

Notably, HolonIQ found that university- bootcamp partnerships are not confined to any particular size of university. With the exception of “very small” universities, partnerships are common with universities of all sizes.

This suggests that bootcamp-university partnerships are not just a path for small schools to reach a bigger audience: medium and large schools benefit as well.

Many of the university-bootcamp partnerships from 2020 and 2021 made headlines. In January 2021, Arizona State University announced a partnership with Chegg, which acquired Thinkful in 2019. Graduates earn a professional certificate from Arizona State University, rather than a traditional certificate from the bootcamp. Also in January, Springboard partnered with the UC San Diego Extension School to offer online training.

Additionally, Nebraska Dev Lab and Doane University have formed a bootcamp-university partnership. Simplilearn and Caltech CTME have also partnered to offer online bootcamp programs. And the University of Oklahoma is preparing to offer two bootcamps in partnership with Fullstack Academy.

In the U.K., there have been a few similar partnerships. Le Wagon, an international bootcamp, partnered with Imperial College London to offer a data science program. And the University of Cambridge Institute of Continuing Education (ICE) has partnered with Flatiron School to offer a 10-week online bootcamp focused on data science.

Commenting on the Flatiron partnership, Dr. James Gazzard, the director of continuing education at ICE, said “our motivation is to ensure all adults can be active participants in the knowledge economy.” This shows that the university has realized the bootcamp model can help teach in-demand skills.

University-bootcamp partnerships are becoming more common not just in the U.S. and Europe, but around the world. For example, Honoris United Universities has partnered with Le Wagon, an international bootcamp, to offer bootcamps across Africa.

University-bootcamp partnerships are in the early stages, and it is still too soon to comment on their success. On paper, however, both universities and bootcamps benefit. Whereas traditional degree programs usually last multiple years and are not for everybody, university bootcamps offer short-term, employment-focused training that caters to a new audience. Bootcamps, meanwhile, can reach a new audience under the brand name of a university.

And of course, the very fact that so many universities of all different types are partnering with bootcamps—especially universities that are new to bootcamp partnerships—is a sign that the model is catching on. Trilogy is no longer the only game in town. We are now seeing an increasing number of partnerships between bootcamps and universities.

Government-Bootcamp Partnerships

A February 2021 report in the Sacramento Bee spoke of a recent phenomenon that has taken off in the last year: government-bootcamp partnerships.

The Sacramento Bee report profiles the Digital Upskill Sacramento program. This program is a fund developed in partnership with the Greater Sacramento Economic Council, the Greater Sacramento Urban League, the City of Sacramento, and General Assembly. The goal of the fund was to pay for the education of 40 people who wanted to acquire new skills to advance their careers.

This partnership is only one of many investments Sacramento made in short-term job training programs. In total, Sacramento County invested $10 million in upskilling. With

$800,000 of that money going to the Digital Upskill program.

The recent Workforce Innovation and Opportunity Act, part of the COVID-19 CARES Act, provides workforce boards and local governments with the capital they need to invest in training, while also making training programs more affordable for those looking to upskill.

While the local workforce boards and governments have only partnered with a small number of bootcamps, such partnerships have taken place all over the country. For instance, 30 graduates of the Zip Code Wilmington program were recently hired by JPMorgan Chase.

The tuition for these students was paid by the Delaware Rapid Workforce Training and Redeployment Initiative, a government-supported training program. Elsewhere, Wyncode partnered with CareerSource South Florida to offer a grant to unemployed local residents who want to upskill.

Federal aid made available through the CARES Act will have a notable impact on the bootcamp industry. As local workforce boards establish ties with bootcamps, they can learn the ins and outs of how bootcamps operate and how they support students. Such relationships could foster more collaboration in the future, such as state-funded programs.

Conclusion

The growth in the bootcamp industry in 2020 exceeded the expectations laid out in our last report. Since the start of the pandemic, bootcamps have proven their ability to adapt to new circumstances.

The skill alignment between what bootcamps teach and what the labor market demands is clear. Bootcamps continue to favor programs in software engineering and web development, where skills are constantly in demand. With that said, bootcamps are continuing to innovate by following market demand.

Cybersecurity and technology sales programs are becoming more common. Such programs aim to prove that the bootcamp model of short-term intensive training can be applied to new careers.

Big companies like Microsoft and Apple are still hiring bootcamp students and graduates, at record rates. Our report finds that companies in many different industries and locations hire bootcamp graduates, which signals that bootcamp credentials are gaining wider acceptance. We expect bootcamps will face a lot of uncertainty in 2021, especially as some schools navigate how to offer in-person programs. Bootcamps have adapted well so far, but they will need to continue to do so to keep pace with a changing world and workforce.

Conflict of Interest Disclosure

Career Karma matches career switchers to bootcamps and job training programs. Career Karma is paid by bootcamps to help prospective students prepare for and get accepted into a training program based on their needs. In writing this paper, the author acknowledged this conflict of interest and took appropriate action to ensure the paper’s findings were not influenced by any relationships with Career Karma partners, affiliates, or external stakeholders.

James Gallagher, the Career Karma main researcher assigned to this project, was given autonomy over the direction of this market study and the final authority on decisions pertinent to the content of this paper.

While great care has been taken to assure the accuracy of the information herein, we did not speak to bootcamps to verify enrollment figures. Our student and graduate analysis is based on publicly-available enrollment statistics on LinkedIn.

Citation

In academic work, please cite document as:

Gallagher, J. (2021). State of the Bootcamp Market Report 2021. Career Karma: https://careerkarma.com/blog/bootcamp-market-report-2021/

Acknowledgments

The author of this report would like to thank the following team members at Career Karma who helped bring this study to fruition: Artur Meyster, Chad M. Crabtree, Galina Bakinova, Alex Consiglio, Naveed Lalani, Marc Juberg, Shanaz Chowdhery, Vladimir Muntyan, George Vozhdayenko, and Brandon Woods.

See Other Reports by Career Karma

If you found this report helpful, be sure to check out other Career Karma publications!

How to Pay for Coding Bootcamp: The Definitive Guide

In this comprehensive Career Karma guide, you’ll learn about the wide variety of funding options available to help you pay for your coding bootcamp tuition. Topics include private loans, income share agreements, scholarships, and more!

State of the Income Share Agreement Market – 2019

Career Karma researcher, James Gallagher, provides a thorough overview and analysis of the major players in the income share agreement market today and offers insights into the future of this innovative funding mechanism.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.