College education costs have been consistently rising in recent decades. What was once a joyful next step for many young people has become a source of anxiety and crushing debt.

Campus is one organization ready to disrupt the traditional approach of higher education. By borrowing elements of the coding bootcamp structure and minimizing out-of-pocket costs of tuition and related expenses, Campus is on a mission to maximize access and improve outcomes for all students.

Read on to learn more about how Campus makes higher education more affordable while providing quality support and resources for their students.

Campus is working to make a college education more accessible for the masses by removing financial barriers to student success.

Check out Campus’ tuition and financial aid here.What Is Campus?

Campus is an organization that’s working to increase access and affordability for students looking to earn a high-quality college education. With affordable tuition and full scholarships, Campus students may earn an accredited associate degree at the lowest cost possible.

But where did Campus even come from? Campus began as Campuswire, a start-up focused on optimizing the world’s teaching and learning by providing a course communication tool for large classrooms in colleges across the United States. After recognizing that students deserve a better and more accessible path to a degree, Campus designed their own two-year business degree program that most modern students can actually afford.

This program was built for the modern student, as tuition costs continue to rise, and higher salaries are increasingly locked behind college degrees.

That’s why Campus partnered with Northwestern College to deliver an Associate of Applied Science in Business Administration degree program that won’t leave students under mountains of debt. With the college transfer process in mind, Campus designed the program to prepare students for careers in business while keeping the option open to transfer to a four-year degree program in the field.

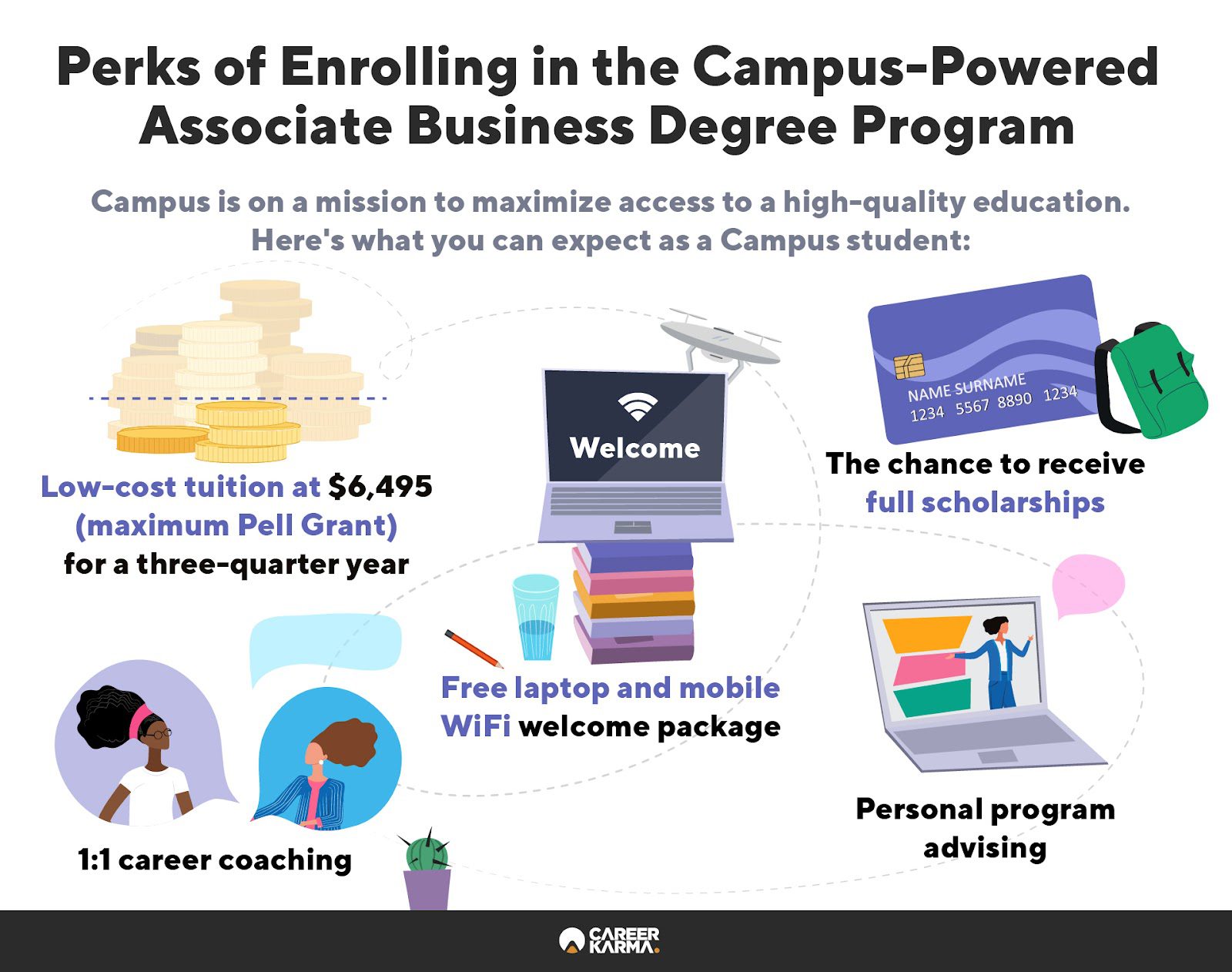

Campus’s mission of increasing access goes beyond the program’s low-cost tuition. They’re aiming to remove any financial barriers to student success, which is why the Campus-powered online degree program includes a free laptop and mobile wifi welcome package, personal program advising, career coaching, and full scholarships.

The Campus-Powered Online Associate Degree Program Tuition

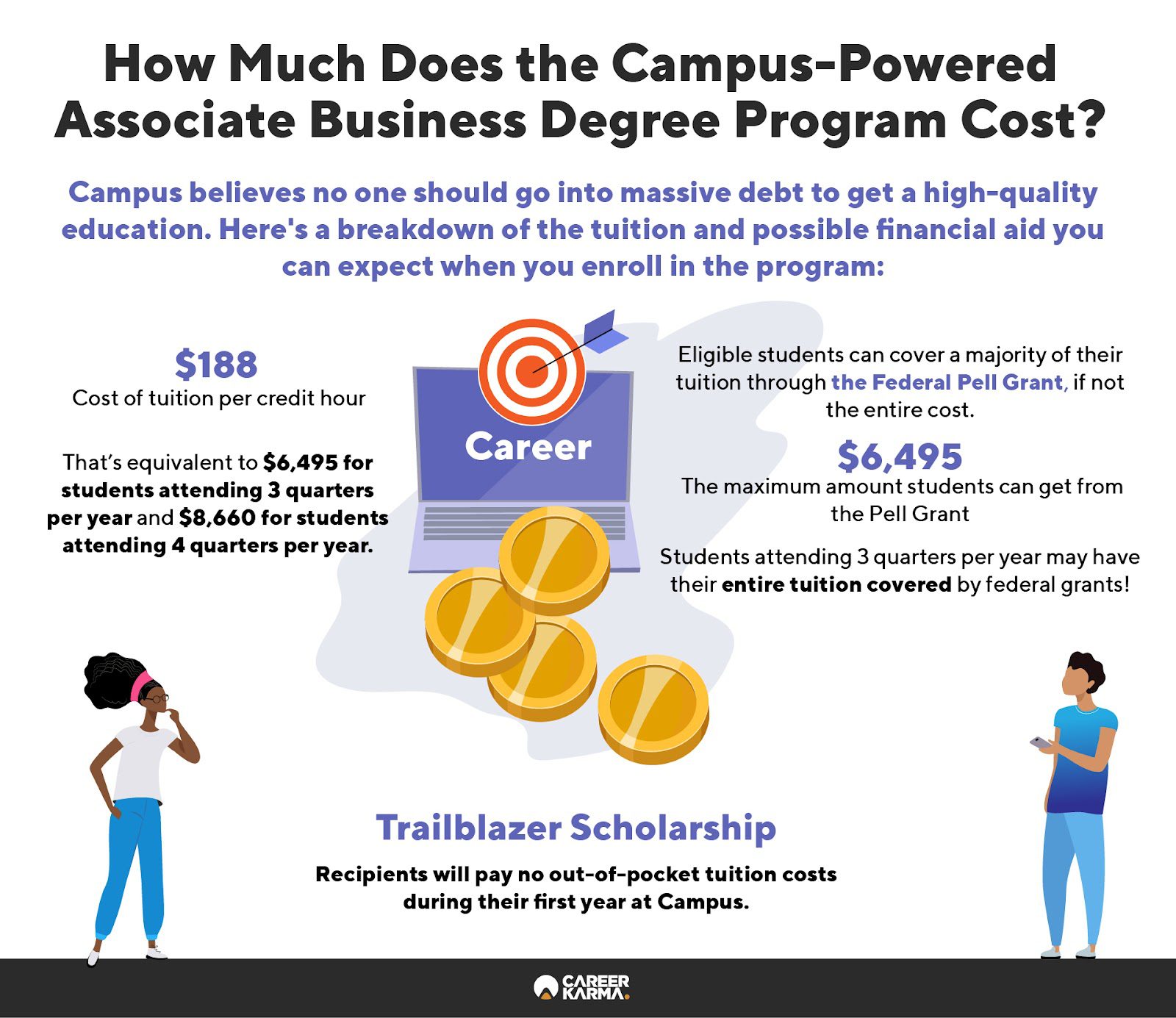

The Campus-powered online associate degree program costs $188 per credit hour, totaling between $6,495 for a three-quarter year and $8,660 for a four-quarter year. In fact, tuition for students enrolled for three quarters per year is the same value as the maximum Pell Grant, meaning students who receive the full federal Pell Grant would have no out-of-pocket tuition costs at Campus.

Campus believes you shouldn’t have to go into massive debt to get a world-class education, and the team designed a degree program that provides the tools and support students need to get ahead, whatever pathway they choose.

As mentioned before, Campus works to keep the tuition of their program at or below the value of the maximum Pell Grant at $6,495. This company’s efforts mean that students with maximum federal grants will pay no out-of-pocket costs. But for those who aren’t awarded these maximum grants, Campus will continue to offer full scholarships to bridge gaps between the Pell Grant and tuition.

For example, Campus is demonstrating their commitment to accessible education by offering the Trailblazer Scholarship, a last-mile scholarship for January 2022 cohort students. With this scholarship, students pay no out-of-pocket tuition costs for their first year at Campus.

This scholarship is part of Campus’s work to provide an affordable alternative to community college. You can finish your associate degree with Campus and enter the industry of your choice, or you can pursue your academic goals of transferring to your dream four-year school with two years of college credits knocked out (and at a much lower cost).

This mission of affordability differs from that of many traditional universities, whose tuition costs grow year after year, increasing the financial burden on their students. According to the National Center for Education Statistics (NCES), the average cost of one year at a public four-year university is $25,500 for students living on-campus.

With two years of your education completed at Campus, paying between $6,495 and $8,660 per year, you’re paying a maximum of $17,320 for your first two years of college as opposed to $51,000. And that’s if you don’t receive any financial assistance whatsoever. Plus, your tuition cost at Campus includes the free crucial tools you receive just for enrolling as a student, specifically your new laptop and mobile WiFi!

Along with accessible tuition, Campus strives to support high-quality education and student experience. Classes are taught by top faculty who also teach at world-class four-year universities (including Princeton, UCLA, NYU, Notre Dame, and more), meaning students get access to expert educators without the high tuition.

That being said, students who hope to enroll in the Campus-powered two-year business degree program must complete a Free Application for Federal Student Aid (FAFSA).

In many cases, the FAFSA is a gateway to a mountain of student loans because of the high costs associated with many higher ed programs. But when it comes to the online degree program powered by Campus, it may be a debt-free path to a quality college education because of their low tuition and scholarship opportunities.

What Is the Free Application for Federal Student Aid (FAFSA)?

The FAFSA is an application to receive financial aid from the federal government for college and other education programs. You can fill out the FAFSA before the annual deadline without financial consequences, even if you haven’t been accepted to the school you’re looking to attend.

This application generally results in federal student loan offers while helping the government and your school determine your eligibility for grants and scholarships.

Pell Grants

The previously mentioned Pell Grant is a need-based federal subsidy awarded to low-income undergraduate students. These grants don’t have to be repaid under standard conditions.

A few factors determine your eligibility for Pell Grants, including financial needs and costs of attendance. But for eligible students, these grants offer a chance to cover a vast majority of the cost of your Campus-powered course, if not the entire cost.

This accessible educational model may leave you wondering what you can do with an associate degree. Well, even if you decide not to pursue a bachelor’s degree after the two-year degree program is complete, you can still find a place in business with this practical associate degree.

Job Outlook with Associate Degrees in Business

This course covers skills in economics, finance, accounting, human resources, management, and marketing. These skills have a broad range of applications that make them relevant in several industries. Here’s a sample of some of those fields that you can enter with this degree, along with an average entry-level salary.

Sales Management

As a sales manager, you would direct daily operations in a company’s sales department. With knowledge of economics, management, human resources, and marketing, your skillset would help you make more effective hiring decisions while making a splash in sales. Entry-level sales managers earn an average of $44,893 per year, according to PayScale.

Human Resources

Human resources generalists use the knowledge of hiring, evaluations, benefits, and compensation to provide broad support for a company’s human resources department. Entry-level HR generalists earn an average of $48,071, according to PayScale. After a few years, it’s possible to move up to a more lucrative HR manager position.

Finance Positions

If you’re more interested in finance, you could be an associate financial analyst, helping a company’s financial department study large amounts of financial data. Or you might end up working as a financial controller, supervising a department while producing financial reports and balance sheets for an organization.

Entry-level finance associates earn an average of $53,750 per year, and early-career financial controllers earn an average of $65,201 per year, according to PayScale. These are just two of the options you can pursue in this rich field.

Business Positions

Naturally, you may want to work at a company after obtaining this degree. Associate business analyst roles provide a great starting point in this position. They help executives determine better practices to boost a company’s efficiency and standing. In this role, professionals might work with several different departments to streamline processes and identify opportunities.

For example, associate business analysts might work with data departments to analyze a company’s current structure and determine bottlenecks that slow down success. Entry-level associate business analysts earn an average of $55,619, according to PayScale.

None of these projected salaries are guaranteed to reflect the compensation in your area, but hopefully, this list gives you an idea of what’s possible with an ASBA. An investment of time and a lower cost than beginning with a four-year university option might result in an attractive salary in a field that you prefer.

Get Quality Education Without Tons of Debt at Campus

The Campus-powered A.A.S. in Business program is just the first of many affordable degree programs that Campus is planning to offer. With an emphasis on accessible education and free resources to show their commitment to students, Campus is taking higher education to a whole new level by giving everyone a shot at a college education that they may not have had otherwise.

If you’d like to learn more about what Campus has to offer, visit their site. You can also reach out to a counselor for more information.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.