Are you interested in helping others plan for uncertain financial events while making a lot of money? By taking an actuarial science course, you can learn about the insurance industry and stock exchange, while also brushing up on your math and business administration skills.

These actuary skills will allow you to assist the elderly, protect families, and help people secure their homes. Discover everything you need to know about learning actuarial science, including recommended courses, exam information, and resource materials.

This article will take you through all you need to know about becoming an actuary.

What Is Actuarial Science?

Actuarial science combines mathematics, economics, probability, statistics, and computer science principles to anticipate future events and take preventative measures as necessary. Actuaries use their knowledge to advise businesses, insurance companies, and individuals on their financial decisions.

Actuaries analyze data to establish how much money someone should put aside to cover any potential financial losses. An actuary will typically pass a series of difficult actuarial exams and will often work for an insurance company to quantify risks.

How Is Actuarial Science Used?

Below is an overview of what actuaries do and some of the skills required for the job.

- Home insurance. An actuary can protect a person’s home and possessions. They create protective insurance products to ensure material possessions are safe from fires, floods, earthquakes, and tornados.

- Pension protection. An actuary also sets pension contributions so that elderly people can retire and enjoy their pension.

- Life insurance. Life insurance is about creating plans in the event that someone passes away unexpectedly. This is to help families maintain financial security if they lose a loved one.

- Business risk management. An actuary understands risk and can safeguard businesses from unforeseen movements in the market.

- Investment experts. An actuary is very knowledgeable in investing. They understand stock markets and know where to invest and understand how returns are correlated.

- Medical aid. In this field, an actuary can help people by developing medical financial aid, allowing people to get the help they need.

Types of Actuary Careers

Now, let’s look at some of the types of careers you may want to look into as you plan your path toward becoming an actuary.

Insurance Actuarial Analyst

An insurance actuarial analyst uses statistics skills to design and price insurance policies. For example, an actuary needs to research a person’s background, health, occupation, and family history before making a medical insurance recommendation.

An insurance actuary must be an expert in math, statistics, and probability. They will also need to have advanced computer skills, and be able to create spreadsheets and databases, and use statistical analysis tools.

Business Analyst

A business analyst evaluates an organization’s structure and data to predict future challenges and potential risks. They also install software to help the business improve its processes.

Business analysts must know how to analyze complex data efficiently. They must have problem-solving skills, numeracy skills, and knowledge of IT and data.

Actuarial Consultant

This role is focused on advising companies on potential financial risks. Unlike insurance actuaries, who work for insurance companies, an actuarial consultant works for a business, financial company, bank, or government regulator.

As an actuarial consultant, you will need skills in numeracy, IT, business, and communication.

Investment Analyst

An investment analyst does market research to help traders, fund managers, and stockbrokers make investment decisions. They also analyze assets such as stocks, bonds, currencies, and commodities and interpret a company’s financial statements, price developments, and yield fluctuations.

Their research is usually presented to a portfolio or investment manager. Collaboration and communication are crucial skills for this job, as investment analysts often need to give team presentations on their findings.

Actuarial Exams

The actuarial exam process is notoriously challenging and lengthy. You must pass a daunting 10 exams to become fully certified. Once you pass seven of the tests, you will become an associate actuary, and will then move on to become a fellow upon passing all 10.

The exams are exceptionally tough and will test your knowledge of math, statistics, probability, insurance, and investments.

How to Learn Actuarial Science: Step-by-Step

For those of you who are unsure of where to start, below is a step-by-step guide to help you gain an idea of where to start. These steps are not set in stone, so there are different ways to get into actuarial science careers if you miss a step.

However, this is the best-case scenario for someone wanting to secure an actuarial position.

- Bachelor’s degree. You should start by obtaining a degree in actuarial science, economics, business, finance, mathematics, or statistics. A degree is usually a prerequisite for becoming an actuary.

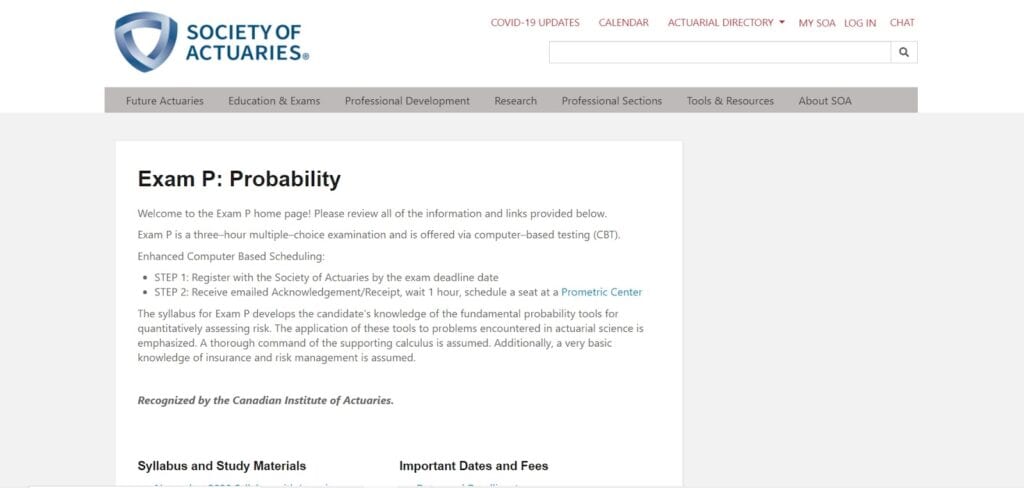

- Exams. There are 10 exams, two of which you must take during college, and the rest throughout your career. The first two are known as Exam P (probability) and Exam FM (financial mathematics), which are offered by the Society of Actuaries.

- Technical skills. Developing technical skills is an excellent next step. You should work on learning Excel and computer programming languages. The most important programming language for an actuary is VBA, but Python, C++, and SAS are great additional languages.

- Actuarial internship. Landing an internship while you’re studying will give you a headstart in the job market. Gaining an internship in underwriting, data analysis, investment, or risk management, will be a fantastic learning opportunity.

- Secure an actuarial job. Once you have graduated, it is time to get your first job. It is common for students to finish all of their exams before entering the job market, but you can begin searching after you have passed your first two exams.

- Gain associateship. Attaining your associateship means you are a first-level actuary. This shows that you have passed seven out of the 10 exams required to become an actuary. You can choose to take either the ACAS exam to go into property and casualty insurance or the ASA exam if you want to become a life and health insurance actuary.

- Gain fellowship. Receiving your fellowship means you are a fully certified actuary and have passed all 10 of your exams. It typically takes around two to four years to complete these tests while working. Once certified and employed, you will be able to reap the financial benefits of this career.

The Best Actuarial Science Courses

We have compiled a list of the best actuarial science courses and training. These include bachelor’s degree options, online actuarial science courses, and a few free online training classes that will help you build your skills.

Best Actuarial Science Degrees

Here are a few of the best four-year actuarial science programs at US colleges and universities. Start here to begin your research before signing up for your actuarial degree.

Michigan State University

- Bachelor of Science Degree in Actuarial Science

- Where: East Lansing, MI

- Time: 4 years

- Prerequisites: 3.0 GPA

This four-year degree program will cover everything you need to know about actuarial science. Students will learn probabilities, accounting concepts, investments, computer science, and statistical methods.

Purdue University – Polytechnic Institute

- Actuarial Science, BS

- Where: West Lafayette, IN

- Time: 3 to 4 years

- Prerequisites: Email: cgtinfo@purdue.edu

Purdue University offers this BS degree in actuarial science. It comprises coursework in mathematics, economics, statistics, and management.

University of Georgia

- Actuarial Science Certificate

- Where: Athens, GA

- Time: 3 – 4 years

- Prerequisites: Email: dwalker@uga.edu

In the University of Georgia’s Risk Management and Insurance program, students will earn a certificate in actuarial science. It is open to all qualified undergraduate students, regardless of their major. This certificate program provides students with everything they need to know to start a career as an actuary.

Online Actuarial Science Courses

Below, we have compiled some of the very best paid and free actuarial science courses available online. The difficulty levels of these courses vary, but all will help you prepare for your career. Let’s take a look at the best online courses out there.

Udemy

Excel for Financial Engineering and Loss Reserving

Principles of Actuarial Modelling

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

- Where: Online

- Time: 1 to 14 hours

- Prerequisites: None

- Price: $30 to $80

These courses are ideal for complete beginners who want to see if actuarial science is for them. Students can get an idea of mathematical, modeling, and market risk concepts.

Khan Academy

- Where: Online

- Time: Self-paced

- Prerequisites: None

- Price: Free

Khan Academy is a non-profit institution that provides free courses. Although it is not an educational institution and does not grant certificates, it does offer high-quality video content.

With these classes, students can learn the foundational math, statistics, and programming required to succeed in actuarial science. Take a look at this Khan Academy review to gain more insight.

Future Learn

Data Science: Big Data, Python and R Programming

Business and Finance Fundamentals

- Where: Online

- Time: 12 to 54 weeks

- Prerequisites: None

- Price: $600 to $2,000

The courses above may be useful on your path to learning actuarial science. Future Learn offers great classes to boost your CV and knowledge of finance, business, data, and programming.

The Infinite Actuary

- Technical Skills Course

- Where: Online

- Time: 15+ hours (12 month access)

- Prerequisites: None

- Price: $195

This excellent course teaches all the technical actuary technical skills you will need. Students will learn how to use Excel for data analysis, VBA, SQL, SAS, Access, and R in the context of actuarial science.

Casualty Actuarial Society (CAS)

Risk Management and Insurance Operations

Insurance Accounting, Coverage Analysis, Insurance Law & Insurance Regulation

- Where: Online

- Time: Varies

- Prerequisites: None

- Price: About $900

CAS is the world’s only actuarial organization that concentrates on property and casualty risks. In these courses, students will learn about property insurance, casualty insurance, reinsurance, finance risk management, and enterprise risk management.

Best Actuarial Science Books

Here is our top actuarial science book pick. This book is acclaimed for teaching how to apply computational actuarial science techniques.

Computational Actuarial Science with R: 17, Arthur Charpentier

This book is a fantastic introduction to the computational aspects of actuarial science. Using simple R programming, you will learn the algorithms involved in actuarial computation. It also covers topics like statistical modeling, C/C++, and parallel computing.

Best Online Actuarial Science Resources

For those looking for extra resources on actuarial topics and exams, there are many options online. These will be of use to students who want to learn more about the industry as a whole.

Soa.org

The Society of Actuaries provides lots of information on Exam P, Exam FM, and the best universities and colleges that offer actuary programs.

Casact.org

Alongside their courses, the CAS offers plenty of resources for students, including exam information, volunteer opportunities, and actuarial community pages.

Should You Study Actuarial Science?

If you love all things finance, statistics, insurance, and want to help people use their finances wisely, then you should consider taking an actuarial science course or program. The ability to safeguard people’s finances can lead to a highly rewarding job.

As reported by the US Bureau of Labor Statistics, an actuary earns a median salary of $108,350 per year. If you still want to learn more about how to learn to code, how to become an accountant, or how to learn R, keep reading through our blog.

We hope this guide to actuarial science courses and training has helped you find a course you will enjoy.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.